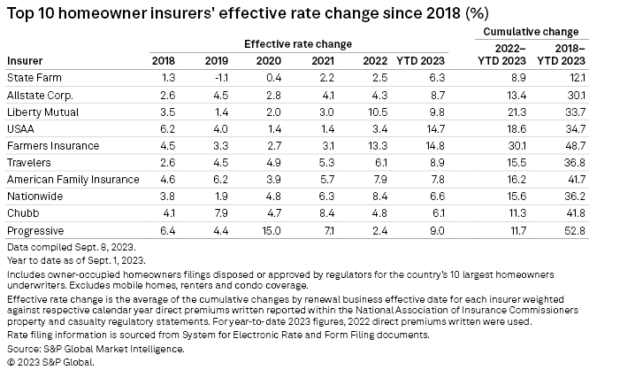

Farmers Insurance Group of Cos. and United Services Automobile Association (USAA) have increased homeowners insurance rates by nearly 15 percent each to lead all other insurers.

According to S&P Global Market Intelligence‘s RateWatch application, Farmers’ year-to-date calculated effective rate change on homeowner policies through Sept. 1, 2023 was up 14.8 percent — just a tick higher than USAA’s 14.7 percent rate hikes thus far in 2023.

“Macroeconomic conditions continue to plague U.S. personal lines-focused insurers as the past two years have seen a higher-than-average rise in homeowners insurance rates,” S&P said. “Between 2018 and 2021, the countrywide yearly average change was in the 3 percent range but jumped to about 6 percent in 2022. Through roughly the first eight months of 2023, the national average rise in homeowners premium rates was 8.8 percent.”

Farmers has received approval to increase rates across 43 states, with an average hike of more than 10 percent in 28 states. S&P said the insurer’s three largest effective rate increases were in Illinois, Texas and Tennessee, at 25.3 percent, 25.1 percent and 23.8 percent, respectively.

Meanwhile, USAA has raised rates in 44 states through Sept. 1, highlighted by a 36.6 percent effective rate change in Arizona, which saw insurers increase rates the most of any other state — a weighted average of 18.4 percent, S&P said. Texas was second highest, with a 16.4 percent increase.

USAA also increased rates by more than 30 percent in two other states: Colorado and Tennessee.

Progressive Corp. has the largest year-to-date effective rate change in any state among the country’s largest homeowner writers with an uptick of about 57 percent in North Carolina that went into effect June 19 for renewals. Progressive was also approved to hike rates by a weighted average of 25 percent in California.

The states with the lowest weighted average increase by insurers so far in 2023 are Hawaii, Vermont and New Jersey at 1.8 percent, 2.5 percent and 2.8 percent, respectively.

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday  Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation