Discussions of talent in the property/casualty insurance industry often focus on the advancing average age of the workforce and the idea that the looming departures of retiring professionals will leave carriers shorthanded.

But an analysis that executives at Aon shared late last year paints a different picture.

There’s been “a little bit of Benjamin Button effect,” Charlie Gall, an associate partner and P/C practice leader for Aon’s Ward Benchmarking Group, said recently, drawing an analogy between industry professionals and a character in an F. Scott Fitzgerald short story who aged in reverse.

Speaking during Aon’s U.S. P/C Performance Outlook webinar in late December, Gall revealed that the average age of P/C insurance professionals actually declined to 45.7 in 2022, down from 46.1 in 2020. The average age figures come from a study of 68 P/C insurers that Ward published in April last year in a report titled “Human Resources and Employee Benefits Practices.”

As people leave the industry, “we’re backfilling with younger, less experienced talent. So, it has brought the average age down,” he said.

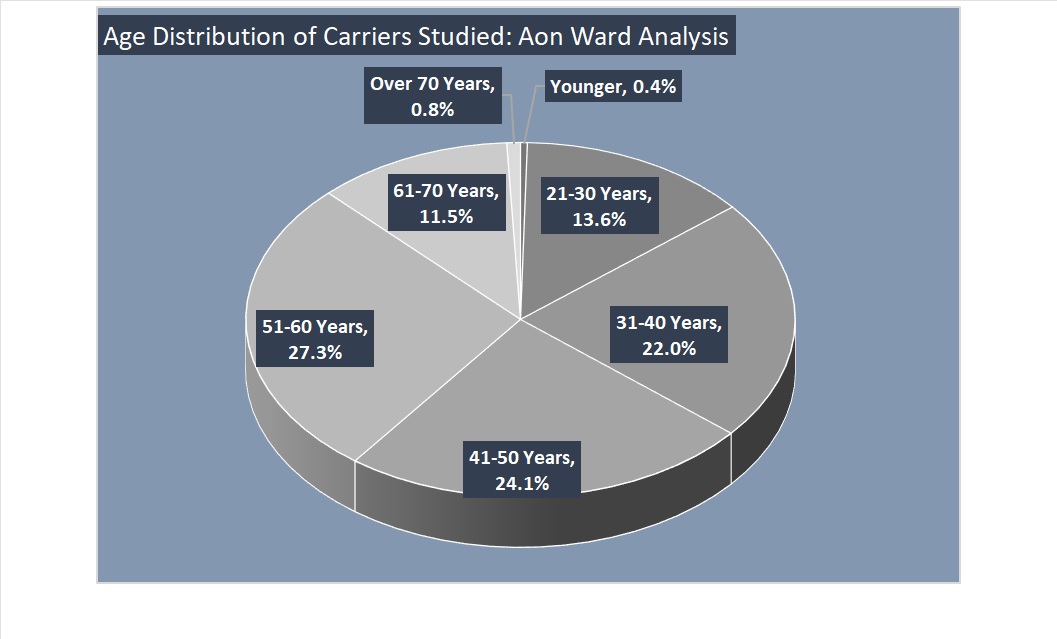

“For the last 10 years, it feels like there was going to be doom and gloom of this mass exodus of talent and people out of our industry. But I don’t think that’s ever really been a problem for us. And it doesn’t look like it’s going to be,” Gall said during Aon’s U.S. P/C Performance Outlook webinar in December. Supporting his view, Gall displayed a pie chart indicated that the percentage of carrier professionals falling in different age ranges is well distributed with about one-fifth in their 30s, about one-quarter in their 40s, and a little over a quarter in their 50s.

“And then you have 60s and people even working into their 70s. We’re having more people working longer in their life. And we have a pretty good [age] distribution.”

“And then you have 60s and people even working into their 70s. We’re having more people working longer in their life. And we have a pretty good [age] distribution.”

“I do think we aren’t going to see that kind of doom and gloom of a mass exodus. That’s not to say we can sit back and just not plan forward. But it definitely feels better than it has,” Gall said.

Gall went on to point out that employees over age 60 represented 12.3 percent of the workforce in 2022, according to Ward’s 2023 analysis, down from 12.7 percent in 2020. A slide he displayed showed that the most recent figure is more than 5 percentage points higher than a 7.1 percent figure from 2008, confirming his assertion that people are working longer. The slide also revealed that the over-50 age cohort dropped from 42.7 of the carrier workforce in 2016 down to 40.6 percent in 2020 and 39.6 percent in 2022.

“We’re starting to see a little bit of shift in this age distribution,” he said, again noting that the average age has gone down.

That said, carriers are still worried about talent. Earlier during the same webinar, Jeff Rieder, partner and head of Ward Benchmarking, shared results of Aon’s Global Risk Management Survey, showing that insurers “failure to attract and retain talent” among their top 10 risks, putting it second—behind the No. 1 risk of “cyber attacks” and ahead of “weather and natural disasters”—in 2023. Looking out to 2026, the same insurers still ranked the talent risk in the top 10, but this time in fourth place with “climate change” taking over the second-place ranking.

Referencing earlier reports, Gall noted that average tenure in the industry is falling—coming down nearly a full year—to 9.4 years in 2023 from 10.3 years in a 2021 study. But like average age, tenure was well-distributed on a pie chart, although the 0-3 years category was the largest segment, making up one-third of the total pie. “As we’ve had a lot of turnover, we haven’t been able to replace with experience and we have had to go into less experience,” he noted.

Strategic Workforce Planning

Gall said that carriers are tackling talent challenges with “strategic workforce planning.” A more robust approach than just paying attention to headcount, such planning means considering skillsets needed for the future, where and how work gets done, and employee rewards and recognition, among other factors, he said.

In terms of the “where” factor, Gall referred to the July 2023 edition of the Jacobson-Ward Labor Market Study, which surprisingly revealed that the percentage of carriers (P/C and life/health combined) expecting workers to come into the office to do their jobs at least one day a week over the subsequent six-month period—65 percent—was lower than the percentage reported in a January 2023 survey (72 percent). On the flipside, nearly one-third (32 percent) said that fully remote work would be the rule over the following six months, up from one-quarter in the January survey. (The small percentage of remaining respondents—4 percent in each period—are requiring their workforces to be in the office 100 percent of the time.)

Life/health carriers had higher expectations for in-office work, with 89 percent expecting their workers to show up in the office at least one day per week, compared to 64 percent of P/C carriers.

The majority of carriers (81 percent) said they anticipated no change in the number of days they would require employees to come into the office looking six months out. Gall said that the typical hybrid model for carriers anticipates two or three days in the office.

Rieder and Gall reviewed other results of the Labor Market Study that Aon jointly conducts with the Jacobson Group every six months—hiring expectations overall, hiring expectations by function, and assessments of the likelihood and difficulty in filling various positions. The results they cited during the December webinar will soon be updated. (The survey is open until the end of January and expected to be published in early February.)

Offering some information pertinent to the “rewards and recognition” aspect of strategic workplace planning, Gall said that Aon projects base salaries will rise about 4 percent in 2024. “That’s about what it was before the last economic downturn in the early 2000s,” Gall said, referring to the 2007-2008 downturn.

Beyond base pay increases, Gall said that the majority of merit increases will be in the 3.5-4 percent range, with promotional budgets adding another half a percent point. Rieder noted that “pay compression” will become increasingly problematic for carriers. In particular, he explained that over the last few years, at smaller companies, “senior contributors are being paid near the levels of executive leadership, in some cases even more.” He also noted that more and more states are adopting pay transparency laws, which will shine the light on this trend.

Rising Headcount at InsurTechs

Separately, Adrian Jones, an insurance investor who tracks InsurTech employment trends, reported rising headcount in that segment of the insurance industry earlier this month.

In a LinkedIn post, Jones updated an analysis 400 large InsurTechs (P/C and L/H) to find that while more than half of them cut their workforces, as a group the 400 companies had 5 percent more employees—rising to a total of nearly 105,000.

For those InsurTechs that cut workforces by at least 5 percent, the average reduction was 35 percent, Jones reported.

(Editor’s Note: Jones accepted a position as chief of staff of Acrisure after posting his tally on LinkedIn in mid-January this year. Last year, he shared a similar analysis of InsurTech workforce trends, using LinkedIn company page headcounts, in a post on LinkedIn and in an article for Carrier Management titled “Assessing InsurTechs Greatest Value to the Industry: Talent“)

Jones found that midsize InsurTechs—those with more than 200 employees but less than 1,000—struggled the most in 2023, shrinking headcount by 0.4 percent overall. Meanwhile, the largest InsurTechs ended the year with 8 percent more employees and the smallest companies grew employee counts by 9 percent.

“Overall, headcount trends are positive for older, larger companies and younger, smaller companies that are still in rapid growth stages,” Jones wrote.

Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages  20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut