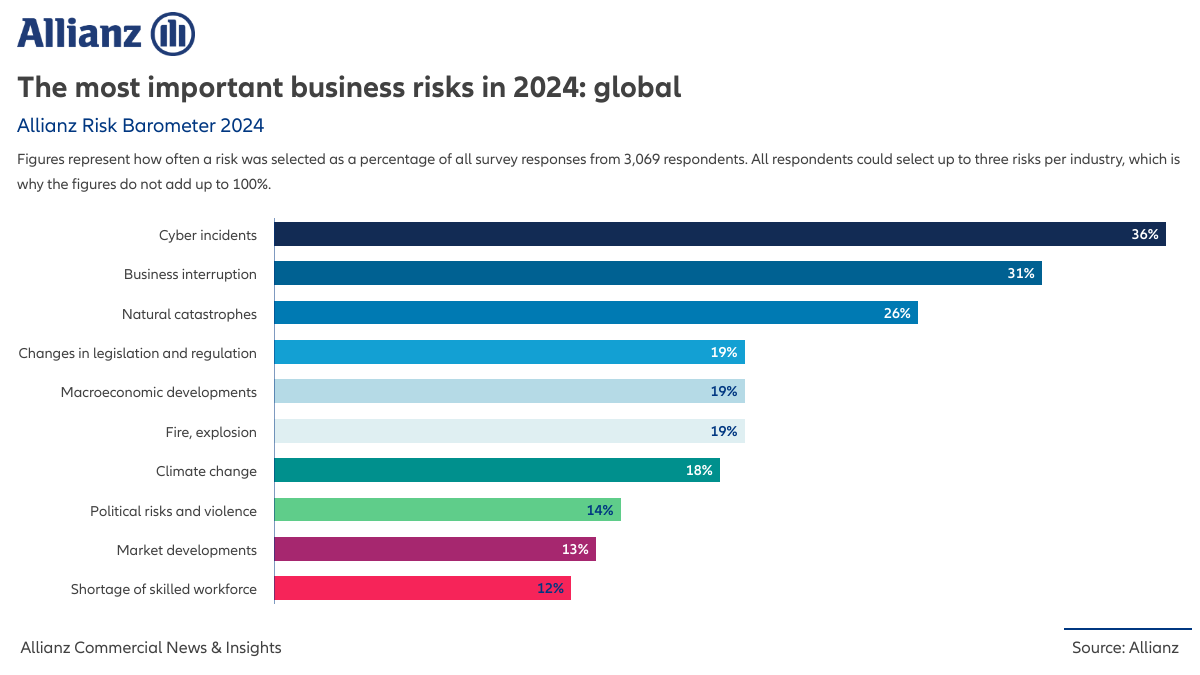

A new report indicates cyber-related incidents such as ransomware attacks, data breaches and IT disruptions are the biggest worry for companies globally in 2024, according to the Allianz Risk Barometer.

Business interruption ranked second, while natural catastrophes ranked third (up from No. 6) on the list of top business concerns.

Fire and explosion and political risks and violence jumped the list to make the top 10, based on the insights of more than 3,000 risk management professionals.

In the United States, cyber has replaced business interruption as the leading risk for the year ahead.

Natural catastrophes rose to the third spot (up from No. 5 in 2023).

In Canada, business interruption jumped to the top spot (up from No. 4 in 2023) followed by cyber incidents and natural catastrophes.

“The top risks and major risers in this year’s Allianz Risk Barometer reflect the big issues facing companies around the world right now: digitalization, climate change and an uncertain geopolitical environment,” said Allianz Commercial CEO Petros Papanikolaou. “Many of these risks are already hitting home, with extreme weather, ransomware attacks and regional conflicts expected to test the resilience of supply chains and business models further in 2024. Brokers and customers of insurance companies should be aware and adjust their insurance covers accordingly.”

The same risk concerns unite large corporates, midsize, and smaller businesses, the report noted, though the resilience gap between large and small companies is widening “as risk awareness among larger organizations has grown since the pandemic with a notable drive to upgrade resilience.”

Because smaller businesses lack the time and resources to identify and effectively prepare for a wider range of risk scenarios, the time to get the business back up and running takes longer.

Trends Driving Cyber Activity in 2024

Cyber threats (36 percent of overall responses) rank as the most important risk globally for the third year in a row — for the first time by a clear margin (5 percent points) — and is now considered the top peril in 17 countries, including Australia, France, Germany, India, Japan, the UK and the U.S.

The threat of most concern are data breaches (59 percent of respondents), followed by attacks on critical infrastructure and physical assets (53 percent).

The increase in ransomware attacks in 2023 led to increased insurance claims activity, up by more than 50 percent compared with 2022, and fears (53 percent) it will continue into 2024.

“Cyber criminals are exploring ways to use new technologies such as generative artificial intelligence (AI) to automate and accelerate attacks, creating more effective malware and phishing. The growing number of incidents caused by poor cybersecurity, in mobile devices in particular, a shortage of millions of cybersecurity professionals, and the threat facing smaller companies because of their reliance on IT outsourcing are also expected to drive cyber activity in 2024,” explains Scott Sayce, global head of Cyber, Allianz Commercial.

Business Interruption and Natural Catastrophes

Business interruption (31 percent) retains its position as the second biggest threat in the 2024 survey., mainly due to the recognition of the interconnectedness of businesses and the reliance on supply chains for critical products or services.

The Allianz report found that improving business continuity management, identifying supply chain bottlenecks, and developing alternative suppliers will continue to be key risk management priorities for companies in 2024.

After a record-breaking year in 2023, natural catastrophes (26 percent) is one of the biggest movers at No. 3, up three positions.

Regional Differences and Risk Risers and Fallers

Climate change (18 percent) may be a non-mover year-on-year at No. 7 but is among the top three business risks in countries such as Brazil, Greece, Italy, Turkey and Mexico, the report found, noting that “physical damage to corporate assets from more frequent and severe extreme weather events are a key threat.”

The sectors most exposed include utilities, energy and industrial sectors.

Ongoing conflicts in the Middle East and Ukraine, and tensions between China and the U.S. pushed concerns of political risks and violence (14 percent) up the list to No. 8 from No. 10.

The shortage of skilled workforce (12 percent) is seen as a lower risk than in 2023, dropping from No. 8 to No. 10, though businesses in Central and Eastern Europe, the UK and Australia identify it as a top-five business risk.

Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb  Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs  Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut