Fairfax Financial Holdings Ltd., the Canadian holding company run by value investor Prem Watsa, sold almost all of its long-dated U.S. Treasuries amid global uncertainty, including the outcome of the U.S. presidential election.

The company exited 90 percent of its U.S. long-term Treasuries on Thursday, increasing its cash and short-term investments to $10 billion from $1.1 billion at the end of September. That brings cash and short-term investments to comprise more than a third of the company’s portfolio, up from 19 percent at quarter-end, Watsa said on a conference call with analysts.

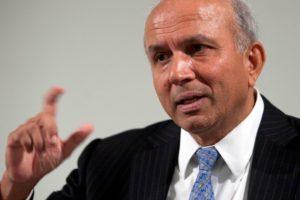

“We’ve sold 90 percent-plus of our Treasury bonds and we’ve made the point that the uncertainties in the U.S. election are the reason,” Watsa, chief executive officer of the Toronto-based company, said on the third quarter conference call Friday. “We don’t know who’s going to win the elections, but you could have significant infrastructure spending, a drop in corporate tax rates, and while we think it might work in the short-term, in the long-term we have questions about that. We wanted to take that risk out.”

The sale reverses Fairfax’s positioning earlier this year, when the company had purchased $2.6 billion of the long bonds in the first nine months of 2016, according to financial statements.

Watsa also said he continued to be concerned about the global deflationary environment, a view that’s led him to invest in short positions and derivatives, betting on more pain for the markets.

Prem Watsa is often compared to Berkshire Hathaway CEO Warren Buffett, as they both seek undervalued firms and can make surprising market calls. Watsa is also invested in BlackBerry Ltd., newspaper-owner Torstar Corp., and golfing retailer Golf Town Canada Inc. after its U.S. company sought bankruptcy protection.

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages  Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk  Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook

Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook  Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation