Willis Re took a close look at June 1 and July 1, 2014 global reinsurance renewal rates and once again found them mostly wanting from the reinsurance industry perspective. Meanwhile, cat bonds continue to add competitive pressure and reach new highs.

Willis Chairman Peter Hearn and CEO John Cavanagh said in their reinsurance advisory firm’s July 1 “1st View” report that fierce competition led to “significant rate reductions and, in some cases, an expansion in terms and conditions” in markets around the world. Observers expected the continued rate drop, a trend that was also evident at April 1 renewals as overcapacity flourished. Reinsurance rate drops first began to accelerate in 2013.

Reinsurers’ concerns are mounting as reinsurance rates continue to soften, Willis Re’s executives said.

Related trends include an increasing negative outlook from major rating agencies on the global reinsurance sector and the ever-increasing presence of insurance-linked securities, which is hammering down pricing in the U.S. catastrophe market in particular—a sector that has helped boost reinsurers’ returns in the past.

Consider how big the non-life catastrophe bond market has become. Hearn and Cavanagh said that it has reached $5.7 billion so far in 2014. The total outstanding amount, however, has hit $21 billion—the highest yet, according to the Willis Re report.

Also boosting competitive pressure is buyers’ tiering of their reinsurance capacity suppliers. Hearn and Cavanagh wrote that the trend is forcing both reinsurers and fund managers to examine their strategies, and reinsurers must speed up the launch of their plans so they can successfully trade and remain competitive.

Willis Re said the softening property/casualty market continued in Australia, China, the United Kingdom and the United States. Latin America has become a partial exception, as market interest is on the rise. The Middle East also escapes this to a degree, as higher investment in infrastructure projects is expected to help premiums grow at a stronger rate.

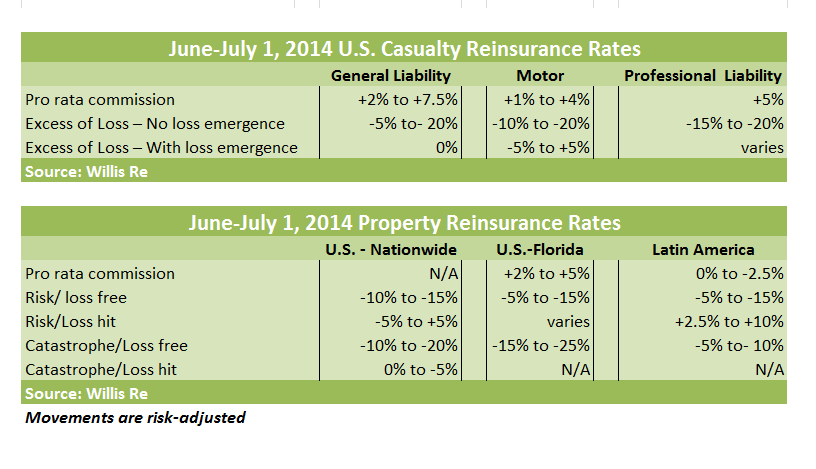

Broken down, some U.S. property-catastrophe renewals dropped as much as 20 percent on a risk-adjusted basis for nationwide business and 25 percent for Florida, Willis Re said. Similar drops hit the United Kingdom. China continued to face a growth in exposures, and the market responded with large risk-adjusted rate reductions, according to the report. Latin America saw declines of between 5 percent and 10 percent on a risk-adjusted basis for property-cat reinsurance renewals, depending on the territory and size of the program.

Hearn and Cavanagh wrote that the current soft market will create worsening challenges for most reinsurers heading into 2015. We’ll see better news in the primary insurance market that will reinforce this, as it enjoyed lower-than-average loss ratios in the first six months of 2014 and is buttressed by “reasonable adequate reserve positions.” This will produce another year of reasonable returns unless there are big underwriting or investment losses through the rest of 2014, they said. But the trend will put new pressure on reinsurance rate levels for next year.

With the way the reinsurance market is going, Willis Re’s leaders predict that primary insurance companies will likely lose the ability to keep posting primary rate increases while slashing reinsurance costs at the same time. While primary reductions can’t be directly tied to reinsurance savings, reductions on primary classes are now evident across most territories.

“The tentacles of the softening market are spreading far and wide” and that the trend will likely continue, Hearn and Cavanagh wrote.

Property and casualty rate changes for the United States and Latin America are summarized below.

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb  Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday