Global commercial insurance rates increased by 1 percent on average in the first quarter of 2024, compared with a 2 percent increase in Q4 2023, according to the Global Insurance Market Index published by Marsh, the insurance brokerage business of Marsh McLennan.

Rates continued to be relatively consistent, with most regions experiencing small decreases in Q1, said the report.

Marsh explained this was largely driven by a strengthening of the trend for decreases in financial and professional and cyber lines and increasing competition among insurers in the global property market.

On average, rates declined in the UK, Asia, Pacific, Canada and in India, Middle East & Africa regions by 2 percent, while rates increased in the U.S. and Europe by 3 percent, and in Latin America and the Caribbean by 5 percent.

Other findings from the report include:

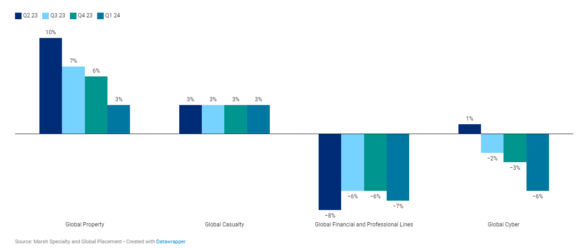

- Global property insurance rates were up 3 percent on average in the first quarter of 2024, compared to a 6 percent increase in the previous quarter.

- U.S. property insurance rates increased by 8 percent on average. However, rates are beginning to stabilize, and many companies were able to secure additional limits in higher layers and improve coverage as competition increased and rate increases leveled off.

- Casualty insurance rates across the globe increased on average by 3 percent, the same as the previous five quarters, largely due to concerns about the size of jury awards in the U.S. (In the U.S., casualty insurance rates increased 4 percent; excluding workers compensation, the increase was 7 percent).

- Globally, cyber insurance rates decreased by 6 percent, compared to a 3 percent decrease in the prior quarter. Insurers are increasingly focused on the strength of organizations’ cybersecurity controls, typically looking for year-over-year improvements in cyber resilience. (In the U.S., cyber rates decreased 6 percent during Q1 2024).

- For the seventh consecutive quarter, the overall average pricing for financial and professional lines fell. Driven by rate reductions and increased competition for business – particularly in the U.S., UK, Pacific and Canada – average rates decreased by 7 percent in the first quarter, compared to 6 percent decline in the previous quarter. (In the U.S., financial and professional lines rates decreased by 5 percent and directors and officers liability insurance for publicly traded companies declined 8 percent, the same as in the prior quarter).

“A continued moderation in insurance rates, and an increased appetite among insurers particularly for well-managed risks, will be welcomed by clients that continue to face major global economic and geopolitical uncertainty,” commented Pat Donnelly, president, Marsh Specialty and Global Placement, Marsh, in a statement.

Marsh noted that all references to rate and rate movements in the report are averages, unless otherwise noted. For ease of reporting, Marsh said it rounded all percentages regarding rate movements to the nearest whole number.

Source: Marsh

Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb  Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation  AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage