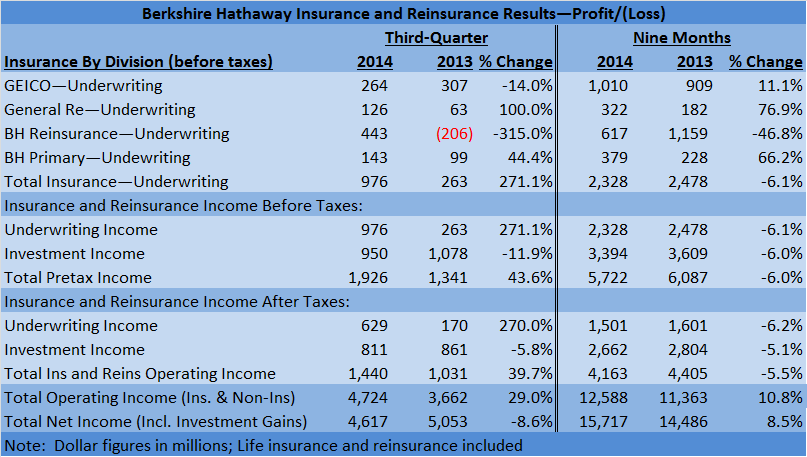

While investment losses pulled net income for Warren Buffett’s Berkshire-Hathaway down 8.6 percent to $3.6 billion in third-quarter 2014, a 40 percent jump in operating income for the group’s insurance and reinsurance operations was somewhat obscured by headlines about the bottom-line numbers.

Pretax underwriting profits overall—for both life and P/C units—increased nearly four-fold to $976 million in the quarter, with the bulk of the increase attributable to Berkshire Hathaway Reinsurance Group.

Investment income fell nearly 12 percent in the quarter, coming in at roughly $976, to bring operating income for insurance and reinsurance operations to $1.9 billion for the quarter before taxes, or $1.4 billion, after taxes—roughly 39.7 percent above last year’s third quarter.

Operating income for all of Berkshire-Hathaway, including earnings from noninsurance operations in retail, railroads and other businesses, rose 29.0 percent to $4.7 billion.

The accompanying chart (above) shows components of insurance operating income for both the nonlife and life businesses together for the third quarter and the first nine months.

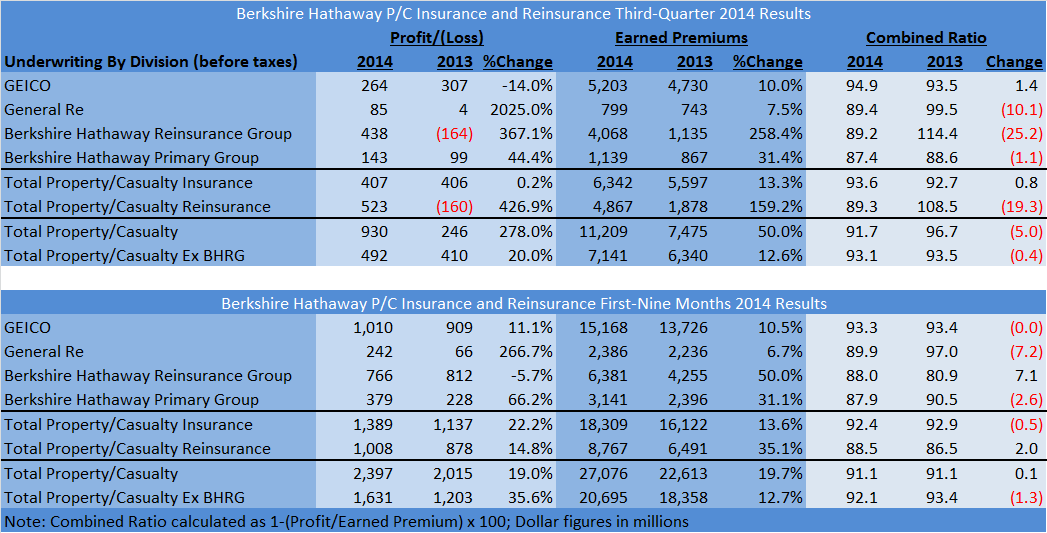

Breaking down the insurance underwriting results on just the P/C side of the business, GEICO posted the only decline in underwriting profit among the Berkshire insurance and reinsurance units in the quarter—and the only combined ratio over 90.

Still GEICO added nearly half-a-billion dollars to the top line. Only Berkshire Hathaway Reinsurance Group reported a bigger dollar gain in P/C earned premiums—$2.9 billion—mainly attributable to a retroactive reinsurance deal with Liberty Mutual Insurance Company announced in July.

Taken together, the P/C insurance and reinsurance operations had a 50 percent spike in earned premiums for the quarter—growing to $11.2 billion. For the year to date, P/C premiums soared nearly 20 percent to $27.1 billion.

Taken together, the P/C insurance and reinsurance operations had a 50 percent spike in earned premiums for the quarter—growing to $11.2 billion. For the year to date, P/C premiums soared nearly 20 percent to $27.1 billion.

Also showing a sharp rise in premiums was Berkshire Hathaway Primary Group, with a more than 30 percent jump in earned premiums pushing the group’s overall premium total over $1 billion for the quarter and over $3 billion for the first nine months. Berkshire’s 10-Q filing with the Securities and Exchange Commission for the quarter says that premium increases were generated for each of the primary businesses in the group for the nine month period, without specifying individual growth rates. Among the companies included in this group is Berkshire Hathaway Specialty Insurance, formed in second-quarter 2013.

Rounding out the reinsurance results, General Re posted a 7.5 percent increase in earned premiums for the quarter in spite of strong price competition.

Underwriting profits for Gen Re rose as well, with profit increases for the quarter and the year-to-date mainly attributable to the absence of catastrophe losses that marred results in 2013. For the first nine months, Gen Re recorded $344 million of pretax underwriting gains on the property side, while casualty and workers comp reinsurance business produced a pretax underwriting loss of $102 million—or a total of $242 million for property and casualty together.

(Warren Buffett Photo: Photographer Jeff Kowalsky/Bloomberg)

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation  Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash