This ranking is based on 2013 premiums. A more recent ranking based on 2014 premiums is now available. See related article, “Top 25 Non-Life Reinsurers Rank: A.M. Best’s 2015 Analysis.”

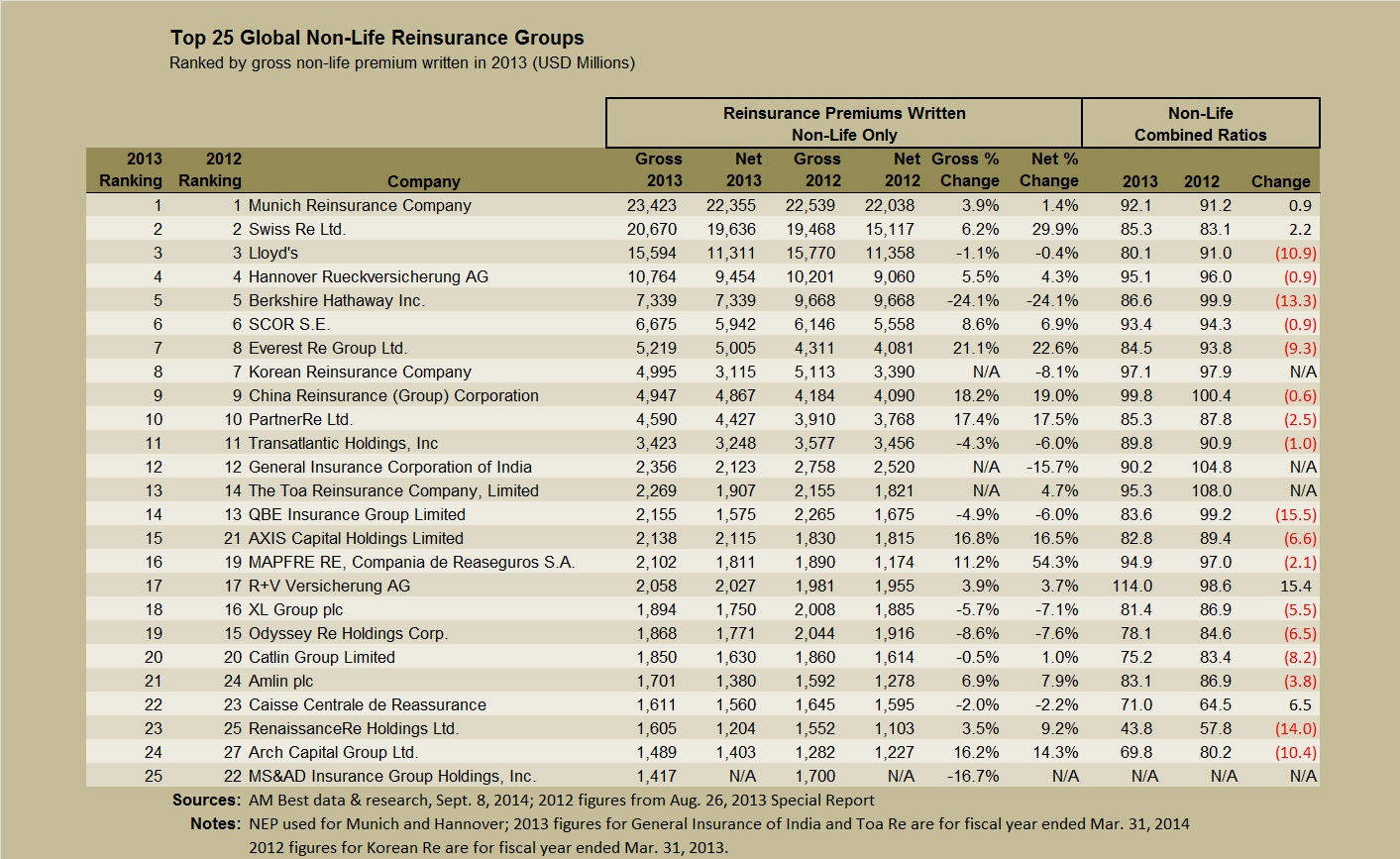

AXIS Capital and Arch Capital rose into the ranks of the top 25 global non-life reinsurers, but no new names appeared among the top 10, according to a list of non-life leaders extracted from an A.M. Best analysis.

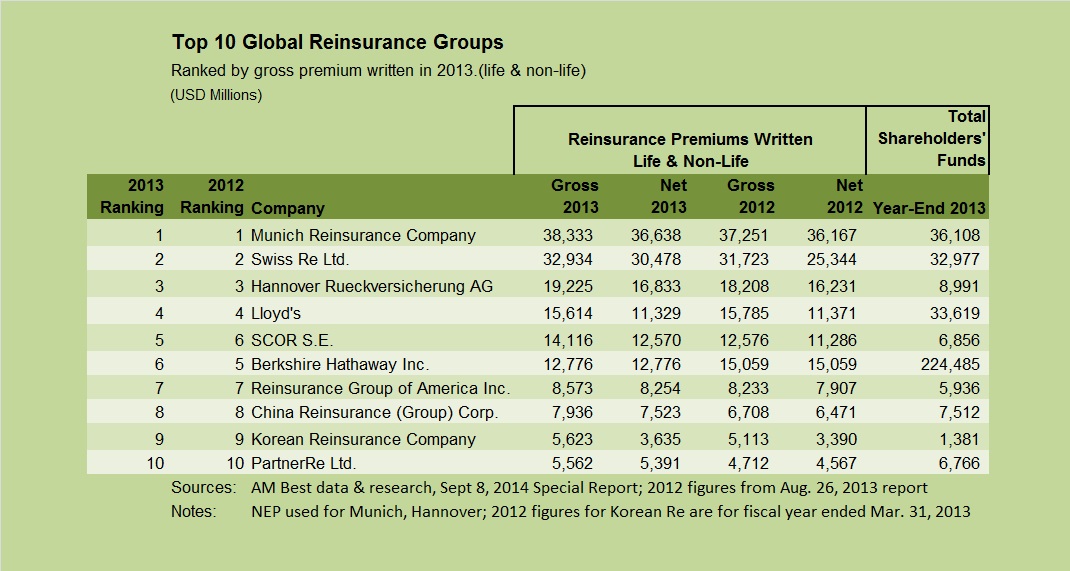

The rating agency’s special report on the reinsurance sector, which was published on Monday, contains a listing of the top 50 global reinsurance groups ranked based on 2013 gross written premiums for life and non-life business taken together.

Extracting just the non-life gross premiums for 2013 and comparing those to 2012 non-life gross premiums presented in a prior A.M. Best report (published last year Aug. 26, 2013) reveals AXIS Capital’s repositioning from a 21st place ranking for the prior year to 15th place. The move came from a 16.8 percent jump in gross written reinsurance premiums to over $2.1 billion.

Arch Capital, posting a 16.2 percent jump to just under $1.5 billion for 2013, moved from a 27th place spot to 24th place.

Everest Re had the biggest percentage increase in gross premiums—a 21.1 percent jump to $5.2 billion. With the increase, Everest climbed over Korean Reinsurance Company to take the seventh place ranking, marking the only repositioning among the top 10.

The A.M. Best report, which focuses on total gross reinsurance premiums—life and non-life combined—highlights the movement of SCOR to overtake Berkshire Hathaway. With total reinsurance premiums growing 12.3 percent, SCOR secured fifth place, moving up from sixth in the prior ranking.

Best attributes Berkshire Hathaway’s drop, in part, to the end of its 20 percent quota-share agreement with Swiss Re. The report also notes Berkshire’s pullback from property catastrophe reinsurance, where rate competition has been the most severe.

Overall, gross premiums written among the top 50 grew 2.8 percent in 2013, according to the A.M. Best report, which also says that non-life gross premiums alone increased by 1.7 percent for the top 50. The report suggests that selective opportunities in specialty lines, as well as growth into emerging markets by some global players, fueled the small bump in premiums for the group.

Analyzing the non-life premium jumps for AXIS and Arch, Best highlights the growth in specialty lines.

For AXIS, the 16.8 percent jump came mostly from agriculture, which grew to $133 million in 2013 from $19 million in 2012, the report says. Other growth areas were professional lines (25.8 percent), property (15.3 percent), liability (10.6 percent) and catastrophe business (6.8 percent).

For Arch, double-digit growth came mainly came from a 48.5 percent jolt in casualty reinsurance business, which includes professional liability, executive assurance, and healthcare. In addition, the Best report notes a 35.7 percent increase in 2013 for “other specialty” business at Arch—consisting of lines such as trade and credit, surety, workers compensation, and the accident and health lines. In addition, Arch’s reinsurance premiums were up in the mortgage and casualty clash class, as well as property business other than cat, while Arch recorded double-digit drops in marine and aviation premiums and property-cat net premiums.

Below the top 25, other notable moves in the non-life ranking include:

- Validus Holdings, with a 20.5 percent jump in gross premiums, taking 26th place—moving up five spots from the prior year’s ranking.

- Markel Corp. also climbing five spots to take position No. 31 with a 26.0 percent increase in gross non-life reinsurance premiums.

- Endurance Specialty Holdings, moving up three spots to 29th place, with gross non-life reinsurance premiums of $1.2 billion.

Just behind Endurance, Aspen Insurance Holdings, with a 7.6 percent drop in gross non-life premium volume to $1.1 billion in 2013, moved down to two spots to 30th place from 28th place in the prior ranking.

A.M. Best’s Top 50 ranking also displays non-life combined ratios and capital levels by reinsurer.

Most non-life reinsurers saw combined ratios decline in 2013, and the rating agency reports that the aggregate reinsurance combined ratio for 2013 was 88.6 for reinsurers in the United States, Bermuda, Europe (the “big four”) and Lloyd’s, compared to 92 for 2012 and 107.4 for 2011.

For the same group of global reinsurers, the five-year average combined ratio was 94.6, and it was 89.4 for the first half of 2014, Best reports.

The A.M. Best special report also includes a discussion of the impact of the influx of third-party capital into the reinsurance industry and separate analyses of reinsurance market conditions in the MENA and African reinsurance markets.

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash  20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Preparing for an AI Native Future

Preparing for an AI Native Future