When Progressive’s chief executive officer weighed the words that should go into the management discussion section of the company’s first-quarter 10-Q report, she considered two possibilities to describe anticipated growth for the balance of 2024.

“Was ‘maximize’ growth the right word” to use? Or was it “optimize?” Tricia Griffith asked.

“I felt ‘maximize’ was absolutely the right word to use because that’s exactly what we’re going to do,” Griffith told an analyst during a first-quarter conference call this week. The analyst was worried about the possibility that seasonality explained Progressive’s nearly record growth in the first quarter.

“We are increasing our media spend to maximize growth and will continue to do so as long as we remain on track to achieve our target profitability and generate sales at a cost below the maximum amount we are willing to spend to acquire a new customer,” the 10-Q states several times.

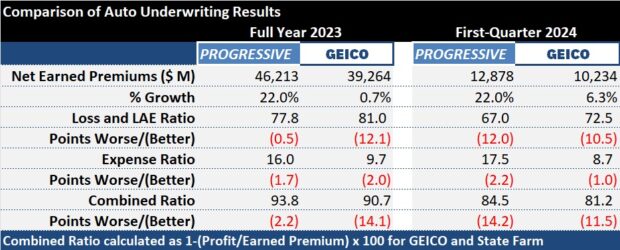

During the quarter, Progressive’s companywide combined ratio of 86.1 was nearly 10 points better than its profit target of 96, with the personal auto combined ratio landing at 84.5, while commercial lines and property came in at 91.8 and 93.4, respectively.

Personal auto written premiums soared 20 percent to $14.5 billion, with premiums across all lines growing $2.9 billion to nearly $19.0 billion in the quarter.

“Since mid-2021, inflationary pressure and its subsequent effect on our profit margins has been a predominant factor in our strategic decision-making…By adhering to who we are, it looks like we have turned that page and we’re now seeing the benefits of the tough decisions and hard work over the last several years since inflation took off,” Griffith said during opening remarks, explaining that while Progressive could have fully pivoted toward growth last summer, leaders held fast to the profit goal.

“Our first quarter of 2024 has really set the stage for us to capitalize on both growth and profitability,” specifically highlighting the profit margins in personal auto that fueled a shift to growth mode.

“Our first quarter of 2024 has really set the stage for us to capitalize on both growth and profitability,” specifically highlighting the profit margins in personal auto that fueled a shift to growth mode.

Griffith noted that Progressive started unwinding some non-rate underwriting restrictions (related to billing plans and verification of garaging locations, for example) late last year. The reduction of those restrictions, combined with both elevated shopping and increased media spending in the first quarter of 2024, resulted in record-setting quote volumes on business written directly, she said, noting in the 10-Q letter to shareholders that the carrier experienced its largest single-day quote volume ever in direct auto business during the quarter.

Still, first-quarter 2024 media spending was actually down 7 percent compared to first-quarter 2023, and new auto applications were down 9 percent as well, compared to record growth in first-quarter 2023.

(Editor’s Note: After a particularly strong growth quarter in the first quarter of 2023, the company tightened underwriting, cut advertising spend and took more rate actions during the balance of the year, reacting to a first-quarter combined ratio coming in above target that was driven by a needed boost in loss reserves.)

But the year-over-year gaps in ad spend and sales declined as first-quarter 2024 progressed, Griffith reported as she shared March figures with analysts participating on the call.

“As we look forward to the rest of 2024, we will continue to seek to strike the right balance between efficient marketing spend, our calendar year profit targets and maximizing our growth,” she said, noting that the opportunity for growth is real because the auto market “is still very tight.”

“Inflationary trends are showing indications of stabilizing, and we believe we’re well positioned to capitalize on a marketplace that is still reeling from the profit challenges of the last two years,” she said.

“It’s comforting to be able to report that we’re pivoting to a more normalized operation where, in most states, we can take small bites of the apple when it comes to rate and can focus on growth and increasing our market share.”

Special Sauce: Matching Rate to Risk

During the question-and-answer part of the call, Griffith addressed a question from an analyst trying to get a handle on expense ratio changes by first noting that Progressive spent the highest amount it ever spent on media during the month of March, but then stressing that the carrier’s ability to match rate to risk in order to minimize the loss ratio is a real competitive advantage.

“That segmentation piece is really important—understanding our rate to risk…It is really a special sauce. And it’s not something that you build in a year or two. In fact, we’ve been building this for many decades.”

“You want to look at the whole spectrum of what makes up the combined ratio. So, we’re constantly investing to push down both loss adjustment expense and non-acquisition expense—figuring out ways with technology, with people, with processes to reduce those expenses, because we can give those back in competitive prices. That’s really important.”

“But remember, anywhere between 70 to 75 cents of every dollar…goes out as LAE and loss. So, that segmentation piece is really important—understanding our rate to risk…

“It is really a special sauce. And it’s not something that you build in a year or two. In fact, we’ve been building this for many decades,” she stated, noting that for the past 10 years ago, the company has been continuously updating product models. “No state is ever more than a couple of models behind, and we’re constantly improving that segmentation. That takes a lot of investment. So, sometimes you can see the expense ratio peak up with that. But those are built over decades,” she said.

In fact, those segmentation models are the envy of at least one giant competitor: Berkshire Hathaway’s GEICO, which has been trying to catch up to Progressive for the last three years. Progressive’s superior segmentation is a frequent topic discussed during Berkshire’s annual meeting, and this year was no exception. “Progressive has done a better job in that recently,” Berkshire Chair Warren Buffett said at the May 2024 meeting, going on to stress GEICO’s relative advantage in the expense ratio department.

Related articles: Berkshire’s ‘Most Important’ Biz Drives Q1 Results; GEICO Still Behind on Tech Progressive ‘Crushing It’ on Profit: Berkshire’s Jain and Buffett

Smaller Bites and the Competition

Not all the first-quarter information that Progressive reported was pleasing to investment analysts. The flattening of one measure of policyholder retention—a three-month policy life expectancy metric—worried one questioner who wanted to know why it wouldn’t be rising since Progressive is now putting through lower and less frequent price hikes.

“In this last year or so, so many customers are getting their renewal bills and the rate increases that are playing through will cause you to shop. We’re always at risk [of] losing customers when that happens.”

“We knew that was a possibility last year as well when we were first to market, getting the rates that we needed on the street,” Griffith said, noting that the metric lags the rate actions.

Now, she added, Progressive is “in a much better position” rate-wise and will only need to take small rate increases—just to stay ahead of trend. Those “small bites of the apple” are another factor positioning Progressive for growth, the CEO suggested, responding to an earlier questioner who wondered if competitors positioned for growth would challenge Progressive’s market share.

“We’re going to focus now on having more stable rates because that’s really what consumers want.”

“So, when they go to shop, if [another] rate is better, then their option is to leave. We’ve got to make sure we have competitive rates,” she said.

An external assessment of auto insurance policyholders’ shopping behavior for the month of March, published by J.D. Power and TransUnion last month, revealed that Progressive has been winning the largest share of customers who switch insurers. Tracking the movements of customers between 10 large auto insurance carriers, the J.D. Power-TransUnion report showed that six of them—American Family, GEICO, Liberty Mutual, State Farm, Travelers, USAA—lose most of their business to Progressive when customers decide to switch. (A seventh carrier, Farmers, is equally likely to lose customers to Progressive and State Farm.)

Related article: Progressive Gains as Drivers Shop Around for Auto Insurance—Again

Are competitors starting to ease up on pricing or loosen underwriting restrictions, an analyst asked Griffith during the conference call.

“I can say that we still feel like it’s a hard market, and we feel like we got ahead of the curve, as far as pricing. We’re seeing that with our growth, and I hope to continue to see that,” she said.

She agreed that competitor margins “look good…I think everyone saw what we saw in terms of trends and reacted…”

“People will catch up. That’s this industry. It’s an ebb and flow of soft markets, hard markets, and it’s just about getting out ahead of it. And again, I can’t stress enough how much segmentation and our ability to match rate to risk matters…That’s a big piece of it as well…”

“It’s about having the right rate the street, of course. That’s table stakes. It’s also about having product models where you really understand the ultimate loss costs,” she said.

A Tech Company That Sells Insurance

Asked about Progressive’s investments in generative AI, Griffith reported that Progressive started working with machine learning and large language models more than a decade ago.

“We put a lot of those in place. So, think of a chatbot that can give you documents without having a human involved…And on Progressive.com, we’ve used a lot of machine learning to give you the best choice for what you need for coverage. Right now, we have well over 100 different models in different formats. Some are tests, some are full bore and some are thoughts, including many in generative AI,” she said, prefacing her report with a nod to former chairman Peter Lewis, who she said described Progressive as “a technology company that happens to sell insurance.”

There’s more to come, she said, reporting that Progressive leaders presented a full-day session to the board of directors a few months back describing the efficiencies anticipated through the use of AI.

“I can’t go into a lot of the details, but we have some great models, great tests that we’re doing, and we believe it’s going to be a game changer literally in every single aspect of our company. Think of recruiting, think of media,” she said, reporting that a board presentation this week will go over AI tests specific to media activities.

“We lean into that technology. Clearly, you always want to think about biases and you want to have responsible AI. So, we have a committee that overlooks every test that we do to make sure that we’re doing it responsibly…”

She concluded, “Just like we have [for] the last nearly 90 years, [we’re] leaning into technology, [and] using it to benefit really competitive prices so that our customers come and stay with us and we grow market share.”

How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality  Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk  Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb