Current and former leaders with Florida property insurers have had some strong reactions to state regulators’ recent efforts to oust company executives who previously helmed now-insolvent carriers. Some have called the unprecedented regulatory action unfair, misguided and impossible to substantiate, while others have said an accounting of Florida’s “revolving door” of insurance execs is long overdue.

The Florida Office of Insurance Regulation’s flurry of letters to seven property insurers and two health insurance firms may amount to little, however, if the companies decide to challenge the law that the removal actions are based on.

“Off the top of my head, I can think of at least four reasons why (Statute) 623.4073 is unconstitutional,” said Robert Jarvis, a law professor at Nova Southeastern University in Fort Lauderdale.

He pointed out that the 2002 law violates insurance company officers’ due process rights, which are guaranteed by the state and U.S. constitutions. The bedrock documents, for example, establish a right to trial by jury and note that no person may be deprived of property, including a job, without due process of law.

The Florida statute that bars insolvent carrier executives from hiring on with other Florida insurers has never been fully reviewed by any appeals court, Jarvis noted. Sawgrass Mutual Insurance Co. briefly raised the constitutional issue in a 2018 challenge to the state’s move to place the firm in receivership and bar its executives from the Florida insurance industry. But an appeals court merely upheld a trial judge on the matter and did not provide an opinion.

Two Florida-based insurance company officials told Insurance Journal that, as of Monday, they have not decided if they will challenge the law or OIR’s actions in court, a legal move that would probably require first going through the state Division of Administrative Hearings.

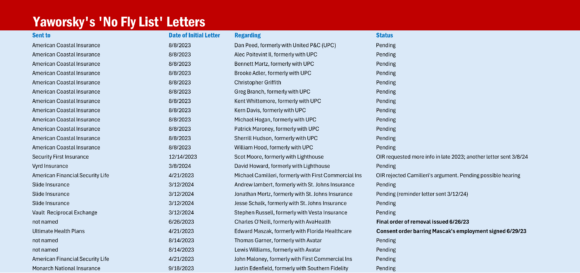

The story about the OIR letters broke last week when the Tampa Bay Times reported on it. The article noted that OIR, under the direction of Insurance Commissioner Michael Yaworsky, began sending letters out to multiple insurance carriers in 2023, asking them to show how the executives were not responsible for the financial troubles of several now-insolvent insurers

The agency provided Insurance Journal with 30 letters, follow-up notices and orders posted in the last 12 months. American Coastal Insurance received OIR removal letters on 12 officers – more than any other carrier. American Coastal, Florida insurance veterans will remember, was merged into United Insurance Holdings, the parent company of United Property & Casualty Insurance Co., in 2016 and remained a subsidiary insurer. When UPC was deemed insolvent in 2023, UPC rebranded itself as American Coastal and signed up several executives from UPC.

Those executives named by OIR for removal from office include Robert Daniel Peed, known as Dan, the former CEO of United.

“Due to Robert D. Peed being an officer and director of an insolvent insurer, the Office requires additional information to ensure that Robert D. Peed meets the criteria for appointment,” reads the 2023 OIR letter to AmCoastal.

A follow-up in February of this year goes further: “Based upon Robert D. Peed having previously served as an officer or director of United Property & Casualty Insurance Company…, an insurer that became insolvent,” he may not serve in his current position at AmCoastal.

The letters cited Statute 624.4073, which reads: “Any person who was an officer or director of an insurer doing business in this state and who served in that capacity within the 2-year period before the date the insurer became insolvent, for any insolvency that occurs on or after July 1, 2002, may not thereafter serve as an officer or director of an insurer authorized in this state or have direct or indirect control over the selection or appointment of an officer or director through contract, trust, or by operation of law, unless the officer or director demonstrates that his or her personal actions or omissions were not a significant contributing cause to the insolvency.”

If the insurers do not prove why the execs were not responsible and fail to remove them from the company, the carriers could face the loss of their certificates of authority, OIR explained. The named officers could be forced to leave the insurance industry or work in another state.

Several of the carriers have provided OIR with written responses, arguing against removal of their officers. But those responses are confidential until investigations are completed, an OIR spokesperson said Monday.

American Coastal did not make Peed and the other officers available for comment. But the company did provide a statement to the news media:

“A confluence of natural disasters, from Hurricanes Irma, Laura, Delta, Michael and Zeta to Hurricane Ian led to the insolvency of United P&C. The actions of executives were not the contributing cause of the insolvency of United P&C, and they did everything in their power to return United P&C to profitability,” reads the statement.

Financial statements also show that Peed, who was previously with AmCoastal, did not join UPC until the merger in 2016, as the Florida market woes deepened, raising the possibility that trouble had begun before he arrived.

Others in the Florida insurance industry said the officer-removal law, often called “no-fly list” law, is ill-conceived. It makes it nearly impossible for executives to disprove that they were responsible for financial failures, especially in the wake of several years in which the industry blamed runaway litigation and fraudulent roof claims for a market that fell into crisis.

“You’d be proving a negative,” one industry leader said. “There’s no way to do that.”

Yaworsky’s sudden enforcement of the law may be as much about optics, some argued, after Florida regulators were criticized for failing to effectively police insurers before 11 insolvencies became unavoidable in the last three years. Florida lawmakers also were chastised for passing insurer-friendly legislation in 2022 and 2023 that was designed to limit frivolous claims lawsuits by ending assignments-of-benefit agreements and one-way attorney fees.

But industry leaders agreed that whatever the reason for the enforcement, the OIR actions should not be taken lightly.

“The commissioner looks like he is committed to enforcing the law and holding insurers accountable. That’s the correct thing to do,” said Michael Carlson, president of the Personal Insurance Federation of Florida, which represents some of the largest property insurers in the state.

Other industry heavyweights said that scrutinizing leadership of failed companies is long overdue.

“Some of the companies were formed and they didn’t really know the business,” said Barry Gilway, the longtime director and CEO of the state-created Citizens Property Insurance Corp. who stepped down in early 2023.

He said that some of the carriers that went bust had, in fact, made terrible financial decisions that crippled their performance. One company, for example, focused heavily on writing older mobile homes that did not have to meet modern tie-down and building codes, making them highly vulnerable to total losses.

“OIR has an obligation to question those decisions,” Gilway said. He also argued that the regulatory agency could have done more under the previous administration to bird-dog warning signs and the leadership of struggling carriers.

Removing a large number of executives from office may prove to problematic, if it comes to pass. Gilway and others in the industry said that Florida has historically had a limited number of people with expertise in the business and the unique demands of the Florida market. That has led to a “revolving door,” in some cases, of executives moving from one company to another, Gilway said.

The proposed actions against the insurers and executives named by OIR are still pending, for the most part. Only two, regarding officials with health care insurance firms, have reached the final-order or consent-order stage.

The regulators are reviewing company information and will make determinations on a case-by-case basis, said Samantha Bequer, communications director for OIR.

The statute is much less severe than it could have been, explained Locke Burt, chairman and CEO of Security First Insurance Co., based in Ormond Beach. The original bill, requested by the Florida Department of Financial Services’ rehabilitation division in 2002, would have barred officers of insolvent companies for life.

“I didn’t think that was fair,” said Burt, a former state senator who was chairman of the Senate Judiciary Committee at the time.

The final bill approved that year was a compromise and allowed officers a hearing to make their case before facing removal from office.

Burt’s Security First received one of the OIR letters last month, about an employee who was previously with Lighthouse Insurance, which went insolvent in 2022. That accounting officer is actually employed with Security First’s managing general agent, not with the insurance company, Burt explained. But in hopes of bringing him on board Security First, the carrier months ago had asked for an OIR review of the matter—a review that is still pending.

Burt and Melissa Burt DeVriese, president of Security First, both said they did not know why OIR had decided to take the enforcement actions at this time.

“We have complied with the law and have communicated with OIR,” DeVriese said. She noted that the OIR’s actions have left insurers, their officers and the officers families in limbo, for months in some cases, while regulators review the circumstances.

*This article was originally published by Insurance Journal, CM’s sister publication.

Preparing for an AI Native Future

Preparing for an AI Native Future  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit  Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk  AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage