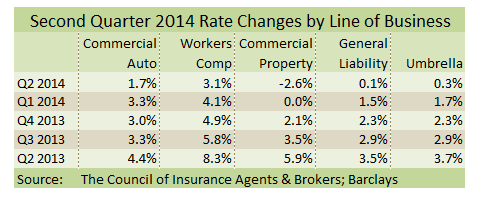

In some sobering news for commercial property/casualty insurers, the 2014 second quarter brought slower rate increases and even some price dips. That’s according to the latest quarterly survey of the market from The Council of Insurance Agents & Brokers.

Small accounts obtained price increases of just 1.2 percent, according to the survey. But medium accounts dipped by -0.2 percent, and large accounts saw rate increases land at -2.6 percent. On average, pricing eased -0.5 percent.

In the 2014 first quarter, pricing climbed on average by about 1.5 percent, the survey indicated.

Pricing for commercial property/casualty has slid steadily at least since mid-2013, the survey noted, though it is still a vast improvement over double-digit declines last seen in the 2007 third quarter.

What is driving this? Quite simply, heavy competition and a lot of capacity.

“Pricing responded predictably to strong competition and plenty of capacity to underwrite most commercial lines,” Ken Crerar, president and CEO of The Council of Insurance Agents & Brokers, said in a statement.

The survey indicated that more competitive underwriting and pricing has taken place in the Northeast, Midwest and Southwest.

Crerar said that pricing trends for the second half of 2014 will depend on capacity, profitability and catastrophe losses.

Rate changes by line are set forth in the table below.

Source: The Council of Insurance Agents & Brokers

How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs  Preparing for an AI Native Future

Preparing for an AI Native Future