Capacity was more readily available during the midyear renewals, which brokers described as “orderly,” in comparison to the turbulent January renewals. At the same time, prices saw some moderating trends while reinsurers continued to maintain underwriting discipline, according to reports published by Aon, Gallagher Re and Guy Carpenter.

Aon said property-catastrophe capacity at midyear was ample, with top layers on some U.S. national programs oversubscribed. “Midyear renewals saw signs of reinsurer appetite for catastrophe returning, with ample capacity for U.S. and Florida,” according to Aon’s report titled Reinsurance Market Dynamics June and July 2023, which noted that “a sense of order returned to renewals at midyear,” after a “turbulent” Jan. 1 renewal period.

“Additional capacity behind established relationships helped increase supply, while several reinsurers began to deploy increased shares on programs,” Aon said, explaining that reinsurer appetite was strongest at the top end of programs, and was more constrained in the lower-middle layers of catastrophe programs.

Reinsurer capital increased by 5 percent, or $30 billion, to $605 billion in the first quarter of 2023, “as earnings were strong and catastrophe bond markets rebounded. While capacity has not returned to 2022 midyear levels, reinsurers are showing a willingness to support current terms and grow in target areas,” Aon added.

“Supply and demand showed signs of coming more into balance, particularly for programs that were perceived by reinsurers to be well structured and appropriately priced,” said Gallagher Re in its report titled “1st View: Continuing Discipline – July 2023,” which focused on the July renewals while the Aon and Guy Carpenter reports covered both the June and July renewals. (The majority of property catastrophe accounts in Florida and Australia renew at June 1 and July 1).

This growing market equilibrium has created a “more orderly” July renewal, which Gallagher Re attributed to new capital entering the market, via capital raising by traditional reinsurers as well as insurance linked securities (ILS) funds, along with moderated demand from buyers through a combination of increased retentions and deferring purchases of additional limit.

Reinsurance broker Guy Carpenter agreed that additional capacity and increased appetite entered the property market at midyear but “the increased capacity remained highly disciplined around attachment points, pricing and coverage.”

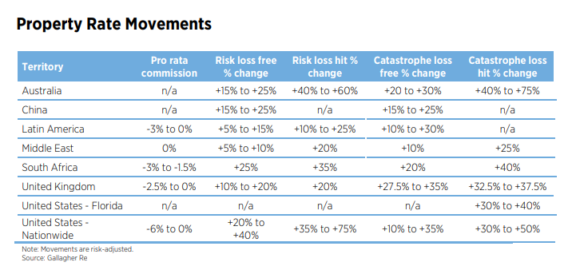

“While property pricing saw continued risk-adjusted rate increases in many segments, the average change moderated from January 1,” according to Carpenter in its market briefing.

Property Prices

Addressing property pricing trends, Aon said, risk-adjusted rate increases for U.S. and Florida property catastrophe covers averaged between 25 and 35 percent, although the level of increase is slowing in comparison to the January renewals.

Guy Carpenter noted that global property catastrophe reinsurance risk-adjusted rate increases ranged from +10 percent to +50 percent, with loss-affected clients often seeing higher prices. “In the U.S., property-catastrophe reinsurance risk-adjusted rate increases were on average the highest in 17 years, with loss-free accounts generally up +20 percent to +50 percent.

“Price adequacy across lines and supportable structures are expected to continue to drive sufficient capacity levels. For cedents, higher levels of retained risk across the business in 2023 will most likely impact volatility in 2024, necessitating strategic portfolio management,” said Dean Klisura, president & CEO of Guy Carpenter, in a statement.

“With the improved terms and conditions available in the reinsurance market, some existing reinsurers are leaning into the hardening market, committing more of their existing capital, as well as any new capital they are raising, to reinsurance,” commented Tom Wakefield, global CEO Gallagher Re. “However, in contrast to other historic hard markets, there are limited signs of completely new reinsurance entities forming and the current trend is one of consolidation into fewer, larger reinsurance entities—which, in the absence of any major losses, points towards pricing stability.”

Regarding structural changes driven by reinsurers, Gallagher Re noted that reinsurers have continued to move from surplus to quota shares, while increased retentions were commonly seen in excess-of-loss programs, which was consistent with the January renewals.

The brokers went on to discuss some of the key trends seen during the midyear renewals. A selection of some of their comments follows here by line of business and alphabetically by broker.

- Aon on property. Aon said there is pent-up demand on the part of reinsurance buyers. “Having strategically held off buying additional limit at January 1, insurers with earlier inception dates returned to the market at midyear to purchase additional limit as catastrophe activity was more readily available,” Aon said. “Demand for property-catastrophe reinsurance protection for 2023 is now expected to increase by high-single-digits globally or as much as 10 percent for U.S. catastrophe as insurers look to reduce net exposure or secure capacity ahead of 2024.”

- Gallagher Re on property. “Overall, there was sufficient supply of capacity to clear [Florida] renewals, albeit at meaningful price increases now compounding over multiple years.” On the other hand, for U.S.-nationwide risks, Gallagher said, risk excess capacity remained tighter as many participants from London withdrew from this market segment. “Unlike catastrophe lines, meaningful increases in appetite for per-risk exposure were not apparent, particularly on lower layers where market interest contracted.”

- Guy Carpenter on property. In many cases, cedents retained more risk rather than accepting unfavorable terms, according to Carpenter. “While lower-layer capacity and aggregates remained highly constrained, new capital raised by existing market participants and growing appetite by other established reinsurers saw overall capacity levels rebound.”

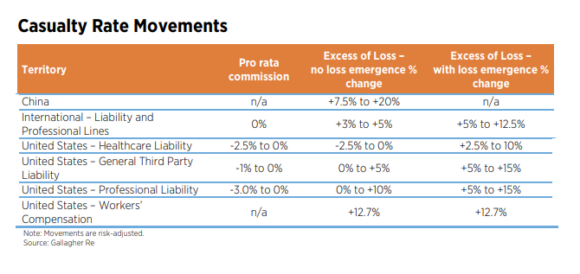

- Aon on casualty. Capacity is abundant in the casualty market, Aon affirmed. “U.S. and international casualty markets remain stable, with ample capacity across almost all major lines of business at the midyear renewals,” the broker added. “Liability insurers are in a relatively strong position following several years of underlying rate increases and rising interest rates, although loss development from prior years remains a challenge for some.” Aon said long-tail lines remain attractive to reinsurers, while reinsurers continue to show underwriting discipline.

- Gallagher Re on casualty. Casualty placements were straightforward in most cases during the July renewals, “with adequate capacity and flat-to-moderate rate increases,” Gallagher Re said. Reinsurers generally were comfortable with “the improvements buyers have been making in their underlying primary policies, including adjustments for recent inflation.” While some classes of professional lines saw signs of rate softening, Gallagher said, reinsurers by and large “have been prepared to continue their support as they see the rates as still being adequate, as an improvement in original claims frequency and disciplined limit management is continuing to mute the impact of severity.”

- Guy Carpenter on casualty. “Reinsurance pricing pressure continued across most casualty lines driven by continued prior-year loss development, effects of social and economic inflation, moderating underlying rate changes (in some cases, decreases) and an increase in reinsurer margin requirements,” said Carpenter, further noting that client differentiation remains critical to renewal outcomes and sufficient capacity “was generally available…”

- Aon on retrocession. “Retro has stabilized, and catastrophe bond markets have rebounded, while Hurricane Ian losses have developed in line with expectations, if not at the lower end of expectations,” said Aon. “Losses from Hurricane Ian have developed within expectations, and towards the lower end of forecasts. With insured losses estimated at $52.5 billion according to [Aon’s] Impact Forecasting, Ian contributed to uncertainty in the run-up to the January renewal and late retro renewals.”

- Gallagher Re on retrocession. “Another sign of an improvement in the supply of capacity was seen in the retrocession market, where capacity on an occurrence basis was available, albeit at a significant cost, which in many cases was no yet proving attractive to buyers,” said Gallagher.

- Guy Carpenter on retrocession. “Midyear renewals saw a continuation of price and coverage trends experienced earlier in the year, with post January 1 oversight leading to a more orderly renewal process and a narrower range of quotes and firm order terms,” said Carpenter. “Capacity was less scarce midyear, predominantly due to modest reduction in demand stemming from retro pricing dynamics and favorable terms on inwards portfolios.”

All three brokers commented on the fact that catastrophe bonds experienced a record first half in 2023.

Aon said the catastrophe bond market has been the main contributor to ILS capital growth, with overall ILS capital totaling $100 billion as of March 31, 2023. “The rebound in the catastrophe bond market this year alleviated some demand-supply pressures at midyear, with catastrophe bond capacity at an all-time high,” according to Aon.

“The catastrophe bond market has grown with outstanding notional increasing by $3.8 billion in 2023 to date and continues to trend upward as widening spreads and heightened rates make insurance-linked securities an increasingly attractive asset class for investors,” Aon continued.

Carpenter said, by June 30, 41 different catastrophe bonds were placed in the market for approximately US$9.2 billion in limit, “taking the total outstanding notional amount to more than $37.8 billion.”

In comparison, Guy Carpenter added, the total limit placed during full year 2022 was $9.3 billion and the average limit placed in the first half of the last five years was US$6.5 billion.

Gallagher Re said one of the more encouraging signs for the market has been the ability of some ILS funds to attract new investments, particularly into more liquid catastrophe bond strategies. “The strong returns achieved by ILS funds in 2023 to date have undoubtedly assisted the growing investor interest, and this in turn has supported an increase in the number of new bonds being issued…”

Gallagher Re said ILS investors also have begun to refocus on ILS for other perils such as cyber and casualty.

This article was originally published by Insurance Journal. Reporter L.S. Howard is the International and Reinsurance editor for Insurance Journal.

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages  Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash