Fairfax Financial Holdings Ltd. said Quebec’s securities regulator is investigating Chief Executive Officer Prem Watsa and President Paul Rivett as part of a probe into possible insider trading.

The Autorite des marches financiers is looking into whether there was “illegal insider trading and/or tipping (not involving any personal trading by the individuals) in connection with a Quebec transaction,” the insurer said in a filing yesterday. The Toronto-based company said it was cooperating with authorities and prohibited by law from disclosing further details.

Watsa is known for controlling the biggest stake in BlackBerry Ltd. and for profiting through derivatives in the financial crisis after he bet against the creditworthiness of U.S. banks and insurers. The CEO mentioned the probe today in a conference call with analysts and said he is “confident that we did nothing wrong.”

Fairfax was the largest shareholder in Montreal-based Mega Brands Inc., the Montreal-based toymaker that struck a deal in February to sell itself for more than $400 million to Mattel Inc. Mattel agreed to pay C$17.75 a share, which was 36 percent above the previous day’s closing price. Watsa’s company hasn’t disclosed any deals involving Quebec companies since then.

John Varnell, vice president of corporate development at Fairfax, declined in an email to identify the securities involved in the transaction being reviewed by the regulator.

‘Nothing Wrong’

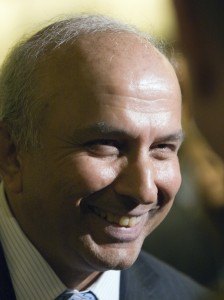

Fairfax Financial Chairman and CEO

“There is no question of personal trading here by Prem Watsa or Paul Rivett,” Varnell said in the email. “We are continuing to fully cooperate with the Quebec authorities and we are confident that we did nothing wrong and there’s no reasonable basis for any proceedings. Unfortunately, that is all the Quebec authorities will let us say at this time.”

Sylvain Theberge, spokesman for the Quebec securities regulator, declined to comment.

Watsa, who hails from Hyderabad, India, founded Fairfax in 1985 and favors contrarian bets like investments in the Bank of Ireland and Greek malls. His company is one of the top shareholders in Torstar Corp., the publisher of the Toronto Star newspaper, Canada’s biggest daily by circulation. Fairfax’s largest holding, in Greece’s Eurobank Ergasias SA, is valued at about $900 million, according to data compiled by Bloomberg.

Fairfax posted second-quarter profit of $363.7 million, compared with a loss of $157.8 million a year earlier that was driven by investments.

Fairfax in 2006 sued hedge funds including Steven A. Cohen’s SAC Capital Advisors LP and Daniel Loeb’s Third Point LLC for racketeering, saying they were part of a scheme to undermine the insurer’s shares. The hedge funds won dismissals and Fairfax appealed.

“The ultimate outcome of any litigation is uncertain,” Fairfax said in last week’s filing.

Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook

Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes