Picture a work day that begins like this: You step out of your house and into a self-driving vehicle, which carries you comfortably and safely to your office while you read the newspaper.

Picture a work day that begins like this: You step out of your house and into a self-driving vehicle, which carries you comfortably and safely to your office while you read the newspaper.

After dropping you off, the car returns home to fetch your spouse for a ride to the grocery story and numerous other errands. The vehicle may pick up your kids from school, take them to the dentist and self-park until they are ready to go home.

All of this occurs before the car returns to your office to give you a lift home.

Two panelists at the RIMS 2015 Conference in New Orleans on Tuesday predicted that the scenario will one day come to pass, and the lead-up to that vision will not only revolutionize traditional transportation but also dramatically alter the insurance landscape.

“Addressing the risk management implications of vehicles that drive themselves and communicate with each other will require lots of collaboration,” said Michael Stankard, managing director of the automotive practice with Aon Risk Solutions.

As the transportation evolution transfers risk from human driver to mechanical vehicle, he said, property and casualty liability will shift. The transition will also affect coverage of directors and officers of corporations that make, service or supply parts for the cars. In addition, computer liability could come into play for providers of the systems that provide connectivity between the vehicles and the traffic-control infrastructure that enables their unfettered movement.

The possibility of malicious interference with vehicle operating systems or a breach of personal data connected with the vehicles could trigger cyber liability, Stankard said. Also, every entity involved in producing driverless cars could face some type of reputational risk.

“The good news is, if all this works, we should see a lot fewer (accident) claims, but if the claims do come through, they may be more severe because courts may think we should have figured it all out in advance,” Stankard said.

Alan Gier, global director of corporate risk management and insurance for General Motors Co, joined Stankard in a session entitled, “No Longer Science Fiction: the Risks and Rewards of Autonomous Vehicles.”

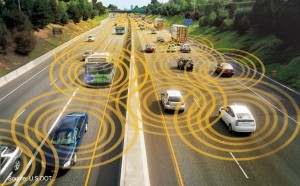

Gier showed the audience a video representing what a city filled with autonomous vehicles might look like as the cars go about their daily business. In the video, people step out of sleek, space age-looking vehicles, which then go off to park themselves. Other cars speed freely along city streets and streak through crowded intersections without stopping – and without touching any of the other vehicles that are crossing their path.

Gier noted that the scenes may seem plucked from the 1960s animated television series “The Jetsons,” but the automotive industry is approaching that reality faster than most people suspect.

“Many of these technology ‘enablers’ are already in use,” Gier said, pointing as an example to existing vehicles that alert drivers if their car is getting too close to another one.

“In 2017, we’ll launch our Super Cruise feature, which keeps you centered in your lane and lets you take your hands off the steering wheel,” he said. That development will position the automotive industry at the brink of what he terms Level 3 in the progression toward vehicle autonomy.

Level 1, he said, involved features that long ago became standard, including power steering and power brakes that enhance a driver’s ability to control the car.

In level 2, vehicle technologies began working together more closely, such as laser sensors monitoring a car’s lane position and signaling the driver if the car veers while activating the brakes and providing blind-spot alerts.

The third phase will bring limited self-driving automation, Gier said. “In this level, a driver can cede control of all safety-critical functions under normal traffic and driving conditions, but must be alerted and prepared to take back control as necessary.”

Gier said Super Cruise will bring General Motors into this stage, and from there the evolution will continue toward full self-driving automation.

Stankard explained that the convergence of technologies and system development that must occur on the way to that goal will require unprecedented coordination.

“We’ve got to have a lot of constituencies cooperating, from federal, state and local governments to manufacturers, parts suppliers and, of course, insurance companies,” he said.

Consumers may be forgiven for wondering if the world is prepared for this revolution. “My take is, the technology will come faster than we are ready for it,” Stankard said.

Noting that the average age of vehicles on U.S. roads is 11 years, he said a movement toward fully automated transportation will take “a lot of transition time.” Also, the question of whether Americans would embrace the concept and give up driving their cars is full of uncertainty.

What is clear is that evolving transportation systems have significant implications for the insurance industry. Taking the full responsibility for driving out of human hands “will move automobile liability back to the manufacturer,” Stankard said.

Driverless vehicles presumably would create an ultra-safe transportation environment because computerized systems would eliminate human errors that cause millions of injuries and more than 30,000 deaths annually on U.S. highways.

But long before driverless cars become the norm, insurers will face new questions. How much personal auto coverage will an owner need as driving responsibility shifts away? Will personal lines carriers subrogate against original equipment manufacturers?

Will fewer highway accidents and deaths reduce the need for health care, and if so, will demand for medical insurance be affected?

Fortunately for insurers who have other issues on their plate, these questions won’t soon become priority concerns. It could be a long time before Americans are willing to end their love affair with driving, the panelists said.

How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk  Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb