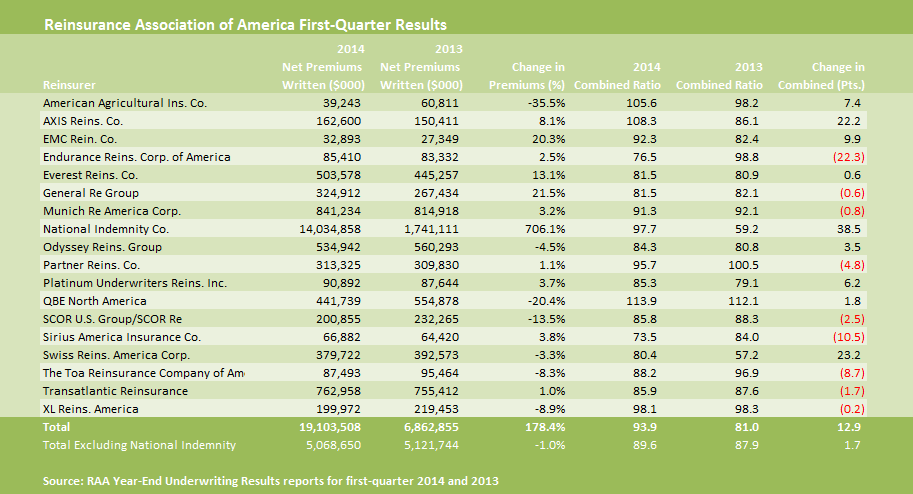

The Reinsurance Association of America’s latest quarterly survey of statutory underwriting results for U.S. property/casualty reinsurers reveals that first-quarter 2014 net written premiums came in at $19.1 billion, with Berkshire Hathaway’s National Indemnity contributing over $14.0 billion to the total.

Excluding National Indemnity, overall net premiums for the remaining 17 reinsurers was $5.1 billion, roughly unchanged from first-quarter 2013.

The aggregate combined ratio, excluding National Indemnity again, was also fairly stable—deteriorating 1.7 points to 89.6 for first-quarter 2014, compared to 87.9 for first-quarter 2013.

Individually, premium growth and combined ratio changes varied.

While only seven of the remaining 17 reinsurers reported premium declines, double-digit declines for QBE and SCOR, together with low-single-digit jumps for some of the bigger players, contributed to a 1 percent decline in premiums for the group.

In contrast, the 17 reinsurers (the RAA group excluding National Indemnity) reported a overall premium increase of 10.8 percent in first-quarter 2013 compared to first-quarter 2012.

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday  Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages