The combination of Validus Holdings and Western World Insurance Group fills in “missing pieces” for both organizations, Validus’ chairman said Tuesday, detailing finer points of a $690 million deal that was announced a day earlier.

For Western World, the deal brings the ability to leverage Validus’ expertise in short-tailed specialty business, Validus Chairman and CEO Ed Noonan said during a conference call.

Validus is “happy to take on” the light hazard mid-tail liability business that has brought a 50-year unbroken string of profits to Western World. But the potential for growth in lines like property, terrorism, and marine—specialties of Validus’ Lloyd’s syndicate, Talbot Underwriters—represents a strong opportunity for Western World, and also the bigger opportunity emanating from the deal for Validus, Noonan said.

“The missing piece in Western World’s arsenal is the ability to deploy our capital and underwriting expertise in the short-tail insurance classes,” he said, describing Western World as “a New Jersey-based leader in the excess and surplus lines business for small to mid-sized enterprises.”

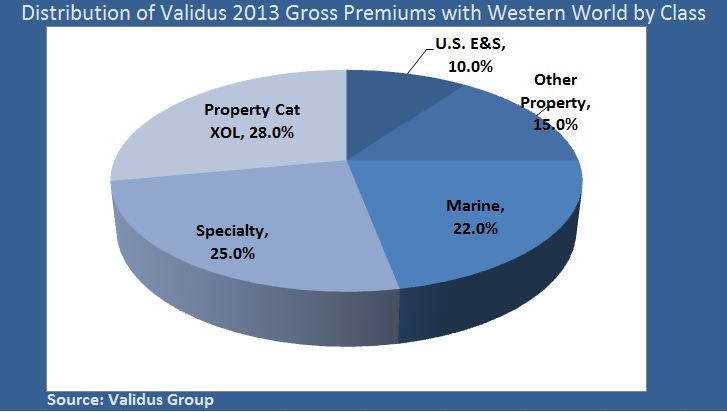

Putting 2013 gross written premiums for the companies together, Western World’s existing U.S. E&S business represents just a 10 percent slice of $2.7 billion pie, according to one of the slides available to conference call participants.

For Validus, above everything else, Western World brings something Validus has been waiting for—an entrée into the world’s biggest insurance market in the United States.

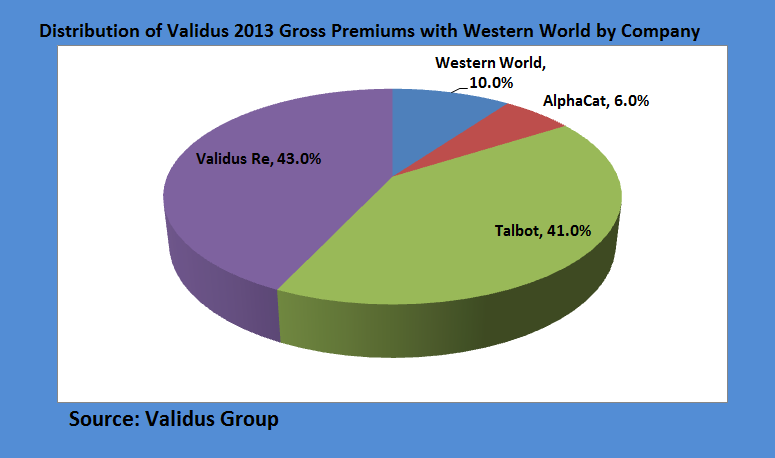

“We are not abandoning our strong bias toward short-tail risk, nor are we reducing the importance of our reinsurance business,” Noonan said, referring to existing reinsurance businesses written out of Bermuda-based Validus Re and an insurance-linked securities manager, AlphaCat, in addition to London-based Talbot.

Referring specifically to Talbot and the similarities between Talbot and Western World, he said, “The direct insurance business has been a critical part of our success and the opportunity to grow by acquiring a premier company doesn’t come along very often.”

When it did, “we jumped to acquire Western World in the same way that jumped to acquire Talbot in 2007,” he said, noting that like qualities include “a fantastic balance sheet, defensible market position, a unique and difficult to replicate set of skills, excellent management and a strong and vibrant culture.”

With respect to the balance sheet, Validus Chief Financial Officer Jeffrey Sangster noted that loss reserves carried by Western World have historically been conservative and that they were adjusted down by $149 million to determine the fair value of liabilities for GAAP reporting.

Noonan said that the Franklin Lakes, N.J. E&S insurer fills in missing ingredients like operating infrastructure, systems, licenses “and most importantly, the management team to allow us to access the U.S. market.”

While also noting that Talbot, like Western World, accesses business through wholesale distribution channels, “what we don’t have is the U.S. primary insurance distribution relationships. [At Western World], these are excellent and not something the Validus could have replicated on its own,” he said, referring to some 271 partnerships with U.S. agent and broker offices with an average tenure of 15 years.

The slide presentation notes that nearly two-thirds of Western World’s business (64 percent) comes from exclusive general agents with binding authority, 22 percent from program administrators and 14 percent from wholesale brokers.

During the conference call, Noonan also highlighted Western World’s technology platform (known as WWIP for Western World Integrated Platform), which allows agent customers to rate, quote, bind, issue, endorse and renew policies online.

“Their technology is homegrown and it is by far the best we’ve seen certainly in the U.S. market—from back office engine right to the customer’s desktop,” he said, also noting that it runs 24/7 on desktop or mobile applications. “If a producer has opportunity on Sunday morning on the golf course, he can take out his iPad and rate it, quote it, bind it and issue it,” he said.

Noonan and Sangster addressed questions throughout the call—some posed by investment analysts and others they simply anticipated. Some of the key points they made were:

• Western World management will stay in place.

“We see the team at Western World as the most critical asset we’re acquiring given the professionalism and track record of excellence the company has built,” Noonan said.

• The purchase price was reasonable.

After adjusting Western World’s shareholders’ equity of $431.3 million at Mar. 31 to $518.3 million (reflecting the reserve release and other adjustments) the price-to-book multiple is 1.33, Sangster reported. He added that comparable multiples for U.S. specialty companies range from 80-200 percent of book value with the majority trading in 100-150 percent range.

• A ratings downgrade would have little impact.

Both companies have excellent relationships with the rating agencies, and the possibility that Western World will maintain its “A+” from A.M. Best “is not out of the question,” Noonan said, adding that the company competes predominately with carriers rated “A” or lower, and that the business is not particularly sensitive to ratings.

Separately, A.M. Best gave an initial answer to the question late yesterday indicating that Validus’ “A” ratings and Western World’s “A+” are unchanged for now, with Best taking into consideration “the terms of the agreement, the ‘bolt-on’ nature of the acquisition, [and] the potential for synergies and efficiencies to be gained in the future and the benefits of being acquired by a larger, well regarded Bermuda-based global re/insurance organization.”

“While the ratings remain unchanged, A.M. Best will continue to monitor Western World’s results up until the close of the transaction,” the rating agency said in a statement.

• Some Western World business will likely to be ceded to Bermuda.

Sangster referred to capital and tax efficiencies that Bermuda companies gain through quota-share arrangements, noting that most peer companies have a 60 percent quota share to offshore affiliates in place.

• ‘Contract binding authority’ isn’t a bad group of words.

When an analyst drew a parallel between CBA business and program business, saying that “there are some people who do it very well, [but] a lot who have struggled and had a lot of problems,” Noonan responded to the analysts challenge to explain why “CBA is not a bad word” in this situation.

“Western World was one of the pioneers of the contract binding authority business back in the 1960s and 70s,” Noonan said, noting that this was at a time when CBAs were not common for liability business. “Their relationships with their wholesale producers on average are over 15 years long,” he said.

Beyond the innovation that has given Western World a unique profitable leadership position in the CBA segment, Noonan distinguished between CBAs as being much broader than programs. “You build a box with [general agents] that you trust and trade with and give them the authority to act within that box. We have done very well with it at Talbot…Western World has done extraordinarily well, and others haven’t.”

“Program biz on the other hand [is] not for the faint of heart. [It] is class- or industry-specific, and you have a disproportionate influence, in many cases, by single producers.…

“People fall in love with program business because there are big blocks of premium [they] can take on.”

Western World doesn’t fall in that category. They are very deliberate. It’s an underwriting company,” Noonan said.

“In these areas, they have clearly gotten it right way beyond the rest of the market.”

• Returns not dissimilar

Responding to an analyst who calculated returns-on-equity for Western World in the mid-single digits, Noonan said: “I don’t think you can look at the returns on [U.S. E&S] company and say it’s a 7 percent ROE business when they have been building up significant reserve redundancies, essentially understating the true ROE….We expect the returns align very comfortably with Validus.”

Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages  Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll