AM Best has placed under review with negative implications the Financial Strength Rating of “A-” (Excellent) and the Long-Term Issuer Credit Ratings of “a-” (Excellent) of R&Q Insurance Holdings’ three wholly owned program management subsidiaries: Accredited Surety and Casualty Co. (ASC), Accredited Specialty Insurance Co. (ASI) and Accredited Insurance (Europe) Ltd. (AIEL).

Concurrently, AM Best has placed under review with negative implications the Long-Term ICR of “bbb-” (Good) of Bermuda-based R&Q Insurance Holdings Ltd. (R&Q), the non-operating holding company of the group.

The credit ratings reflect R&Q’s balance sheet strength, which AM Best assesses as very strong, as well as its adequate operating performance, neutral business profile and appropriate enterprise risk management.

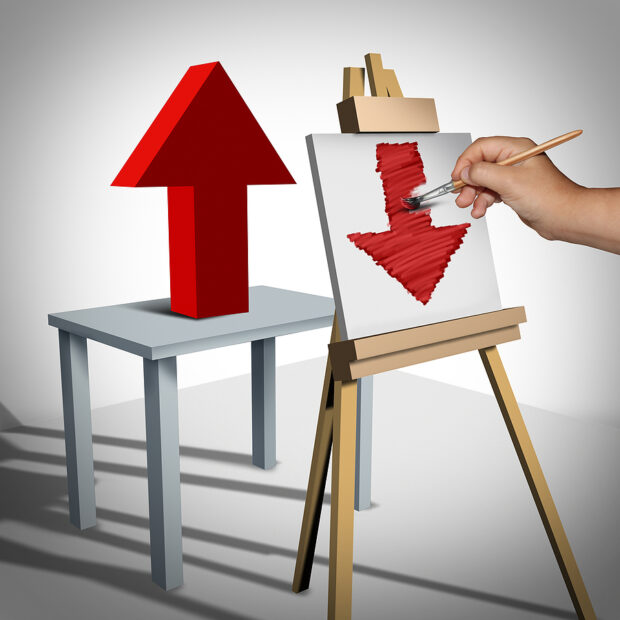

The rating actions follow the April 4, 2023 announcement that R&Q is reviewing strategic options to separate its program management and legacy insurance businesses, and that the group is expected to report a material operating loss for 2022. AM Best had previously considered the three Accredited subsidiaries to be strategically important to the R&Q group and will now review the impact of the likely separation on their rating fundamentals.

Furthermore, the expected operating loss for 2022, driven by R&Q’s legacy operations, will likely lead to a material weakening of the group’s risk-adjusted capitalization, as measured by Best’s Capital Adequacy Ratio (BCAR), AM Best said.

The ratings are expected to remain under review until AM Best has sufficient clarity over the rating fundamentals of the Accredited companies and the R&Q group, subsequent to their likely separation. It is considered probable that in the near future, the Accredited companies will form an independent rating unit, separate from R&Q.

Source: R&Q Insurance Holdings

Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb  Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford