Even though reinsurance executives are making noise about social inflation and liability rate inadequacy, WTW isn’t expecting any major changes in the pricing for commercial casualty or property insurance markets heading into 2024.

“The property market will try to lean into the hard market for as long as possible (which could be increasingly difficult if new money comes into the market on January 1). With a constricting capital base and current insurers remediating their liability portfolios, the casualty market might attempt to drive rate increases,” the global broker and advisory firm said in the latest edition of its semiannual “Insurance Marketplace Realities Report,” published in mid-November.

“Despite the shifting terrain, in the near term, we don’t expect material or sudden changes in the market—for better or worse,” the report said.

Throughout the introduction to the report, WTW referred to the “shifting terrain” that brought reinsurers and primary insurers to the current market. On the property side, the report describes inflationary and supply chain challenges driving property losses, “wholesale cuts in reinsurance capacity,” and subsequent overhauls of property insurers’ portfolios. For casualty, social inflation and geopolitical and economic uncertainty, along with rising investment yields, are the potential shifting or destabilizing forces in the market.

“Heading into 2024, casualty treaty reinsurers are telegraphing concerns around social inflation and rate adequacy in the liability lines. If investment and reinsurance capacity falls out of the liability lines, the current ‘moderate’ rate environment could be pushed into harder conditions,” the report says.

Not so for financial lines, including cyber, which WTW identifies as the “the bright spot” from a buyer’s perspective. These lines “appear to be on steady ground in a soft market,” the report says, predicting that a shift toward a hard market won’t happen unless insurers face “a couple of considerable claims or a troubled financial market.”

The report offers these observations by segment or line of business:

Property

“Every insured will see continued pressure at renewal on rates, values and terms. The overall risk profile of the insured (cat/non-cat, loss free/heavy losses, etc.) will determine the overall impact,” the report says.

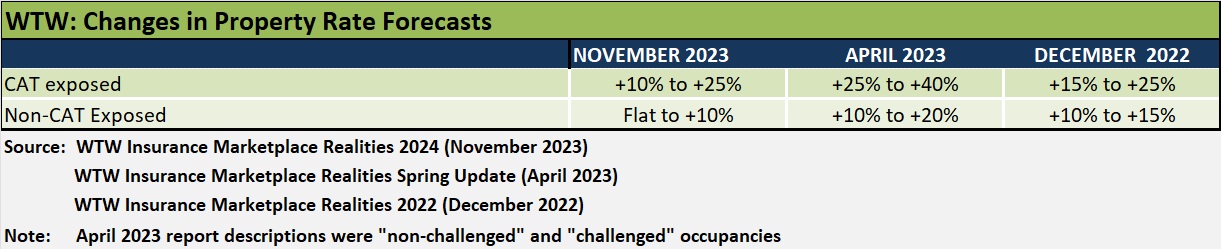

Notably, a comparison of WTW rate forecasts with prior reports shows the biggest relief from existing hard market conditions for buyers coming in property lines. Even for cat-exposed property, the low end of rate hikes has dropped from +15 percent in the first report for 2023 (published in December 2022) to +10 percent in the current report.

As for the prospect of “new money” softening the market, the report notes that new reinsurance capacity through capital market investment has remained largely on the sidelines due to more attractive and guaranteed investment returns in the current interest rate environment. And because the U.S. Federal Reserve’s monetary policy “is seen to remain restrictive for the foreseeable future,” the report suggests that the higher interest rate environment will continue steering potential capital market investments away from insurance and reinsurance.

Domestic Casualty

For domestic casualty lines, including general liability, umbrella, commercial auto and workers compensation, the WTW report shows rate forecasts changing little from recent prior periods.

Most of the discussion in the section on domestic casualty in the report centers around changes in limits and program structures that have been made since 2015 when mega verdicts started to impact carrier balance sheets.

A key observation: WTW has found that 55 percent of its large and complex clients purchased umbrella liability and primary liability from the same carrier in 2023—down from 37 percent in 2015. At the same time, average umbrella limits for clients with these structures in place dropped to $11.2 million from $20.1 million eight years earlier.

Cyber

WTW’s forecast for cyber indicates the possibility of decreasing rates for the first time in years, with the low end of the rate forecast at -5 percent.

“Premium stabilization that began toward the end of 2022 has continued into 2023. While 2022 started with 50-150 percent increases, we now regularly see flat increases or even decreases at renewal,” the report says, noting that rate increases “will be the steepest for those organizations that cannot demonstrate strong cyber risk controls, culture and overall cyber hygiene.”

The report also notes that competition between markets is strong. “[W]e frequently receive two to three quotes for certain risks. Incumbents are eager to retain business,” the report says.

Directors and Officers Liability

For public company D&O, the worst result WTW forecasts for primary business is a flat renewal, while excess and side A rates could fall as much as 15 percent.

WTW cites an influx of capacity into the market starting in late 2020 as the driver of competition which pushed rate hikes down in 2021 and 2022. In 2023, WTW saw “flattened-to-reduced” D&O premiums

The report notes, however, that insureds that experienced material premium relief in previous renewal cycles, may see decreases tapering off.

Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb  Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook

Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook  Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster  Preparing for an AI Native Future

Preparing for an AI Native Future