Property/casualty insurers in the U.S. made money in the 2014 first quarter even as many key indicators dipped, reflecting industry struggles caused, in part, by a tough winter.

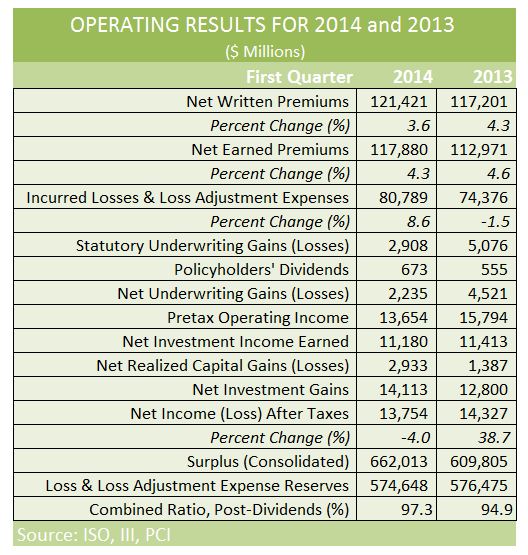

Net income after taxes fell 4.0 percent down from the first-quarter 2013 level. With underwriting profits cut in half and pretax investment income falling 2.0 percent, pretax operating income dropped 13.5 percent.

Net investment gains kept the bottom-line income slump out of double-digits.

Increases in policyholders’ surplus and net written premiums are also among the exceptions to the overall downward trend documented by ISO (A Verisk Analytics company), and the Property Casualty Insurers Association of America.

Robert Hartwig, president of the Insurance Information Institute, framed the results in prepared remarks on the III’s web site as generally positive for the P/C industry despite a number of obstacles.

Robert Hartwig, president of the Insurance Information Institute, framed the results in prepared remarks on the III’s web site as generally positive for the P/C industry despite a number of obstacles.

“Despite an unusually costly winter, rising non-cat losses, and persistently low interest rates, the industry posted another profitable quarter aided by capital gains and reserve releases. Premium growth, while still modest, is now experiencing its longest sustained period of gains in a decade,” Hartwig wrote, referring to a 3.6 percent rise in net written premiums.

“Fundamentally, the P/C insurance industry remains quite strong financially, with capital adequacy ratios remaining high relative to long term historical averages,” he said.

The industry’s combined ratio for the 2014 first quarter worsened to 97.3, according to the report, versus 94.9 for the same period last year.

The rate of growth in net written premium slowed year-over-year, from 4.3 percent last year to 3.6 percent in the 2014 first quarter. The same holds true with net earned premiums, which expanded to nearly $117.9 billion in the 2014 first quarter. That’s up from $113.0 billion last year, but only reflects a 4.3 percent growth, versus a 4.6 percent hike last year.

Overall net loss and loss adjustment expenses relating to catastrophe losses rose to $3.2 billion during the 2014 first quarter, up from $2.5 billion in the 2013 -first quarter. Other net loss and loss adjustment expenses also climbed higher, hitting $77.6 billion in Q1, versus $71.9 billion in the 2013 first quarter.

The consolidated surplus jumped to $662 billion during the quarter—a record high. That compared to $609.8 billion in the 2013 first quarter.

Robert Gordon, PCI’s senior vice president for policy development and research, said that insurers, property owners and businesses should still focus on risk management for the remainder of the year. Why? He noted that a storm could cause serious damage even though hurricane season is expected to be relatively light.

“Insurers are strong, well capitalized and well prepared to pay future claims,” he said in a statement. “The experts are predicting the hurricane season this year will be relatively calm, but it only takes one powerful storm to disrupt millions of lives and cause tens of billions of dollars in damage.”

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash  Preparing for an AI Native Future

Preparing for an AI Native Future  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  Five AI Trends Reshaping Insurance in 2026

Five AI Trends Reshaping Insurance in 2026