Drivers are not only shopping around for auto insurance more than ever, they are switching carriers.

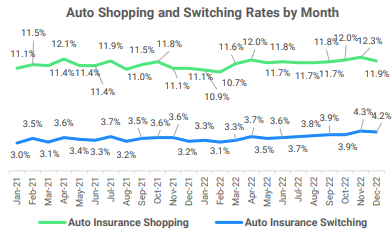

According to a quarterly report from J.D. Power, in collaboration with TransUnion, the quote rate for auto insurance in fourth-quarter 2022 was 12.1 percent and the switch rate was 4.1 percent – both are highs in the more than two years J.D Power has been doing the quarterly loyalty indicator and shopping trends (LIST) report.

J.D Powers noted that insurers have also decreased spending in advertising, in some cases “closing acquisition channels to slow the growth of new, unprofitable business.”

“As we see, consumers are out shopping more than in the past, entering a market that is more difficult to navigate and finding carriers who are not as interested in winning their business,” J.D. Power said. “How this plays out in 2023 will be something we will watch throughout the year.”

Though consumers are shopping for lower rates at a higher clip, the adoption of telematics has plateaued, according to the report. Most consumers who opted in to a telematics program were satisfied, but more than 40 percent said their rates actually went up.

“The value proposition of telematics is that consumers give up some sense of privacy or autonomy to provide insurers a demonstrably safe driving record in real-time,” said Michelle Jackson, senior director of Personal Lines Market Strategy at TransUnion. “If they’re not seeing that translate into lower rates, or if their rates actually increase, some may not continue with the program.”

Usage-based insurance offerings are becoming increasingly important. Rises in auto insurance rates have affected bundling of home and auto insurance, suggested J.D. Power last year.

Related: Rising Auto Rates Affecting ‘Bundle’ Strategy: J.D. Power

Among the top insurers, consumer loyalty was strongest for USAA, MAPFRE and New Jersey Manufacturers (NJM). It was lowest for National General, The Hanover and Progressive, according to the report.

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford