The chief executive officer of Validus Holdings said that there are growth opportunities for the group’s insurance operations in the United States, at a time when growth for the Bermuda reinsurance operations are harder to come by.

While reinsurance premiums declined for Validus’ Bermuda reinsurance operations in the first quarter, insurance premiums out of the London-based Talbot Underwriters unit were basically flat, CEO Ed Noonan reported last Friday during a first-quarter earnings conference call.

Rates were down some 3.5 percent across the Talbot book, with price declines in aviation and property treaty contributing to the drop. But Noonan said Talbot saw offsetting growth from Talbot’s Singapore, Dubai and Latin American operations. “While these territories are also competitive, there are good opportunities for Talbot’s products in less developed markets,” he said.

“Talbot has one other huge opportunity for growth which is the U.S. market,” Noonan continued. In addition to growing U.S.-based accounts in London, he said Talbot is currently writing $53 million of energy, terrorism, property and marine business out of a New York office. “We see very broad opportunities to continue to grow our business by continuing to add additional classes on the ground,” he said.

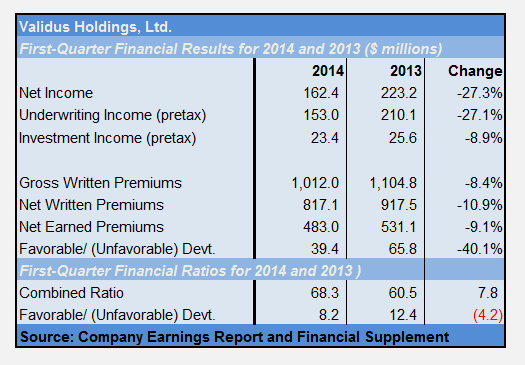

Later, during the question-and-answer session of the call, on which he also reported that Validus Holdings posted $162.4 million in the first-quarter income with Talbot contributing $36.2 million to the figure, Noonan reiterated his point about potential growth in the United States.

“The U.S. market is the world’s biggest. We really have never scratched the surface of it in our direct insurance operations.

“While the rate of increase for pricing in U.S. is slowing,” he said, “it’s still positive. Rates are broadly attractive. So I would expect to see us expanding our footprint in the U.S. as a growth source.”

Asked specifically if the growth might come through an acquisition, Noonan said, “if we could find the right company, then we would do that.

“We would have done it already,” he said. “Candidly, we’ve looked a lot and tried a couple of times.”

Until the right target company comes along, Talbot can leverage the 50 state excess-and-surplus lines licenses it has as a Lloyd’s underwrite to continue to build its “on-the-ground presence” as it has been doing in New York, he said. “It’s less fulfilling than being able to move on broader scale,” he said.

“If we found the right property, we would be a willing buyer. In the absence of that, we still think it’s important to push ahead. Underwriting on behalf of the syndicate is best way to do that.”

Hostile Deals Too Much Trouble

Noonan said that he sees no reason to expand the Bermuda-based Validus Re platform at the moment. “We have size and scale to be one of elite group of providers in the catastrophe reinsurance space….We don’t feel any particular need to be bigger to be relevant.”

Referring to “current activity on the island”—Endurance’s hostile bid for Aspen—Noonan said, “We read the papers like everybody else with interest. We wish them a good outcome for whatever it is they seek. [But] we don’t see ourselves at this point in time as being a consolidator in Bermuda just for the sake of consolidation.”

Later on the call, an analyst pressed Noonan to specifically explain why Aspen, which has a Lloyd’s business and a U.S. specialty platform, would not be an attractive proposition to meet the growth goals he has in mind for Talbot.

“If I said anything that suggested a view of relative attractiveness, that wouldn’t have been my intent. Aspen is a good company. They have a nice track record [and] have built a good business.”

“This idea though of getting into unfriendly situations in acquisitions, we’re not in favor of that,” he said, quickly disclosing that the remark was made tongue in cheek. Validus won acquired monoline property-catastrophe reinsurer IPC Re with a hostile takeover bid in 2009. In 2011, the company made an unsuccessful bid for Transatlantic Re. A year later, Validus acquired fellow member of the Bermuda “Class of 2005″ startup, Flagstone Reinsurance.

Although Noonan was being facetious with his remark, he did go on to tell the analyst, “We don’t see ourselves engaging in that type of situation at this point,” describing some lessons learned from his past experiences.

“We have kind of concluded that having been successful in one unfriendly takeover, and unsuccessful in another, that you do an awful lot of work towards a very good end, and at the end of the day, there’s a white knight willing to pay a dollar more.”

“To get to that point, you probably have antagonized the board and management of the target company so much that they fall into the camp of ‘We’ll do a deal with anybody other than you.'”

“So our view is [that] we wish the parties well and are happy to sit on the sidelines” of the current battle, he said.

He added: “I didn’t mean to opine on the relative attractiveness of either company. [Aspen CEO] Chris O’Kane has done an excellent job with Aspen, and they have built a really nice company, as I think [Endurance CEO] John [Charman] will do with Endurance.”

“John’s track record speaks for itself, and I wouldn’t have anything other than good things to say about that,” Noonan added.

Amping Up Retro Strategy

Overall, Validus reported a 17.7 percent annualized return on average equity for the first-quarter and a combined ratio of 68.3.

“While we’re in competitive markets broadly across our business, our results reflect the outstanding quality of our risk portfolio,” Noonan said. “We’re executing on the strategy we laid out the day we started the company—that is as pool of acceptably priced risk shrinks, we reduce our writing and hedge our portfolio to protect our balance sheet, and right-size our capital.”

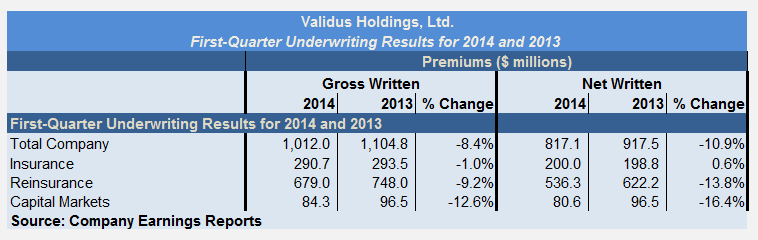

CFO Jeffrey Sangster noted that an 8.4 percent drop in gross written premiums was primarily driven by a 9.2 percent decline in the Bermuda-based Validus Re segment. More broadly, he said the drop reflected “declining rates in various classes and nonrenewal of certain contracts where pricing returns were unfavorable,” supporting Noonan’s statement about reducing writings as prices become unacceptable.

“We have retained customer relationships. So the typical path is to reduce our lines [on accounts] rather than nonrenew,” Noonan said.

“As a corollary, we right-size our capital” as evidenced by stock repurchases of $200 million in the quarter, he said.

As to the hedging component, Noonan confirmed that Validus is taking full advantage of the retrocessional market. “A key dynamic of the quarter for Validus [has been] what we’ve been able to achieve through the use of retrocession and reinsurance,” noting that the result has been “a meaningful shift in Validus’ risk position.”

Citing figures on declining probable maximum losses to illustrate the shift, he said the “most comprehensive retrocessional program” that Validus has “ever had as a company” included the purchase of $450 million of retro limit on an ultimate net loss basis rather than an indexed basis.

“Four or five years ago, we were happy to run PMLs that were 23-24 percent of equity as we felt we were well paid for the risk. As catastrophe rates have weakened, our willingness to retain risk on our balance sheet has decreased,” he said, noting that the 1-in-100 year PML in 17 percent of equity.

“We have maintained our importance in the market while taking a much more defensive posture on risk,” Noonan concluded.

Noonan also disclosed that Talbot tapped into alterative reinsurance capital to secure “collateralized multi-pillared reinsurance” coverage.

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation  Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook

Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit