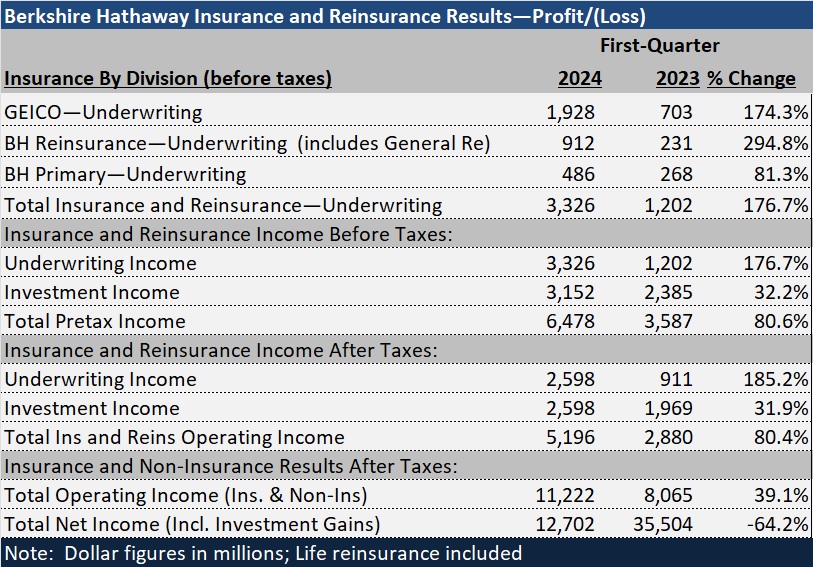

Berkshire Hathaway continued to deliver eye-popping results for its insurance and reinsurance operations during the first quarter of 2024, with underwriting profits for personal auto insurer GEICO and reinsurance operations topping any prior first quarter in the last decade.

Across Berkshire’s insurance and non-insurance operations, operating profit rose 39 percent, but an 80 percent jump in the businesses that Chairman Warren Buffett describes as “the most important” ones in the conglomerate—the insurance and reinsurance operations—soared 80 percent to $5.2 billion after taxes. Underwriting and investment income from the insurance and reinsurance operations each contributed $2.6 billion to the overall results.

Related articles: “Jain Successor is Recurring Berkshire Board Topic; Leadership Lessons“; “GEICO’s ‘Eye-Popping’ 2023 Insurance Profits, Falling Employee Counts“

GEICO’s pretax underwriting profit soared 174 percent to $1.9 billion in first-quarter 2024 from $703 million in first-quarter 2023—with both the 2024 and 2023 first-quarter results reversing an underwriting loss in 2022. The latest underwriting profit figure eclipsed the prior first-quarter profit record at GEICO of $1.0 billion set in 2022.

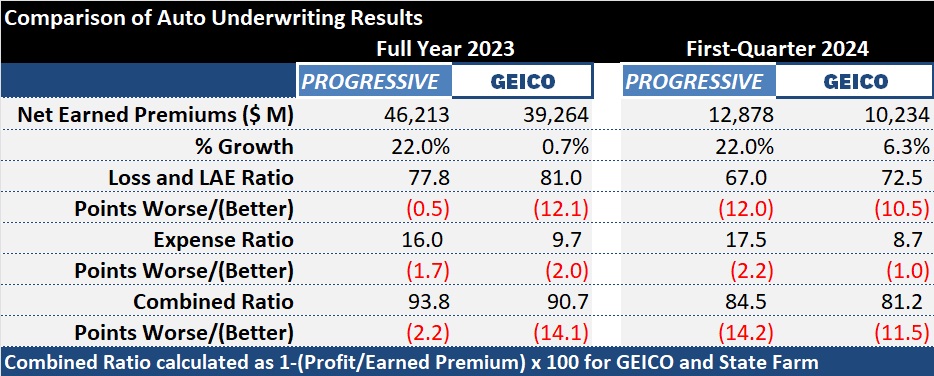

GEICO’s $1.9 billion underwriting profit translates to a first-quarter 2024 combined ratio of 81.2. That was 11.5 points lower than first-quarter 2023, with the loss ratio improving 10.5 points to 72.5, and the expense ratio coming down a full point to 8.7.

GEICO vs. Progressive: Playing Catch-Up

In spite of the stunning progress, Berkshire’s leaders admit they are still lagging on an important aspect of the personal auto insurance business: data analytics. During the Berkshire Hathaway annual meeting on Saturday, Chair Warren Buffett and Vice Chair Ajit Jain addressed a shareholder’s question about GEICO’s relative weakness when measured against competitor Progressive. Jain said GEICO’s work in this area is continuing but won’t be finished until the end of 2025, while Buffett pointed to GEICO’s low-cost operating model as a continuing source of profitability.

Jain responded first echoing statements he and Buffett made in 2021.

“One of the drawbacks that GEICO is faced with [is that] it hasn’t been doing a good job at matching rate with risk, and segmenting and pricing product based on the risk characteristics. This has been a disadvantage at GEICO for a few years now,” Jain said.

“We are trying to still play catch-up. Technology is something that is unfortunately a bottleneck. But we are making progress—and equally importantly, we have hired people who are much better than what they inherited in terms of data analytics and pricing and slicing data,” he said.

“I recognize we’re still behind. We’re taking steps to bridge the gap and hopefully, certainly by the end of ’25, we should be able to be [among] the best of players when it comes to data analytics, whether it’s pricing, whether it’s claims or any other factor that drives the economics of the insurance business.”

Buffett continued, noting that equating rate with risk is important in every line of insurance business. “Progressive has done a better job in that recently,” he said.

Related 2021 article: “Progressive ‘Crushing It’ on Profit: Berkshire’s Jain and Buffett (2021)”

Still, Buffett asserted that GEICO’s “fundamental advantage” against all auto competitors “is that we have lower costs than virtually anybody. And that cost advantage has been dramatic. We’ve driven our underwriting expense ratio below 10 percent, and there are just very, very few companies that can compete with that,” he said.

Buffett went on to note that the fact that GEICO has trailed competitors on data analysis technology “is not a threat. It’s not remotely a threat to survival. It’s not a threat even to profitability. On the other hand, we would like to be growing with something that is the best model around in the insurance business of delivering at a low cost.”

“We would rather have X percent of the market than half of X percent,” he said, noting that GEICO didn’t lose many of its 16 million policyholders in the month of March.

Buffett concluded that GEICO “does have to do a better job of matching rate to risk,” adding that the insurer’s low cost model has “masked the fact” that it was behind on that. GEICO CEO Todd Combs is working intensively on shoring up that part of the business. While GEICO has made good strides, “there’s still work to be done. In the meantime, we’re not going to shrink and we should make better underwriting profits than most companies in the auto insurance business,” he said.

The Management Discussion and Analysis section of Berkshire’s first-quarter 2024 earnings report indicates that GEICO’s written premiums grew 7.3 percent compared to the same quarter in 2023, with rate hikes pushing up average premiums per policy by 9.8 percent partly offsetting a 6.6 percent decline in policies in force. According to the discussion, the rate of decline of policies slowed in the first quarter of 2024, “driven by increased new business and higher retention rates.”

The MD&A attributed the 10.5 point drop in GEICO’s loss ratio to the impact of higher average premiums per policy and lower claim frequencies offset by higher claims severity. Explaining the 1.0 point decline in the expense ratio vs. the prior-year first quarter, the report said the improved operating efficiencies and increased operating leverage were partially offset by higher advertising expenses. The report did not specifically refer to any decline in the number of employees at GEICO, which was evident from a schedule in the conglomerate’s 2023 annual report published in February.

Progressive recently announced a hiring push to keep pace with growing revenue, with the goal of filling 10,000 open roles in claims, IT and other areas of the carrier’s operations. (Related article: “Growing Progressive Set to Hire 10,000+ in Claims, IT, Other Roles“)

What About Tesla?

During Saturday’s annual meeting, Buffett and Jain were asked another question they have addressed in at prior meetings: What will be the impact on GEICO of Tesla making inroads into the auto insurance business? More specifically, a shareholder asked what would happen to GEICO’s business volume if Tesla’s full self-driving capabilities achieve CEO Elon Musk’s goal of reducing accidents by 50 percent.

“If the accidents get reduced 50 percent, it’s going to be good for society, and it’s going to be bad for insurance companies’ volume. But good for society is what we’re looking for,” Buffett said, later describing consumer advocate Ralph Nader’s contribution to bringing down road fatalities.

Related article: “‘I Worry Much More About Progressive’ Than Tesla, Buffett Says” (2019)

As for Tesla being in the insurance business, Buffett said, “Insurance always looks easier than it is. It’s so much fun because you get the money at the start,” he said, adding that you don’t find out whether you’ve done something stupid until later on.

“It’s a very tempting business when somebody hands you money and you hand them a little piece of paper,” he said.

“It’s a very tempting business when somebody hands you money and you hand them a little piece of paper.”

“It’s a very tempting business when somebody hands you money and you hand them a little piece of paper.”

Warren Buffett, Berkshire Hathaway

Jain said that even if the number of accidents do come down, repair costs are skyrocketing. “If you multiply the number of accidents [by] the cost of the each accident, I’m not sure that total number has come down as much as Tesla would like us to believe,” he said,

“Tesla has been toying with the idea of writing insurance directly or indirectly, and so far it hasn’t been much of a success. Time will tell, but I think automation just shifts much of the expense from operator to the equipment provider,” Jain added.

Florida Reinsurance Bet Pays Off; ‘Corruption’ Lingers

While GEICO’s profit surge accounted for nearly 60 percent of the overall $2.1 billion improvement in insurance and reinsurance underwriting profits in the first quarter of the year, a nearly four-fold increase in reinsurance profits explained another 30 percent, with specialty primary insurance operations accounting for the rest.

First-quarter 2024 reinsurance profits of roughly $900 million were higher than any prior year since 2013, according to records kept by Carrier Management.

Adding underwriting profits from the primary specialty operations and investment income from all the insurance and reinsurance divisions brought operating income to $6.5 billion before taxes, or $5.2 billion after taxes—up more than 80 percent over first-quarter 2023.

The MD&A noted that loss and loss adjustment expenses for the property/casualty reinsurance operations decreased $394 million in the first quarter of 2024. There were no significant catastrophes impacting first-quarter 2024 results, but $400 million in first-quarter 2023.

(Editor’s Notes: Berkshire considers pretax incurred losses exceeding $150 million to be significant. The chart above includes results for life reinsurance and retroactive reinsurance operations.)

While Buffett and Jain didn’t address any questions specific to the reinsurance market during Saturday’s annual meeting, last year Jain spoke about a big bet that Berkshire was making by writing property-catastrophe reinsurance in Florida during renewal periods after 1/1/2023. And this year, he addressed a question about the Florida primary auto and homeowners insurance markets referencing Berkshire’s good fortune in avoiding losses last year.

Related article: “Jain Talks Reinsurance: Berkshire Could Lose $15B in Florida“

A Florida resident, who described the car and property insurance situations in Florida as “out of control,” asked whether a mismanaged Florida market represents an opportunity for Berkshire.

“I hope Florida will be a fairly buoyant insurance market, because at the end of the day, they do believe in the free market more than some of the other states that have insurance crises, like California and New York.”

“I hope Florida will be a fairly buoyant insurance market, because at the end of the day, they do believe in the free market more than some of the other states that have insurance crises, like California and New York.”

Ajit Jain, Berkshire Hathaway

Jain said insurers face two problems in Florida: “One is the lawyers, and the amount of corruption that takes place in the Florida market, [which] keeps skyrocketing making it difficult for us to price the product and make a profit.”

“Secondly, the amount of activity in terms of storms—both the frequency and the severity—is also so severe that the losses in Florida tend to make it very difficult for a risk bearer to make money.”

“Having said that, we’ve fortunately had a very good run at Florida last year…Nothing bad happened so a lot of our premiums that were in the top line flew straight to the bottom line,” he continued.

Speaking about the situation in Florida more generally, Jain said, “Florida is a large market. Florida is a market that’s subsidized by the rest of the country. I don’t think that is going to stand the test of time,” noting that legislators passed reforms aimed at bringing down the amount of fraud.

“I hope Florida will be a fairly buoyant insurance market, because at the end of the day, they do believe in the free market more than some of the other states that have insurance crises, like California and New York.”

He concluded: “Yes, Florida has a problem. Prices will go up fairly substantially, but at the end of the day, I think we’ll achieve a degree of balance so that the risk bearers can make a decent profit and will be deploying capital out there.”

Related Article: “Berkshire Wary of “Fashionable’ Cyber Insurance, AI“

What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday  Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers  Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs