Companies are actively pursuing alternative coverage to fill in reinsurance gaps left by the demise of TRIA after Dec. 31, Willis Re said in its Jan. 1, 2015 renewals report.

“There are many companies in the market looking for capacity on top of their existing programs,” Willis Re noted. “Reinsurers are being asked to absorb a significant amount of aggregate capacity.”

That’s a trend worth noting. It comes as Willis’ renewals report points out the reinsurance sector faces more rate reductions and market softness heading into 2015.

Regarding TRIA’s lapse, it is particularly noteworthy that available capacity is tightening in geographic regions including New York and California. There’s also a short-term expectation that rates will be impacted as a result. Willis Re said it doesn’t expect additional rating pressure to develop if Congress can renew TRIA soon.

Despite months of aggressive industry lobbying, Congress abandoned renewal efforts for the Terrorism Risk Insurance Act on Dec. 16. TRIA was passed in the aftermath of the Sept. 11, 2001 terrorist attacks to help calm the commercial markets and had been renewed a number of times since. Business and p/c industry lobbyists had pushed hard for its renewal, and have pledged to push for speedy passage of a TRIA extension in the new Congress.

Willis Re said that mostly small firms and state funds are searching for extra reinsurance capacity with TRIA lapsing, though some are “looking for large stretches of capacity.” As well, A.M. Best is driving much of the buying according to the report, with a focus on terror only and not an extension of the all perils catastrophe program.

Other renewal trends Willis Re identified in a world without TRIA:

- Pricing is hit around a 1.25 percent to 2 percent rate on line range, depending on the size and geographic footprint of the exposure.

- Coverages are both including and excluding nuclear, biological, chemical and radiological.

The Willis TRIA comments are part of a broader reinsurance renewal report for Jan. 1 that notes the continued downward spiral of the sector.

“After three years of relentless rate reductions, the Jan. 1, 2015 renewal season has not offered reinsurers any respite,” Willis Re Chairman Peter Hearn and CEO John Cavanagh said in their introductory letter to the report. ” Yet again, buyers have held sway, driving prices down along with improved terms and conditions.”

Hearn and Cavanagh said that the global reinsurance market may fail to cover its cost of capital in 2015 due to continued rate softening and low interest rates. They assert that after continued falling rates, lower-than-average loss experience, low investment returns and excess capital, many reinsurers will have to increase their scale, but also change their business models and portfolio mixes in order to catch buyer interest.

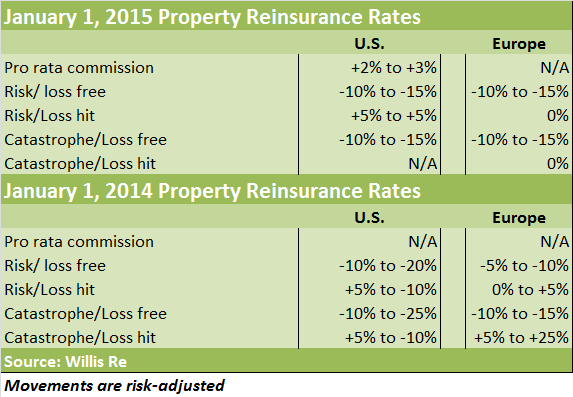

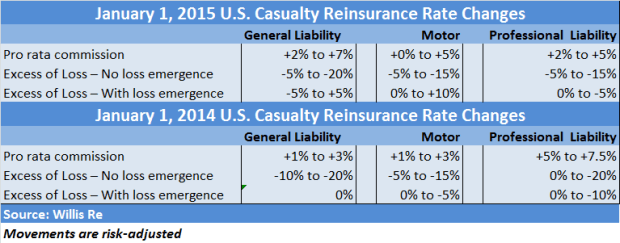

Here are some charts illustrating some of the renewal details contained in the Willis Re report:

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk  AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb  Preparing for an AI Native Future

Preparing for an AI Native Future