The private U.S. property/casualty insurance industry saw its net underwriting gains increase to $5.4 billion in the first nine months of 2019 from $4.7 billion a year earlier, bolstered by growth in premiums and a drop in catastrophe losses.

The industry also boosted its surplus to a record high of $812.2 billion, according to data analytics firm Verisk and the American Property Casualty Insurance Association (APCIA).

The surplus grew $70.1 billion in nine-months 2019 as the stock market recovered from a significant downturn at the end of 2018.

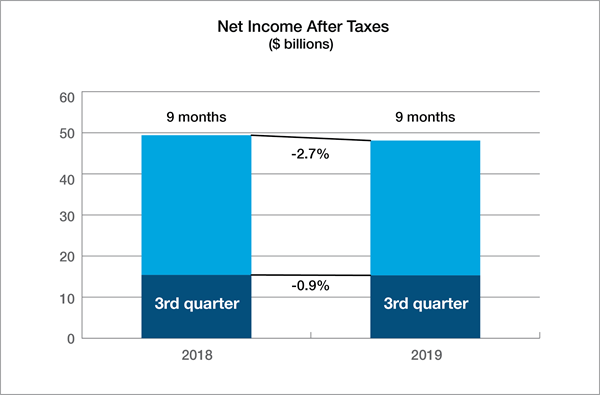

The industry’s net income after taxes and underwriting gains remained strong despite small declines compared with the prior year. Net income after taxes declined to $48.1 billion for nine-months 2019 from $49.4 billion a year earlier, and insurers’ combined ratio deteriorated to 97.8 from 97.4 a year earlier. Net losses and loss adjustment expenses from catastrophes declined to $21.5 billion for nine-months 2019 from $26.0 billion a year earlier.

Net written premium growth slowed to 2.7 percent in nine-months 2019, after jumping 11.4 percent a year earlier; in both years, growth was significantly affected by one-time increases in net written premiums caused by the changes multiple insurers made to their reinsurance arrangements in 2018. Net earned premiums grew 4.7 percent.

“The strong economy, along with a drop in catastrophe losses, has helped insurers continue to enjoy strong results and build a record surplus,” said Neil Spector, president of ISO.

“The U.S. property/casualty insurers’ financial results during the first nine months of 2019 paint a picture of a strong industry with a rock-solid foundation that enables consumers to rest assured that they will be protected when they need it most,” said Robert Gordon, senior vice president for policy, research and international, at APCIA.

Third-Quarter Results

Insurers’ net income after taxes fell to $15.3 billion in third-quarter 2019 from $15.4 billion in third-quarter 2018. Their combined ratio improved to 98.8 in third-quarter 2019 from 99.7 a year earlier.

Net written premiums rose $9.8 billion, or 6.2 percent, to $166.2 billion in third-quarter 2019 from $156.5 billion in third-quarter 2018.

The contribution of underwriting activities was essentially zero; that is, underwriting had break-even results in third-quarter 2019, which contrasts with a $1.3 billion net underwriting loss in third-quarter 2018.

*This story ran previously in our sister publication Insurance Journal.

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook

Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook