Overall commercial property/casualty premiums increased slightly for all account sizes to 7 percent on average in the fourth quarter of 2024, continuing a trend that has now last more than six years.

According to The Council of Insurance Agents and Brokers’ Q4 Market Survey, the 7 percent average increase in Q4 compared to 8.1 percent in Q3 is the 25th straight quarter with increases. Almost all lines of business recorded smaller increases than in the previous quarter.

Respondents said not much had changed since last quarter, although some said competition had increased a bit for large accounts. These accounts saw overall average premium increases of 6.1 percent, which was the lowest among all account sizes.

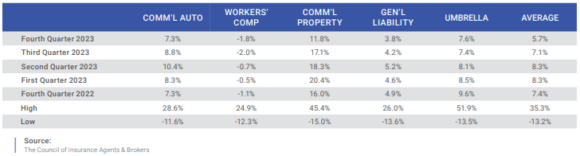

Increases in major lines of business—commercial auto, commercial property, general liability, umbrella and workers compensation—averaged 5.7 percent in Q4, down from 7.1 percent in Q3. Commercial property increases of 11.8 percent during Q4 continued a trend of moderation throughout 2023. Increases were 20.4 percent in Q1, 18.3 percent in Q2, and 17.1 percent in Q3.

According to respondents, reinsurance and natural catastrophe losses were given as reasons for increases in commercial property. Sixty-four percent of agents and brokers that answered the survey said there was a decrease in underwriting capacity. This marked the ninth quarter in a row that more than half of respondents said there was a decrease in capacity.

“At this point, we’re all numb to the changes and inundated with articles and whitepapers outlining the reasons,” said one survey respondent. “The underwriters and I have essentially stopped discussing the reasons and have moved on to individual account solutions at this point.”

In Q3 2023 D&O premiums decreased for the first time since Q1 2017. In Q4 2023, D&O increases were very nearly flat at 0.1 percent. Cyber increases dipped below 1 percent for the first time since the beginning of 2019, up 0.7 percent.

The Council noted that insureds’ rate fatigue and frustration with requests from carriers. Though down from the 70 percent mark recorded in Q3, 62 percent of agents and brokers said clients felt rate fatigue in Q4 and 55 percent felt burdened by requests for information from carriers.

On respondent said a client will attempt to improve its risk profile, but “the next year there are additional requirements,” and some feel they are “chasing a never-ending system where they have to make improvements to obtain coverage and then are hit financially both with improvements and premiums.”

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday  Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages  Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs  20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut