Florida-domiciled property carriers are extremely reliant on the reinsurance market, making them vulnerable to coming price hikes, a just-released report from the AM Best financial rating firm said.

Despite that, AM Best is willing to consider rating more of those Florida insurers as the state grapples with the best way to handle the fallout left after another rating firm, Demotech, this year announced potential downgrades of more than a dozen companies.

Jeff Mango, managing director at AM Best, on Wednesday cast doubt on Florida lawmakers’ reported plans to create a state-run rating firm.

“You ultimately have to look at the default rates among rated insurers per rating level and the performance across different rating agencies. If Florida insurance companies’ default rates remain high, will a state rating agency do any better than rating firms do now?” Mango asked. “I would challenge that idea.”

A state Legislative Budget Commission last week agreed to spend $1.5 million to hire a consultant to examine ways to pull the state out of the potential ratings crisis, perhaps by better utilizing other rating firms or by setting up a state agency to conduct financial stability analyses on carriers. The action came after Florida regulators and insurance agents questioned the validity of Demotech when the firm in July warned of the pending downgrades.

The AM Best report on Florida’s reinsurance burden warned that some struggling insurance companies will only see higher costs as reinsurers prop up so many companies, take on exceptional amounts of ceded premium and fund losses in the state.

“Premium assumed by U.S. (re)insurers has grown roughly 66 percent the last three years, and the loss ratio has still spiked—again, even without significant hurricane losses over that time, further suggesting that current prices are not adequate to cover the claims inflation and fraud,” reads the report. “As such, reinsurers have been pulling back from the Florida property market or significantly raising prices.”

The AM Best report echoed recent statements from Moody’s, S&P Global and Fitch that indicated most reinsurers expect rates to rise again in the next few months. That’s on top of June renewal prices that increased by as much as 50 percent for some Florida property carriers.

The analysis, released during the Rendez-Vous de September reinsurance conference in Monte Carlo this week, offered other brow-raising findings that show how out of line the Florida market is with other states on its reinsurance tab. Mango said analysts looked at about 45 Florida insurers, but not the larger national carriers that enjoy a larger capital base and which aren’t as dependent on reinsurance. Many of the smaller companies have participated in Citizens Property Insurance Corp. takeouts, leaving them with premium and losses, but not much surplus, Mango said.

Other takeaways from the report include:

- Reinsurance recoverables and ceded premiums for the Florida insurers were 5.7 times greater than policyholder surplus in 2021 compared with an industry average of just 0.5 times. The ceded premium amounted to more than $7 billion in 2021. “These Florida personal property companies report significantly elevated dependency ratios, highlighting their sensitivity to reinsurance pricing. Pricing will continue to impact business plans and companies’ ability to use reinsurance structures with adequate limits to protect against severe storms,” the three-page report noted.

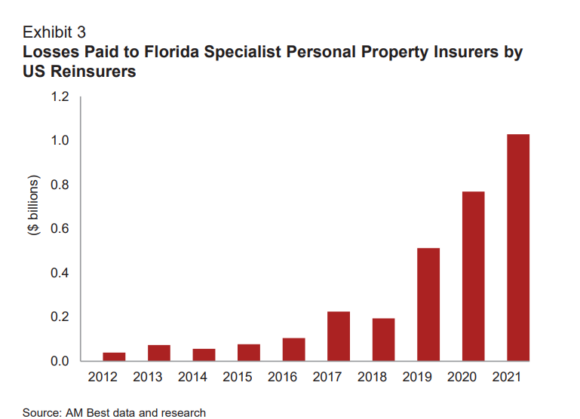

- Premiums assumed by reinsurers and losses paid has soared. The analysis found that premiums assumed by U.S.-based reinsurers for the Florida market have grown by two-thirds in the last three years and losses have increased fourfold, “even without significant hurricane activity.” Losses paid topped $1 billion in 2021—10 times more than the 2012 number.

- The largest share of Florida insurers’ ceded premiums went to the Florida Hurricane Catastrophe Fund, at 10 percent, followed by Berkshire Hathaway at 8.3 percent of the market, the report said. Ten reinsurers accounted for half the reinsurance market.

The increase in losses paid is significant, but probably not enough to threaten reinsurers, AM Best said.

“Given that the vast majority of companies have exposures of less than 5 percent to these companies, total current Florida exposure is still likely manageable for reinsurers,” the report said. “Still, reinsurers are likely to remain selective in the risks they reinsure, placing further burdens on the Florida homeowners market.”

RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit  Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook

Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook  Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages  Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash