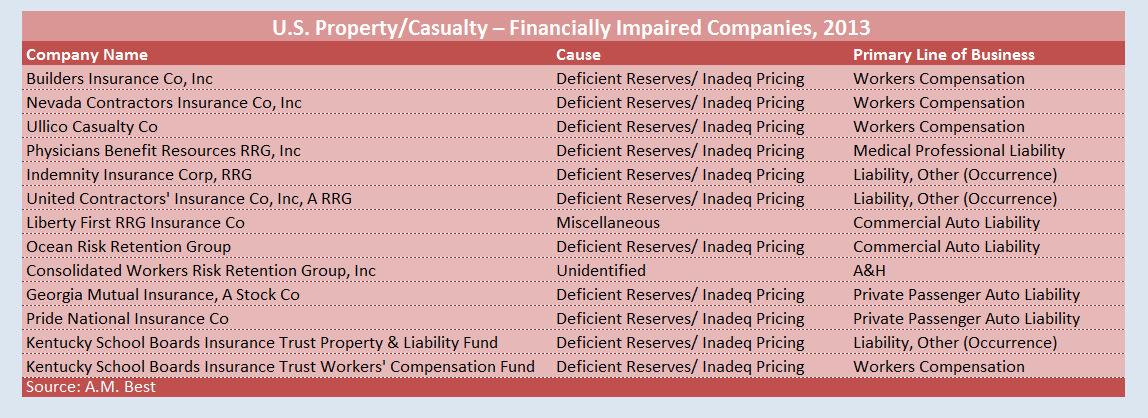

A.M. Best announced its final tally of impairments for 2013 on Wednesday, counting just 14 for the year—the lowest level since 2007.

The level was a little more than half the historical average and the 2012 count of 25, the rating agency said, also noting that risk retention groups represented half of the impairments.

“A.M. Best generally views RRGs favorably because of their focused business, low retentions, active loss control and robust risk management, but some of these entities have proven susceptible to underreserving and too-rapid growth,” analysts for the rating agency wrote in the special report.

RRG or not, most of the impairments were attributable to deficient reserves or inadequate pricing.

The P/C industry’s 2013 financial impairment frequency (FIF)—which Best believes is a more accurate indicator of impairment trends than a mere count—was 0.43 percent, falling well below the industry’s historical average of 0.81 percent. The 2013 figure was near record low levels recorded during the 1970s (except for 1975, when the FIF spiked to 1.09 percent following the trough of a soft market and an economic recession). According to Best, more recently, the 2011 FIF of 1.05 percent marked the peak for impairment frequency following the 2007-2010 soft-market trough and the 2007-2009 recession.

So far in 2014, there have been four impairments:

- Sunshine State Insurance Co., a Florida-based homeowners insurer, which was placed into liquidation on June 3 after a sale of the company fell through.

- Freestone Insurance Co., a multistate carrier writing comp, auto and general liability insurance.

- Four-state workers comp insurer Lemic Insurance Co., domiciled in Louisiana.

- Commonwealth Insurance Co., a Pennsylvania-based surety writer.

While workers comp was the primary line for most of the companies that failed in 2013 and 2014, it wasn’t always that way. The report shows that over a period of more than four decades studied (1969-2013), private passenger auto was the leading line for impairments, with personal auto writers suffering more than one-quarter of the impairments (26.4 percent) compared to 17.1 percent for workers comp.

Other commercial liability lines—other liability, commercial auto and commercial multiple peril—followed, each representing roughly 8 percent of the impairments over the 44-year study period.

The study analyzes impairment correlations with a number of factors—ownership type, geographic concentration, line of business concentration, size and age.

Among the takeaways:

- Looking at data for more than a century, impairments of stock companies have soared above mutual impairments since 1968; from 1900-1968, mutual impairments were greater.

- For the decade ending in 2013, single-state writers accounted for more than half the impairments.

- In 2013, 83 percent of the impaired companies had surplus of less than $20 million.

The report also gives a brief description of each company that failed in 2013 and 2014, along with the financial results in the years before impairment. In addition, the report included detailed analyses comparing long-term failure frequencies with economic factors and underwriting metrics and results drivers (combined ratios and catastrophe losses, for example) as well as analyses of A.M. Best ratings in the three years prior to impairment.

In an early tally announced in January, Best said there were 8 P/C impairments for 2013. In the past, A.M. Best has noted that counts may increase from one report to the next as information emerges about confidential regulatory actions.

For the purposes of its analysis, A.M. Best designates an insurer as financially impaired as of the first official regulatory action taken by an insurance department indicating that one or more of the following conditions is true:

- The carrier’s ability to conduct normal insurance operations is adversely affected.

- Capital and surplus is inadequate to meet legal requirements.

- The carrier’s general financial condition has triggered regulatory concern.

Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook

Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook  Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster  AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  Preparing for an AI Native Future

Preparing for an AI Native Future