Stocks for 20 publicly traded reinsurance companies performed far worse than the overall market for the first nine months of 2014, according to an equity trend analysis from A.M. Best.

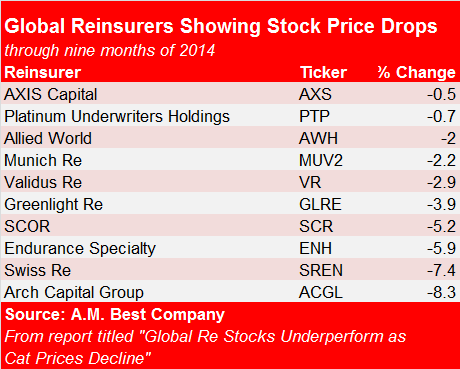

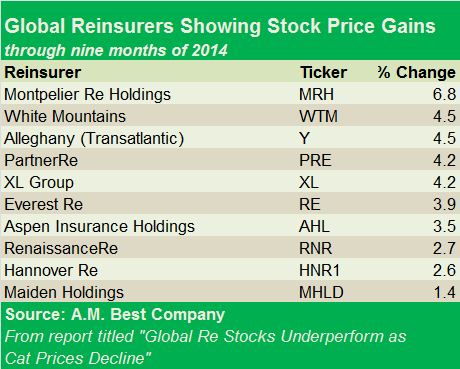

The analysis of stock prices of 20 global reinsurers, including Bermuda reinsurer and the four large European reinsurers (Munich Re, Swiss Re, Hannover Re and SCOR), reveals stock price declines for just about half.

While stock prices rose for the other 10, the average change for the 20-member group was flat, and only one reinsurer outpaced the S&P 500 change of 6.7 percent—Montpelier Re, growing 6.8 percent.

Separately, rating agency Fitch suggested that Montpelier Re is no better off than its reinsurance peers—and in fact may be worse off because of its concentration in the property-catastrophe area of the reinsurance market. On Friday, Fitch affirmed Montpelier’s “A” financial strength rating but changed the rating outlook to negative from stable, indicating that the ratings “will likely be downgraded by one notch within the next 12 months.”

The affirmation reflects “continued solid financial performance, conservative operating leverage, modest financial leverage, sound risk management processes and niche market position with regional and super-regional primary insurers” as well as the company’s “significant exposure to earnings and capital volatility derived from its property catastrophe reinsurance products.”

The changed outlook, however, reflects Fitch’s view that a “comparatively narrow business focus and smaller size/scale” means that “the company is relatively more exposed to the current difficult reinsurance market conditions,” Fitch said noting that property-catastrophe risk comprised 42 percent of Montpelier Re’s total 2013 gross premiums written—and area where record capitalization among traditional reinsurers and the growing capacity provided by alternative capital market providers are softening reinsurance pricing and broadening policy terms and conditions.

The A.M. Best report repeated the same themes as it described the situation for global reinsurers generally—an environment which so far has fueled just as many stock price advances as declines over the past year.

“Despite the low level of losses and continued favorable reserve releases from prior years, pricing pressures for catastrophe business continued to overshadow the prospects of this sector during the third quarter,” the Best report says, noting that reinsurance companies saw catastrophe price declines of 20 percent in some cases during the first nine months.

The A.M. Best report notes that as of Sept. 30, 2014, the average price/book value for the 20-member group of global reinsurers it tracked was roughly 99 percent—way down from the 117 percent historical average value which Best calculated from 1993 through 2014. Only Arch Capital is trading above that average at 127 percent. Others above 100 are:

- Renaissance Re,117

- Greenlight Re, 104

- Maiden Holdings, 104

- Aspen Insurance Holdings, 103

- Everest Re, 102

Partner Re and Montepelier sit on the other end of the list, with price/book ratios of 88 and 92, according to Best’s calculations. Others in the group with price/book ratios lower than 95 are:

- Platinum Underwriters, 94

- Validus Holdings, 94

- Allied World Assurance, 92

The A.M. Best report does contain some positive metrics related to underwriting and overall performance. For one thing, combined ratios “remain solid,” Best says, noting that U.S. and Bermuda reinsurers tracked by A.M. Best (including some of the 20 in the stock price review along with names like ACE Limited, Third Point Re, Watford Re, Hamilton Re, PacRe and Odyssey) posted an 87.4 combined ratio through nine months, and roughly 93.2 for the past five years.

Overall, the annualized returns on equity for the U.S. and Bermuda reinsurers averaged 10.9 percent for the year to date and about 10.4 percent over five years.

Favorable loss reserve development helped to buoy some of those figures, however, with these nine reinsurers reporting takedowns of $100 million or more in 2014, according to A.M. Best calculations: Partner Re ($491.3 million); Arch Capital Group ($248.7 million); AXIS Capital ($193.1 million); Validus ($167.7 million); Alleghan7 ($165.1 million); Endurance ($165 million); XL Group ($158.3 million); Allied World ($141 million) and Montpelier ($110.2 million).

Noting that low levels of catastrophe losses and efficient asset management strategies have helped to drive recent strong ROEs, A.M. Best doesn’t see continued double-digit ROEs in the future. “As the industry continues to struggle, ROEs are expected to settle eventually into single-digit territory for most if not all [global reinsurance] companies,” the report says.

Best expects further reinsurance pricing drops and increasing commissions, tapering reserve releases—all leading to thinner underwriting margins—and continued low investment returns to challenge overall returns of reinsurers in 2015, fueling more share buybacks. According to Best’s figures, share buybacks totaled $5.1 billion for the first nine months of 2014, with Munich Re buying back $1.3 billion of the total. In addition, reinsurers returned $6.2 billion to shareholders through dividends, with Swiss Re accounting for more than $3 billion of the total.

Separately, Montpelier announced dividends yesterday, declaring a quarterly dividend of $0.20 per common share, and a quarterly dividend of $0.554688 per 8.875% Non-Cumulative Preferred Share, Series A, each payable on or before Jan. 15, 2015, to all shareholders of record as of Dec. 31, 2014.

RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit  Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers