After reporting a third-quarter combined ratio nearly 14 points below breakeven, and just about equal to the figure reported in last year’s third quarter, the leader of ACE Limited predicted that future ratios will move higher.

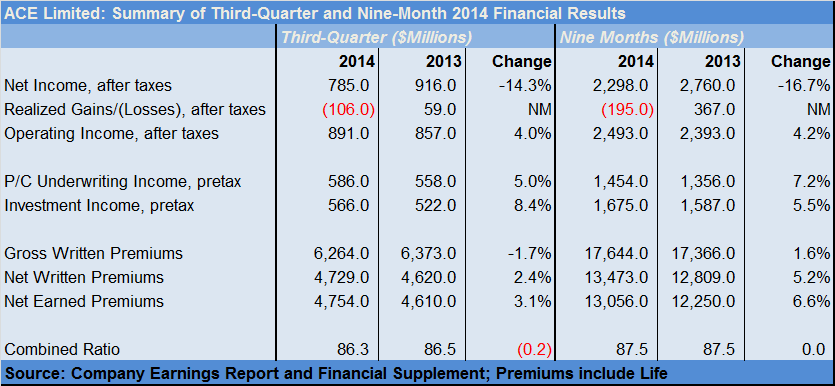

Evan Greenberg, chair and CEO of ACE Limited, gave the forecast during an earnings conference call on Wednesday morning, after summarizing the drivers of a 5.0 percent jump in underwriting income, which translated into a 0.2 point drop in the combined ratio for the quarter—to 86.3.

“Depending on the class of business, I think the level of rate increases are either not keeping pace with loss costs or barely keeping pace with loss costs,” he said. “Naturally, over time, if you look at the kind of combined ratios we are producing, I would expect the combined ratios to rise. That’s just natural,” Greenberg reasoned, responding to an analyst who asked about the stability of core underwriting margins in the rate environment of the current market.

Still, Greenberg is by no means throwing in the towel on margin erosion. “Beyond rate and loss cost trend, it’s really about risk selection and portfolio management. Product mix…is another tool you have to help mitigate margin deterioration. And we practice that rigorously,” he said.

Insurance portfolio management, favorable prior-year reserve development and relatively light catastrophe losses were among the factors behind ACE’s enviable combined ratios for the quarter and the year to date—both coming in below 90. In addition, growth in investment income—attributable to a higher base of invested assets and partnership income—boosted operating income roughly 4 percent in both the third quarter and the first nine months, compared to the same periods in 2013.

Realized investment losses, however, meant declines in bottom-line net income for both periods.

Most of questions Greenberg fielded on the conference call centered the state of the market, with the CEO giving a big picture of variations across what he characterized as an “incrementally more competitive” environment, as well as activity on the mergers-and-acquisitions front and new entrants. He also addressed a question about a rumored linkup between ACE and BlackRock on a hedge-fund reinsurance vehicle, although neither Greenberg nor the analyst posing the question mentioned BlackRock by name.

“When we have something to say, we’ll be clear about it,” he said, declining to comment on the rumor directly, but going on to give a bigger picture of the evolution of capital providers to support insurance and reinsurance risk.

During the course of the call, Greenberg also commented on liability underwriting for accounts impacted by Ebola risks and the reauthorization of the Terrorism Risk Insurance Act. (See related article, “ACE CEO Said Ebola Risk Underwriting Approach is ‘Common Sense.’“)

Excerpts of his comments are the other topics are set forth below:

The Market: Getting Softer

Asked for a high-level view of the competitive dynamics of the marketplace, Greenberg said, “The market is a chaotic place. Everybody wants to put it in a very neat statement …I struggle to give you one.

“The market is growing more competitive. There are some ends of the market that behaving in a more ferocious way. Reinsurance is an example. Middle and smaller commercial are behaving in a far more orderly way. And you have every gradation in between and it varies much by country and by territory and by line of business; different competitors have a different capability in different territories and behave differently …”

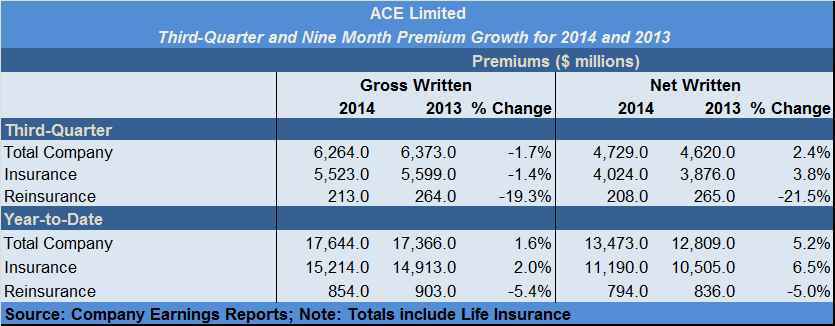

Earlier in the call, Greenberg had noted ACE’s growth rates of 9 percent and 18 percent in ACE Westchester and ACE Commercial Risk Services—middle market and small commercial E&S and specialty businesses—contrasted with a 10 percent decline for large account business written by ACE Bermuda, a 6.5 percent drop in ACE’s Lloyd’s business, and a 22 plunge in reinsurance premiums (partially attributable to the nonrenewal of a large workers comp treaty).

Responding to the market question, he went on to distinguish the behavior of large and small competitors.

Large companies, with the analytics and the data they have, are able to do a better job of discipline. “But at the same time, there are always a lot of smaller and mid-sized players who are just gun-and-run—they come in and have a way of disrupting markets.”

Greenberg concluded: “You have all that going on right now. But the fact is, we’re moving into a softer market.”

Wholesale vs. Retail

Clearing up a mistaken conclusion that wholesale pricing is holding up better than retail, Greenberg noted ACE’s growth in Westchester and Commercial Risk, and declines in Lloyd’s and ACE Bermuda—all wholesale specialty business, but varying by size. The smaller account pricing is holding up better, he said.

He also said that reinsurers that have been setting up U.S. onshore wholesale operations over the last few years haven’t yet managed to ruin the market for small to middle market business.

“They haven’t quite gotten to it. It’s harder work,” he said. “You’ve got to have underwriters. Business is placed locally. It doesn’t just box itself up into one place You’ve got to be present in L.A. and Chicago and San Francisco and Altanta and Boston and New York …

“You’ve got to really have the relationships It’s flow business and trades move fast. And you’ve got to have the confidence of the brokers,” he said.

Reinsurers Teaming Up with Asset Managers: ‘Glimmers’ of Transformation to Come

After declining to address the BlackRock rumor directly, Greenberg addressed the question of marriages between hedge funds and reinsurers, suggesting that the benefit of having skilled asset managers generate higher returns for reinsurers is “just a feature” of such combinations.

Beyond that, they are indicative of marketplace that is changing from a model that has “originators of risk and underwriters and managers of risk around the world, the primary companies, distribute [risk] to buy-and-hold pools of capital,” namely traditional reinsurers.

The model “needs to evolve beyond that because [it] constrains how much capacity there is to take on the value of risk that is being created around the world—and the values are increasing,” he said.

“What you’re seeing now are glimmers of early steps towards new kinds of buy-and-hold models potentially…using other sources of capital,” he said, going on to suggest that primary companies could package risks and directly provide them to the new forms of capital—cutting out reinsurers entirely.

Greenberg alluded to a discussion he penned for the shareholder letter in ACE’s 2013 annual report, in which he described the same sort of evolution. In the letter, he summarized his view this way:

“Right now the capital markets players, who are managed by the wholesale market, both reinsurers and fund managers, aren’t the global originators of risk; primary companies like ACE are. The company that can originate and package risk at the wellhead, all over the world, across a broad swath of products, and has the capability to manage it better through sophisticated data analytics supporting good underwriting discipline has a winning model for the future.

“I can envision a day when we aren’t simply accessing traditional reinsurers but originating risk globally that we package and distribute directly through the capital markets.”

M&A

Responding to the question of whether a softening market will fuel mergers and acquisitions, Greenberg predicted an increase in activity culminating in a “feeding frenzy.”

On the sell side, he said there are “companies that will find it more difficult in this environment to continue with the strategy that has served them in the past.” The mounting pressure on performance will be a catalyst for sales.

On the buy side, in a softer market, “there’s inflation in what people will pay for properties …Others will see no other way of getting their growth or actually keeping themselves from shrinking.” Acquisition is their only option. “That hunger builds,” he said.

Greenberg said ACE’s strategy continues to be the pursuit of organic growth. “If an acquisition comes along that will complement what we are already doing on an organic basis, and if the returns are favorable for shareholders, we will pull the trigger. If not, we’re happy sit on the sidelines,” he said.

Is India Next for ACE?

Greenberg, responding to the question of whether a new government in India might motivate ACE to consider expansion opportunities there, said the country “is always on our radar screen.”

“The new government in India is a welcomed statement of change in direction by the electorate in India, the largest democracy in the world. It is a more business-friendly government,” he said, adding that Prime Minister Modi has a track record of supporting economic growth.

“I’m hopeful that will translate into legislation and action that will help accelerate growth …For the insurance market, it may create greater opportunity. It may lift the ownership cap from 24 to 49 percent.”

While ACE is not currently operating in the India market, “we’re dynamic,” Greenberg said. “We’re constantly probing and looking,” he continued. “If the environment is more favorable, and we see the right opportunity, …we will take advantage of it and enter the Indian market,” he concluded.

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit