While the reinsurance market indeed stabilized during the January 2024 reinsurance renewals (from the chaotic January renewals of last year), buyers with loss-affected programs experienced further upward pressure on retentions and prices, according to reinsurance brokers in comments about the renewal season.

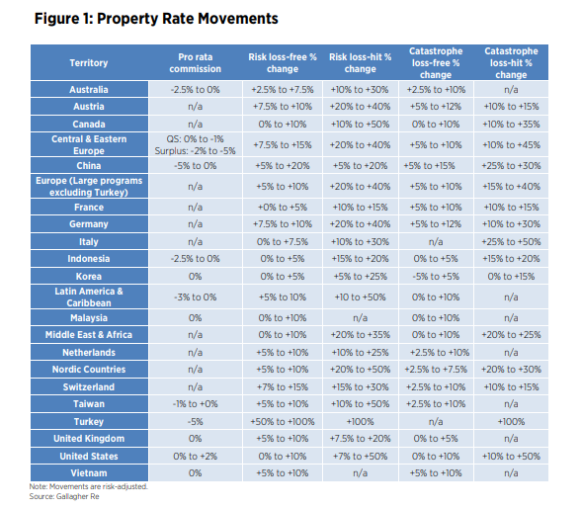

“Overall, there was an adequate supply of catastrophe and risk capacity and in some cases capacity outpaced demand. But there was greater reinsurer price sensitivity on loss-impacted programs.” That was Gallagher Re’s summation of the US property renewal market at 1/1, which saw catastrophe-loss-hit programs ranging from price hikes ranging from 10% to 50%.

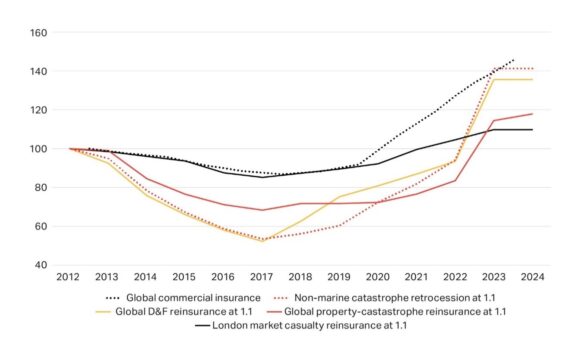

“Lower attaching catastrophe layers [in the US] experienced the greatest [upward] pressure on rate, while mid-to-upper layers benefited from ample capacity,” said Gallagher Re’s 1st View report, titled “What a Difference a Year Makes.” (See related chart below).

U.S. renewals at Jan. 1, 2024 “reflected improved supply dynamics, with reinsurers willing to support terms and pricing levels broadly aligned to those established during last year’s renewals,” said Howden in its report, titled “A new world.” “Whilst capacity continued to be restricted for lower layers, increased competition further up programs (driven in part by the ILS market) brought more attractive pricing for mid-to-top layer risks.”

Loss-hit catastrophe programs saw significant rate hikes elsewhere in the world. For example, Turkey experienced a doubling in rates after the deadly 7.8 magnitude earthquake in February 2023, while Italy saw increases ranging from 25% to 50%, according to Gallagher Re’s report.

Global property catastrophe reinsurance risk-adjusted rate changes averaged from near-flat to single-digit increases for non-loss-affected programs with 10%-30% increases for loss-affected programs, “with a wide range of outcomes around these averages,” said Marsh, in its renewal commentary, titled “January 1, 2024, Reinsurance Renewals Reflect a Motivated Market With Increasing Capital.”

Loss-Free-Program Surprises

Jefferies, the equity research firm, quoted Gallagher’s report, which revealed that most loss-free contracts were priced upwards by 0% to 10%.

However, Jefferies further commented on the “surprising strength of rate rises in Europe,” pointing to “loss-free Turkish contracts pricing up by between +50% and +100% (due to the earthquake),” said Jefferies, quoting Gallagher Re statistics.

“One particularly positive surprise to us was that German, Swiss, Austrian, and Eastern European loss-free contracts priced up between +7% and +15%. European contracts generally appear to have priced up more than most, with loss-free contracts up by between +5% and +10% in most cases, which compares favourably to the US and most of Asia at between 0% and +10%. In Asia, China stands out at +5% to +20%, which perhaps reflects the underlying profitability issues,” Jefferies continued.

Elevated Catastrophe Losses

Elevated catastrophe losses mean elevated exposures and elevated demand for 2024, the brokers confirmed.

“[I]nsured losses from natural catastrophe events were again at elevated levels relative to historic averages, driven mainly by an unprecedented impact from severe convective storm activity in the US and Italy, windstorm Ciaran in France, flood losses in New Zealand, flood and wildfire losses in Greece, a major earthquake in Turkey and Hurricane Otis in Mexico,” said Aon in its market report titled “Reinsurance Market Dynamics – January 2024.”

The overall property catastrophe price tag for re/insurers hit $100 billion during 2023, with severe convective storm (SCS) losses accounting for nearly $60 billion of that total, said Gallagher Re. “Reinsurers adjusted their view of SCS frequency to account for the 2023 storm season, which put additional pressure on pricing.”

The exposure trends, ongoing inflation and the January 2024 renewals set “the stage for an interesting year ahead,” as demand for property catastrophe reinsurance remains strong, Aon said.

“As capacity continues to build, there will be opportunities for insurers to buy additional limit at the top of programs, and for reinsurers to work with brokers and clients to share the burden of secondary perils [such as SCS] more equitably,” Aon continued.

“The increases in retentions a year ago have mitigated reinsurer losses and contributed to their positive returns in 2023. But this has come at the expense of increased retained losses for insurers many of whom are struggling to achieve the improvements in primary pricing and underwriting which are often slowed by regulatory approval process quickly enough given their limited sources of capital to sustain increased catastrophes,” Aon said.

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages  Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook

Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook  Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers  Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk