Insurance brokerage USI is forecasting that half of 32 commercial insurance product lines analyzed will experience softer pricing in the first half of 2023—including a predicted “buyer’s market” for directors and officers liability with some caveats.

Comparing USI’s forecasts for the first half of 2023 from the firm’s recently published “2023 Commercial P&C Market Outlook” with midyear 2022 forecasts from a June 2022 publication, Carrier Management counted up 16 with rate forecasts more favorable to insurance buyers and 10 unchanged.

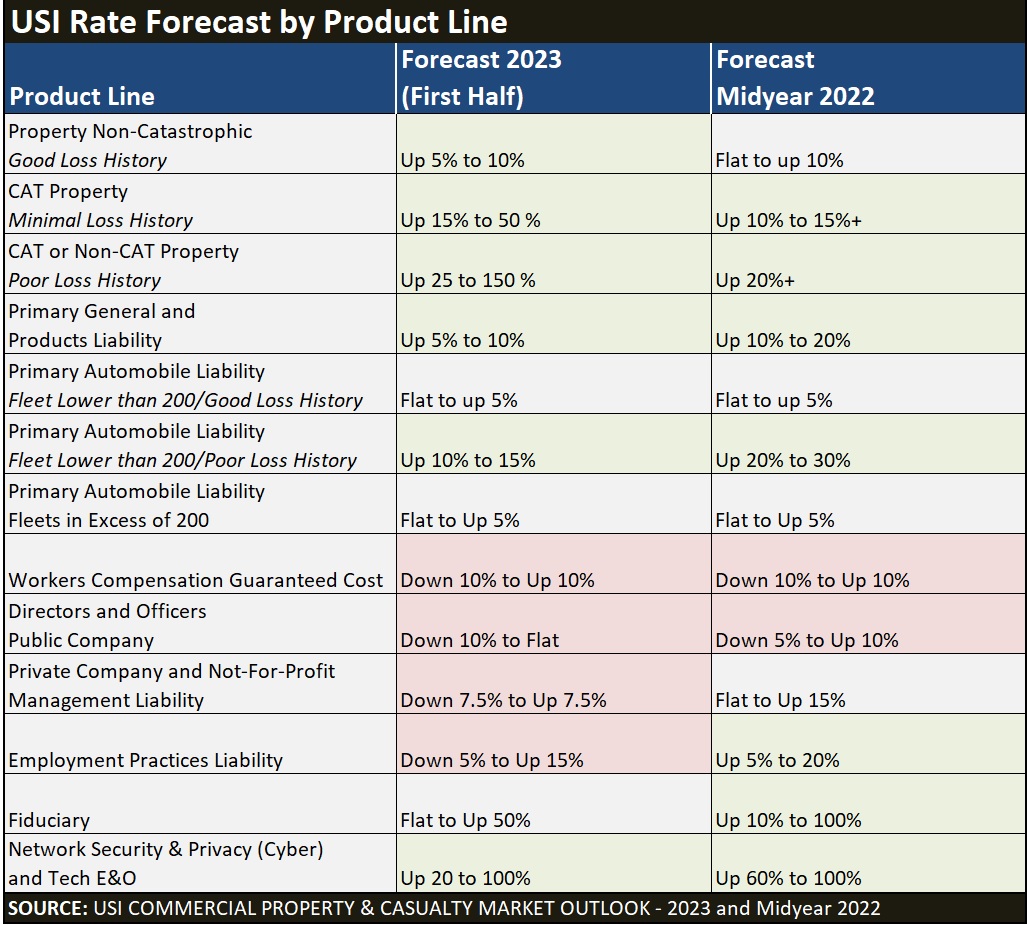

The chart below sets forth 13 of the USI forecasts for both periods, indicating potential premium declines for management liability lines, and lower price increases for the worst commercial auto risks.

“The overall public company D&O marketplace turned even further toward a true buyer’s market in the second half of 2022,” the report said.

For 2023, USI D&O practice leaders are expecting single-digit premium decreases for D&O liability placements for most insureds with no significant claims. The high-end of a range of premium increases presented in the report is a flat renewal. The report notes, however, that the extent of the economic slowdown and the pace of inflation will impact whether decreases continue in 2023.

Related article: What to Expect: Commercial Insurance Rates Stabilizing, WTW Forecasts

Reviewing the second half of 2022, the report describes factors contributing to a softening D&O market, including a stabilization in federal securities class actions and new capacity for excess layers of coverage. In addition, “insurers became more aggressive in the face of premium budget shortfalls (compared to record 2021 premium levels),” report said.

Premium decreases in the second half were seen across the board—on primary layers, excess and Side A difference-in-conditions layers. “Even the renewals of initial public offerings (IPOs) policies, including special-purpose acquisition company (SPAC) IPOs, have seen significant premium and retention decreases,” the report said.

Separately, in early January, Kevin LaCroix, executive vice president of RT ProExec, a division of RT Specialty, and author of the D&O Diary blog, gave his own assessment of the level of securities class action filings and D&O insurance market conditions.

Identifying a decline in federal securities actions in the top item in his annual report on the most important D&O stories of the prior year (“The Top Ten D&O Stories of 2022, The D&O Diary blog, Jan. 3, 2023), LaCroix said that 196 lawsuits in 2022 represented a 10 percent drop from 2021, a 14 percent decline from the 1996-2020 annual average, and 53 percent drop from the peak of 411 filings in 2017. LaCroix noted, however, that prior-year comparisons are distorted by the number of federal court class action merger objection lawsuit filings in 2017 to 2020. Removing these from the comparisons, he calculates an annual average of 192 core (or traditional) federal court securities class action lawsuit filings during the period 1996-2020, just slightly above a figure of 189 core federal court securities suits filed in 2022.

Like practice leaders at USI, LaCroix declared a turn toward a buyers D&O insurance market during 2022, reversing the “true hard market” conditions that prevailed from 2019-2021. The hard market came after “years of underwriting losses driven by chronic underpricing,” he wrote in the final item of the Top 10 blog post.

“During the hard market, D&O insurance buyers not only faced steeply rising premiums, but also saw significantly increased self-insured retentions and reduced capacity available as carriers reduced the limits they were willing to offer for individual risks,” he wrote.

The hard market conditions, he noted, attracted fresh capital and new players in 2020 and 2021.

Like USI, LaCroix also noted that D&O insurers—”both legacy players and new entrants”—set 2022 budgets based on assumptions that new business opportunities from IPO and SPAC activity would continue throughout the year. Facing a steep falloff in IPOs and SPAC instead, “insurers’ only chance to meet their aggressive budgets was to compete for existing business.”

LaCroix reported that competition was most intense for higher attachment excess limits. The buyer’s market not only meant double-digit price drops and increased capacity for some insureds, but also declines in self-insured retentions, “in some cases by millions of dollars.”

Offering some commentary on expectations for 2023, LaCroix echoes USI in noting that economic conditions could have an impact on whether softening continues.

“There are respectable and intelligent insurance industry observers—focused on the huge backlog of pending securities class action claims and concerned about the adverse macroeconomic conditions – who conjecture that D&O prices will level off at some point early in 2023. Were that to happen, it would certainly be beneficial for the overall health of the D&O insurance market,” he wrote.

On the other hand, “new players, unburdened by an overhang of older claims,” could continue to compete to win business and “ensure their own continued survival.”

Both LaCroix and USI note that some industries and organizations with “concerning risk profiles” (in the words of the USI report) or “checkered claims histories” (as LaCroix put it), fall outside of the appetites of many D&O insurers. USI listed the cryptocurrency, biotechnology, life sciences, health care and technology, and cannabis industries among facing a more constrained market.

Stabilized Commercial Auto

Commenting on another line for which recent hard insurance market conditions have been linked to litigation and economic trends—commercial automobile—the USI report noted that inflation-driven loss costs jumps (escalating vehicle repair and replacement costs, rising medical inflation, and continued legal environment challenges) did not prevent the stabilization of auto premium rate increases in 2022.

Looking ahead, however, carrier performance in commercial auto may be unstable in 2023 and beyond for this line, the report notes.

As the rate chart illustrates, USI practice leaders are expecting primary commercial auto premium increases in the 10-15 percent range for fleets less than 200 with a poor loss history—a significant drop from the 20-30 percent range of increased forecast at midyear 2022. Forecasts for other categories—larger fleets and fleets with good loss histories are unchanged at 0-5 percent.

“Insurers are exceptionally competitive and are heavily pursuing accounts that deploy the use of technology and intensely focus on safety. Fleets with an adverse risk profile are still experiencing higher pricing, but can secure more favorable terms because of increased deductibles, self-insured retentions (SIR), and alternative program structures,” the report says, reviewing anticipated 2023 trends.

Recapping 2022 conditions, the report notes that “new capacity and the re-entry of dormant insurers” helped to stabilize auto liability rates for top-performing risks.

“In some circumstances, those ‘premier risk’ policyholders have been able to achieve YOY decreases as a result of insurers competing for preferred business.”

Other Softening Lines—and Harder Property

USI offered the following second-half 2022 assessments and 2023 predictions for primary general liability, umbrella and excess, cyber and property.

• Primary general and products liability. Average rate increases hovering in the 10-15 percent range in 2022, should fall to the 5-10 percent range, with more insureds likely seeing flat to 5 percent increases as the year progresses. Noting that some the premium changes will come as a result of insurers assuming more risk (higher deductibles or SIRs), “a good portion is due to rate adequacy being achieved for many insurers,” the report said, suggesting that prior rate hikes have caught up with loss trends.

• Umbrella and excess liability. “An increasing number of carriers are willing to negotiate on price rather than walk away from what they believe are unprofitable accounts”—and they are increasing their capacity to $25 million or more for select accounts, up from $10-$15 million in recent prior years.

Still, “continued underwriting discipline, selective deployment of capital, and pressure on rate adequacy have prevailed longer than anticipated,” the report said, noting that rate increases have not come down as fast as they have in primary layers.

• Cyber. Rates began to stabilize in the second half of 2022. “New capacity outlets (particularly from global markets), including InsurTech facilities that expanded their offerings beyond the U.S., helped drive the stabilization.”

A maximum $5 million limit offering became the “new normal” limit (versus $10 million) for insurers.

• Property. Hurricane Ian and continued global insured losses above historical averages have crushed buyer’s hopes for a return to a more stable insurance market environment.

Challenges will continue in 2023 for insureds with significant exposure to wildfire, named storm, convective storm and flood.

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality  Preparing for an AI Native Future

Preparing for an AI Native Future  Earnings Wrap-Up: AXIS Expanding Insurance Biz, Shrinking Re Book

Earnings Wrap-Up: AXIS Expanding Insurance Biz, Shrinking Re Book