With the June 1 reinsurance renewals a week away, the outlook for Florida-based property insurers may not be quite as dire as many had predicted earlier this year, at least according to a top official with one of the world’s largest reinsurance brokers.

“So far, what we’re seeing is a much more orderly renewal process than what we saw in 2022,” Rhandahl Fuller, managing director and Florida practice lead for Guy Carpenter & Co. He spoke this week at an online Florida market briefing hosted by the AM Best financial rating firm.

While some in the industry have warned that reinsurance renewal costs could rise another 40% next month, along with tightened availability, Fuller suggested the feeling now is more of “cautious optimism.”

“We saw a bit more overall appetite as some of the reinsurers that had stepped back last year either reentered or they increased their participations this year,” he said.

And one big reason for the measured sanguinity is that recent Florida legislative reforms, which have limited assignments of benefits and one-way attorney fees, already appear to be having an impact on many carriers’ long-suffering bottom lines.

Claims litigation and defense containment costs in Florida rose steadily from 2014 to 2018, dipped a bit in 2019, then rose again, explained Chris Draghi, AM Best’s associate director, who also spoke at the webinar. Since 2013, defense costs have increased more than six-fold and since 2018, Florida insurers have spent $2.6 billion in that category for homeowners, allied lines and fire insurance claims. Draghi called that “a material amount.”

Looked at another way, the direct defense and cost-containment expenses for Florida carriers were about 8% of direct premiums earned in 2022, compared to 2% for most other states. The next-closest state was Louisiana, with about a 4% cost number.

Looked at another way, the direct defense and cost-containment expenses for Florida carriers were about 8% of direct premiums earned in 2022, compared to 2% for most other states. The next-closest state was Louisiana, with about a 4% cost number.

But since late 2022, those defense costs have started to drop in the Sunshine State, after May and December legislative changes, the AM Best-compiled data show.

“We really started to see the impact pretty quickly,” Fuller said. “We’re already starting to see companies observing pretty significant decreases in reported claims and frequency of AOB, and frequency of litigation. So a lot of that stuff is kind of happening behind the scenes and not all of it’s going to be reflected in operating results right away.”

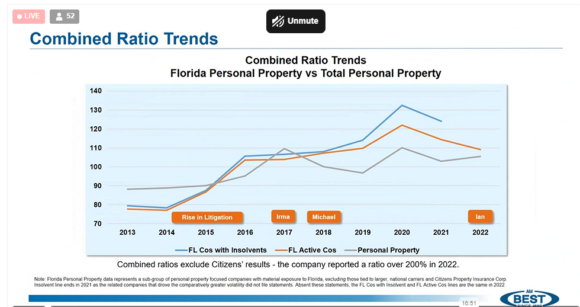

Combined ratio for Florida carriers, excluding major national companies and Citizens Property Insurance Corp., also has dropped since 2020, after rising steadily for six years, Draghi pointed out. In 2014, those carriers enjoyed a luxurious combined ratio in the high 70s. But by 2020, that had almost doubled before sliding back slightly. For many insurers, though, the bellwether measure of profit is still well above 100, he noted.

Direct-loss ratios also are improving, Fuller said. For the first quarter of this year, the Florida domestic industry saw the ratio drop 5 points from the same time in 2022. The average ratio is now 15 points lower than the five-year average for Q1 – “pretty meaningful movement there,” Fuller said.

“We saw that more than 75% of the companies were reporting improvements year-on-year on that direct-loss ratio,” he noted. “So that’s really, really encouraging.”

But the Florida market is not out of the woods yet, Fuller and Draghi said. Capital contributions since 2018 for those Florida carriers, excluding Citizens and major nationals, have increased significantly, totaling $1.8 billion. But in that time, surplus amounts have risen just $158 million, or about 7.6%, Draghi’s data show.

“So what this indicates is that there has been a substantial amount of capital that has been flowed into these primary insurance carriers that is almost needed in order to keep them afloat,” he said. “And you have to wonder how long that can continue, if there’s any concerns in that kind of dynamic.”

Top photo: AM Best’s Jeff Mango, left, and Guy Carpenter’s Randy Fuller, in the webinar.

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash