While global non-life insurance premiums increased in 2013, their growth rate dipped compared to the previous year. The slowdown could have become even worse, but robust coverage demands in most emerging markets came to the rescue.

Blame economic stagnation and downturns in Western Europe and India as well as tax policy changes in South Korea for the downward shift, Swiss Re said in its latest sigma study.

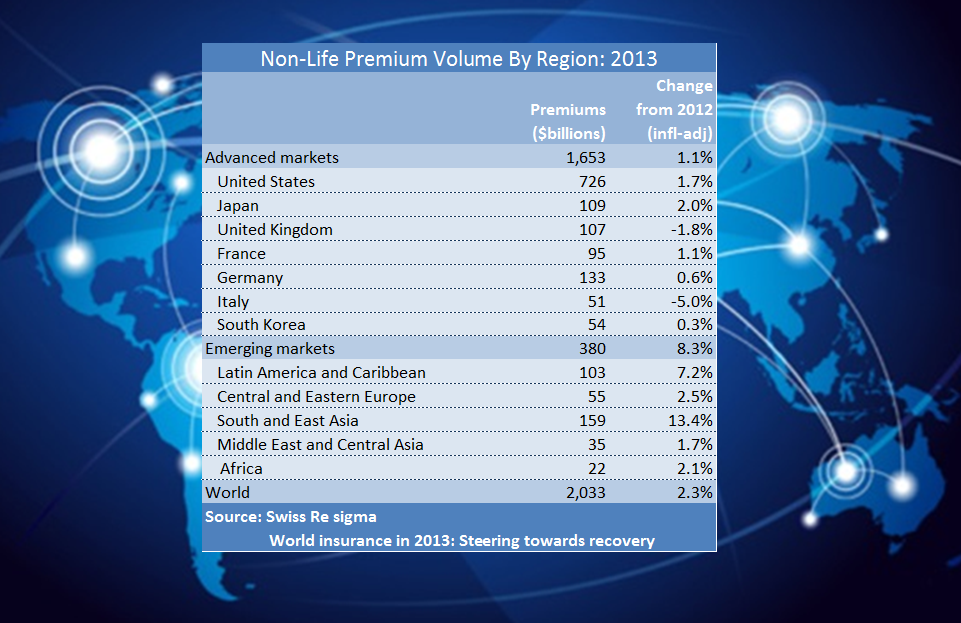

Overall non-life premiums inched up 2.3 percent in 2013 versus a 2.7 percent expansion in 2012. Swiss Re said the emerging markets drove the premium growth, particularly in Southeast Asia and China. Emerging markets alone produced 8.3 percent growth in non-life premium, down slightly from a 9.3 percent premium spike in 2012.

“As people get wealthier and acquire more physical assets to protect,…they spend more on non-life insurance products,” Mahesh Puttaiah, one of the Swiss Re study authors, said in a statement. “That is what is happening in many emerging Asian countries.”

The one emerging-market exception: India, where a slower economy and weaker business climate knocked the non-life premium sales growth down to 4.1 percent for the year, less than half of the 8.9 percent increase in 2012, Swiss Re said.

The one emerging-market exception: India, where a slower economy and weaker business climate knocked the non-life premium sales growth down to 4.1 percent for the year, less than half of the 8.9 percent increase in 2012, Swiss Re said.

Non-life insurance premium growth in advanced markets remained tepid at 1.1 percent in 2013, down from 1.5 percent in 2012, a trend that Swiss Re said has continued since the 2008 financial crisis. Also, advanced Asian markets have seen more dramatic slowdown in non-life premium growth. The Swiss Re sigma study noted that non-life growth in those countries dropped to just 1.7 percent in 2013, compared to a 4.7 percent jump in 2012. Swiss Re blames a Western European market that remains depressed, plus a “sharp tax-reform induced slump in South Korea” for depressing advanced market-premium increases.

Non-life premium growth also remained moderate in the U.S., at 1.7 percent for 2013, and in Canada, at 3.2 percent.

As Swiss Re explains in its study, global life premium growth faced even more dramatic drops. Premiums in this sector increased just 0.7 percent in 2013 versus 2.3 percent in the previous year. That drop helped depress overall global premium growth, which diminished to 1.4 percent in real terms in 2013, down from 2.5 percent in 2012. At the same time, however, Swiss Re noted that overall profitability improved during the year.

Of course, insurance premium trends are often cyclical, and Swiss Re said as much as far as premium expectations in the months ahead. The Zurich giant asserted that economic growth will propel premium hikes in both advanced and emerging markets through 2014. What’s more, Swiss Re emphasized, after a long period of low levels, interest rates will rise and help support insurer investment returns in the long term.

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers  20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut