Tremor Technologies Inc., the Boston-based reinsurance pricing and placing platform, has launched a catastrophe bond issuance platform called Tremor Issuer™.

Tremor Issuer is part of the suite of Tremor services that can be accessed online by investors, issuers, bankers and brokers.

“In the last two weeks alone, we have seen four cat bonds price 15% or more below initial guidance. While this signals more capital coming back into the market which is great to see after last year’s market challenges, it also confirms that the original guidance for these bonds was extremely poor,” commented Sean Bourgeois, Tremor’s CEO.

“Could prices have been even more competitive? A traditional issuer will never know because the process is negotiated rather than powered by competitive market forces. The clearing price of a bond issued today is determined when the phone gets put down, not by economics,” he said, noting that Tremor Issuer will vastly improve price discovery and allocation for the issuance of cat bonds.

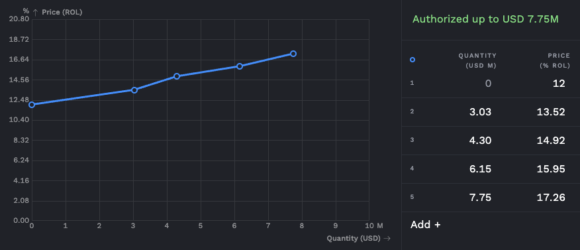

Tremor Issuer is powered by Tremor’s Panorama marketplace technology. Investors bid on bonds by expressing their rich preferences for prices, quantities and important contingencies confidentially. (See example below).

The technology then compiles the entire investor market for the issuance revealing aggregate supply. Tremor said the issuers get to see the entire, most competitive version of the market for their bonds, powered by competitive market forces, where the optimal price is competed for and true equilibrium is revealed rather than eguessed at and negotiated. (See example below).

Tremor’s Panorama platform is suited for best execution for the issuance of cat bonds, the company said.

The traditional issuance process takes many weeks if not months, and the negotiation process to pin down terms and allocations is laborious with suboptimal results, Tremor continued.

By contrast, the Tremor Issuer process takes hours and all participants can be confident that they will receive what they have requested – with no guesswork required. The net result is vastly improved price and cost efficiency for the entire market.

Tremor offers Tremor Issuer through its new subsidiary, Tremor Capital Markets, LLC.

Source: Tremor Technologies Inc.

Earnings Wrap-Up: AXIS Expanding Insurance Biz, Shrinking Re Book

Earnings Wrap-Up: AXIS Expanding Insurance Biz, Shrinking Re Book  Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster