Reinsurers had varied appetites for casualty reinsurance during the January 2024 renewals; while capacity was sufficient, they still maintained underwriting discipline, according to reinsurance brokers in their renewal reports.

“Some reinsurers adopted a tougher stance ahead of the January 2024 casualty treaty renewals, against a backdrop of prior-year reserve deterioration and concern for adverse litigation trends. Others recognized the earnings potential of improving primary casualty pricing and higher interest rates,” Aon said in its market report titled “Reinsurance Market Dynamics – January 2024.

“Reinsurers demonstrated a mixed appetite for growth amid concern around loss trends, broadly dependent upon their respective positions during the 2015-2019 years. Reinsurers with less exposure to those soft market years were poised for growth at 1/1…,” Aon said, noting that buyers saw favorable outcomes despite these varied reinsurer risk appetites.

Similar viewpoints were provided by Marsh, Gallagher Re and Howden in their respective reports.

“While property renewals were the focus a year ago, casualty faced more scrutiny this year,” said Marsh in its renewal commentary, titled “January 1, 2024, Reinsurance Renewals Reflect a Motivated Market With Increasing Capital.” “While negotiations were nuanced and bespoke, capacity was ample once market clearing terms were met.”

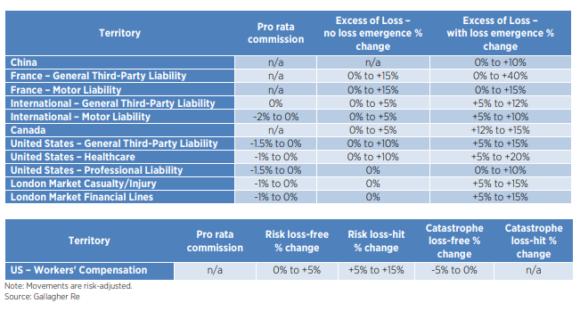

“Casualty, notably but not exclusively U.S. casualty, was no longer the valuable currency that was used to support property catastrophe capacity this time last year,” said Gallagher Re’s 1st View report, titled “What a Difference a Year Makes.”

Howden said that sufficient capacity and market discipline characterized casualty reinsurance renewals at Jan. 1, 2024. “Certain markets are growing their portfolios in what they perceive to be an attractive marketplace whilst others are reducing, reflecting their view that the market continues to require underlying rate increases,” said Howden’s January renewal report titled “A new world.”

Aon said that casualty insurers achieved “a fair outcome” during the Jan. 1, 2024 renewals, “driven largely by sufficient reinsurance capacity despite reinsurer concerns around prior-year reserve development and adverse litigation trends. While the renewal cycle began with many reinsurers making strong statements regarding casualty market dynamics, the 1/1 renewals were ultimately completed in an orderly manner compared to prior years.”

Reinsurers were less confident in third-party liability lines, “despite very significant increases in primary market pricing and limit reductions since H2 2019,” said Gallagher Re.

In the weeks leading up to renewal negotiations, Howden said, certain reinsurers “talked up the need to push for wholesale action to address economic and social inflation” and the associated risks to reserve adequacy.

However, renewal outcomes “ultimately reflected more discerning underwriting informed by loss experience, underlying rate change and prior-year development across individual portfolios,” Howden added. “Underlying prior-year loss development and social inflation trends have affected U.S. markets more than international carriers, which was reflected in reinsurance placements at 1 January 2024.”

Casualty reinsurers continue to differentiate between individual insurers rather than applying a broad approach, said Aon. “Reinsurers that attempted to broad brush the market did not succeed.”

Aon said that reinsurers were again focused on prior-year development, underlying rate changes and social and economic inflation. “Given that most metrics measuring inflation are showing a significant decrease from the peak in summer 2021, reinsurers pivoted to citing concerns around social inflation rather than economic inflation which is a stark contrast to last year’s renewal cycle.”

D&O Decreases Continue

Howden noted that prices in the directors and officers market continued to drop and there were signs of softening in other casualty classes, but underlying rates for most long-tail lines are still at “historic highs.” “Investment portfolios are also now yielding significantly improved returns following rapid interest rate rises.”

“With heathy primary rating, most liability reinsurance classes were stable at 1/1…,” Aon said, adding that capacity, program structures and terms remained largely unchanged.

“The one exception is directors and officers, where lower direct rates have led to reinsurers becoming more cautious and risk selective,” Aon continued, noting that its public D&O pricing index for Q3 2023 dropped 16.3 percent year-over-year, representing six consecutive quarters of pricing decreases.

Gallagher Re said that underlying rates in the U.S. for public D&O decreased, “but there are indications that decreases are moderating.”

“This follows a very hard market in 2020-2022 where D&O rates nearly doubled across the board, [and] there were dramatic reductions in limits deployed…,” said Gallagher. “In addition, during 2023, the claims environment (specifically the frequency of securities class actions) has been relatively low for the third year running.”

Related:

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality  Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  Preparing for an AI Native Future

Preparing for an AI Native Future