In Japanese yen, the profit figure that Tokio Marine Holdings projects for 2024 is ¥1 trillion.

While the forecast may seem less extraordinary in U.S. dollars of roughly $6.7 billion, either way it’s a 40 percent jump over 2023.

Executives from the Japan-based international insurance group revealed the projection and a midterm plan for “drastic expansion” of value-creating opportunities during a virtual media event and via documentation for investors on the group’s website this week. The media event was open to reporters outside of Japan for the first time—a point noted at the outset by Brad Irick, the co-head of Tokio Marine’s international business. Irick said the broad invitation reflected the weight of year-over-year growth in insurance premiums and profits from insurers outside of Japan on overall results.

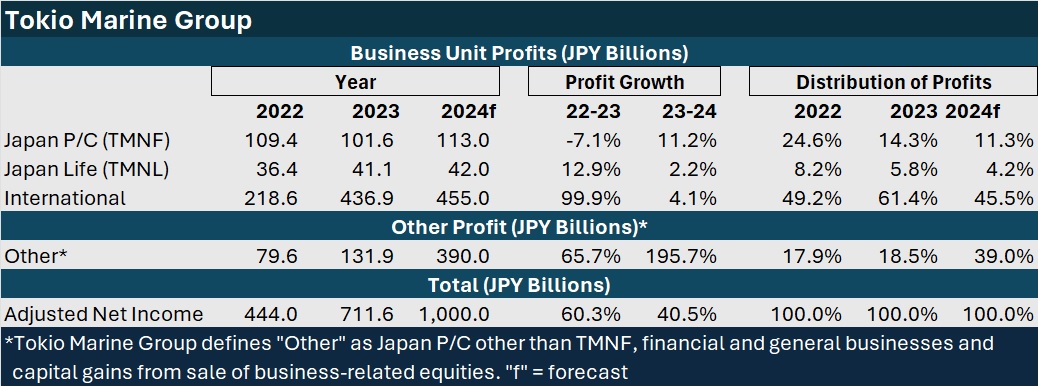

In fact, almost half of the $6.7 billion profit forecast and over 60 percent of 2023 recorded profit of $4.7 billion (¥711.6 billion) relates to business unit profits from their international insurers, including Philadelphia Insurance Companies, Delphi Financial Group (including Safety National) and Tokio Marine HCC in North America.

For 2023, business unit profits for Tokio Marine’s international insurance business nearly doubled—to $2.9 billion (¥436.9 billion) from $1.5 billion (¥218.6 billion) in 2022. Business unit profits for the North American insurers grew 29 percent to $2.4 billion (¥359.9), with net written premiums for the North American insurers growing 11 percent and their combined ratios averaging 90.7. A reversal from loss to profit in Asia business explained most of the remainder of the profit growth for Tokio Marine’s international insurance operations.

The forecast 2024 profit for international insurers is $3.0 billion (¥455.0), representing a 4 percent jump from $2.9 billion (¥436.9) in 2023.

Financial summaries for the various insurance entities reveal that business unit profits are essentially underwriting profits and investment profits (investment income and capital gains). Not included in the business profits, however, are capital gains from sales of “business-related equities” (shareholdings in clients in Japan), which are reported as “Other” profits in Tokio Marine’s financial statements.

While under 20 percent of the total income figures reported for 2022 and 2023 relate to “Other” profits, for 2024 the proportion of overall income from “Other” is nearly 40 percent.

Taro Arakawa, head of the Tokio Marine investor relations desk in New York, explained that the ¥1 trillion forecast includes profits from the accelerated sales of business-related equities. “Specifically, in 2024, we aim for equity sales of ¥600 billion, which alone will raise profits by ¥300 billion year on year,” he said.

Business-related equities refers to shareholdings in clients in Japan. These are being sold by Tokio Marine and other nonlife companies in Japan, after discussions with Japan’s regulator, in order to ensure there is no conflict of interest in dealings with clients. (Editor’s Note: In 2023, Japanese financial regulators also investigated and ordered Japanese insurers to end anti-competitive practices related to premium price fixing. Related articles, “Japan Casualty Insurers’ Shares Sink on Concerns Over Suspected Price Fixing,” “Japan Competition Watchdog Probes Insurers Over Price Fixing,” “Japan Orders 4 Non-Life Insurers to End Anti-Competitive Business Practices“)

Excluding the sales gains, 2024 profits will still increase but by only 2 percent, Arakawa said. A large-scale hail disaster that occurred in Japan in April and the absence of significant favorable prior-year reserve development in 2023 explain the lower profit growth rate from insurance underwriting and investment results, he said.

(Editor’s Note: “Adjusted Net Income” of ¥711.6 billion in 2023 and the forecast of ¥1 trillion for 2024, each representing the sum of business unit profits and other profits in the year, is not the bottom line figure recorded on Tokio Marine’s income statement. In 2023, the bottom line “net income” figure, ¥695.8 billion, includes items such as amortization expense of goodwill and other intangible assets.)

Looking Ahead: Midterm and Beyond

“We’re proud of these results and the growth that we continue to achieve,” Irick said during the media event, referring to 2023 results. “But the measure by which we judge ourselves is how they have been achieved and what the growth enables us to do in the future,” he said, introducing Arakawa to set forth details of the midterm plan titled “Inspiring confidence. Accelerating progress.”

“Over the past midterm plan, we stated our commitment to achieve top-tier EPS [earnings per share] growth and raise ROE [return on equity] to the level of our global peers, all while managing volatility. The new midterm plan will also follow the same trajectory,” Arakawa said, comparing the plan for the next three years (2024-2026) to one that had been in place for the prior three.

“Our journey continues. Specifically, EPS growth is targeted at over 8 percent CAGR [compound annual growth rate]—and with the inclusion of the sales gains from business related equities at over 16 percent.

According to Arakawa, Tokio Marine targets getting business-related equities outstanding down to “zero” in six years, with a 50 percent reduction built into the midterm plan for the next three years. “When possible and optimal, we will accelerate this as much as possible,” he stated.

Articulating a second goal of the three-year plan, he said that ROE is projected over 14 percent. ” The driver of this growth is enhanced capabilities of each individual business,” he said.

Finally, he announced increased dividends (an increase of 29 percent for 2024) and share buybacks (¥200 billion in 2024). “Our belief is that both the growth of our business and the increase of shareholder returns should be in step,” he explained.

“Our philosophy on capital policy remains unchanged—that is capital generated through organic growth…will first be allocated to M&As or additional risk taking that contributes to our ROE improvement. If such opportunities are not available, we have no intention of unnecessary accumulation of capital and we will execute share buybacks,” he stated.

A slide presentation posted on Tokio Marine’s website outlines five strategies—three pillars of growth and two pillars of discipline—that support the midterm plan and the group’s overall purpose “to protect customers and society in their times of need.”

The first of three growth pillars—”drastic expansion of domains where we can deliver our value”—involves developing and providing “best-fit insurance products for new risks” and also “new solutions other than insurance.”

The executives were not specifically asked about noninsurance possibilities, but they were asked about the “drastic expansion” language and potential “gaps” they might fill to perhaps diversify the group in other regions or insurance products.

Rejecting the term “gaps,” Irick said there are “opportunities” to be embraced instead. “I think there’s opportunities to grow within the Americas, including North America, despite that being already our largest international area,” he said, also making note of the group’s strong businesses in Asia. “I think we can do more to add to those over time,” he said.

“But again, we’re very disciplined,” he said, noting that M&A candidates have to meet the criteria of having a strong track record, a unique business model and also represent a good cultural fit.

Related article: “Tokio Marine Has $10 Billion for Potential Acquisitions: Executive“

“Beyond that, the organic capabilities of this group, really around the regions that we already are in, [are] really strong and will continue to grow over time,” he stated.

Earlier in the session, the executives addressed a specific question about the M&A landscape and the interplay between M&A opportunities and share buybacks.

Said Irick: “There’s not a deal in the world that happens without us having a chance to have a look,” noting that the co-heads of the international segment have a “real challenge” in assessing opportunities all around the world. “I don’t think there’s any one geography that we limit ourselves to,” he said, again calling out the Americas and Asia as places with more potential.

Through an interpreter, Arakawa reiterated the capital deployment policy. “When we have excess capital, we will seek use of that excess capital into M&A or additional risk-taking. And if we do not find those opportunities, we will take a disciplined manner in executing our share buyback in order to return to the capital market.”

The comment supports the second pillar of discipline listed on the website as part of the midterm plan: “Enhancement of business portfolio and capital management.”

The remaining pillar of discipline—”strengthening and improvement of internal control and governance”—and the other two growth pillars—”diversification of our distribution model” and “extensive improvement of productivity”—were not specifically discussed during the media session.

The online presentation, addressing the pillar about distribution diversification, refers to the expansion of “highly specialized distribution networks” and to “upgrading embedded and direct distribution models.”

Addressing longer-term aspirations out to the year 2035, the presentation includes a visualization of noninsurance solutions for “prevention, mitigation and recovery” and those that contribute to customer “well-being.”

Supporting initiatives include the accelerated use technology, including “thorough utilization of AI, to improve productivity, accelerate growth and enhance business quality,” and initiative related to human resource development and consolidation of common functions and services of group companies.

Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  Preparing for an AI Native Future

Preparing for an AI Native Future  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll