Aspen Insurance Holdings reported an annualized operating return-on-equity of 14.8 percent for the first quarter on Thursday, also giving double-digit forecasts for future years—targets which its leader says Aspen can achieve as an independent company.

Attributing the first-quarter results to the payoff from investments the company has made in its insurance operations over the past five years that are now coming to fruition, as well as to changes in its reinsurance and retrocessional programs (under which Aspen retains more to retain more business), Chief Executive Officer Chris O’Kane said he was hardly surprised by the results.

Nor was he surprised by questions about a hostile takeover bid from Endurance Specialty Holdings. Anticipating those during opening remarks of an earnings conference call Thursday, O’Kane reiterated information in letters and press statements released over the past weeks.

“Endurance represents a remarkably poor strategic fit for Aspen,” he said.

Who might be a better fit?

Responding to that question from an analyst during the follow-up question-and-answer session, O’Kane said: “There are loads of such people out there. However, what we’re doing is running a successful independent business.”

O’Kane continued: “What we’re showing the market is you haven’t seen anything yet. You’re going to see a vastly more profitable and successful Aspen business, which we think the market will recognize. That’s what we believe is the best way and the surest safest way to create value for our shareholders.”

O’Kane noted that Aspen’s stock has trailed the true value of the company and that the leaders have not touted the investments the company has made in people, systems and infrastructure over the last five years.

“Now is a good time to do it when they’re beginning to pay off,” he said.

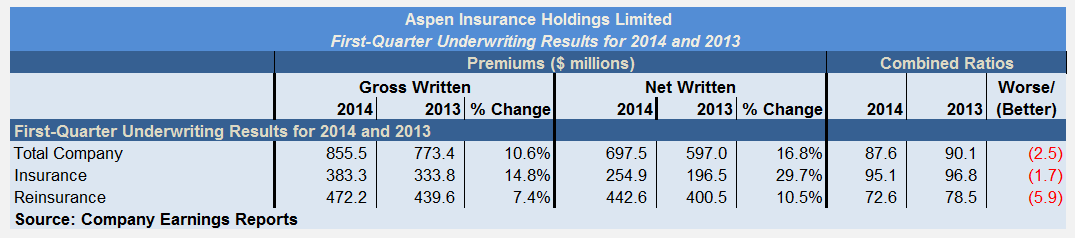

- Overall Aspen reported a 10.6 percent rise in gross premiums to $855.5 million, the bigger reinsurance piece growing 7.4 percent to $439.6 million, while insurance premiums jumped 14.8 percent to $333.8 million.

- Net premiums rose more—by 16.8 percent overall—as changes in reinsurance programs moved the net-to-gross premium ratio up to 82 percent versus 77 percent last year.

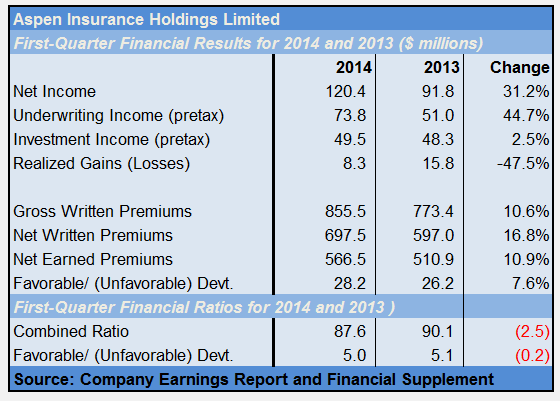

- The overall combined ratio was 87.6, improving 2.5 points from last year, with comparable levels of favorable prior-year loss development impacting the combined ratios in both the 2014 and 2013 first quarters.

- Investment income contributed $49.5 million to overall earnings, but the real driver of a 31 percent boost in net income was more was higher underwriting income—more than $20 million higher (before taxes) than in last year’s first quarter.

As for Endurance, O’Kane said the $47.50 per share proposal is “a gross undervaluation of our stock.”

As for Endurance, O’Kane said the $47.50 per share proposal is “a gross undervaluation of our stock.”

The proposal comes with significant execution risk and material unanswered questions about financing, he added.

O’Kane did not specifically respond to questions about whether Aspen has gotten any other offers or what might be a proper value, but he did lay out the criteria Aspen might look for in potential partner—one that could move the company in the same direction it is moving even faster.

Noting, Aspen’s “strong presence at Lloyd’s,” for example, O’Kane said a partner that expanded its presence even further might be welcomed. “To be a bigger player in the market would be highly beneficial,” he said.

Aspen’s contentions that Endurance’s leader, CEO John Charman, has expressed a disdain for Lloyd’s is one of the points the two companies have been sparring over in a war of words since Endurance made its offer to acquire Aspen public on April 14.

O’Kane said other welcome partners might expand Aspen’s presence in the U.K. regional market, help grow its specialty insurance franchise in the United States “in a way that’s culturally at one with the way we do it.”

A culture clash is another sticking point between Aspen and Endurance, with Aspen suggesting that a “top-down” management style at Endurance is odds with its more collegial culture.

On the reinsurance side, O’Kane said his company is wary of growing catastrophe exposures or tackling with a challenged casualty reinsurance environment. Instead it prefers to continue to expand in U.S. Midwest regional zones rather than peak cat zones on the property side, and in specialty reinsurance lines. Partners who could push these initiatives forward and help Aspen grow reinsurance business in Latin America and the Asia Pacific would also be attractive, he said.

Inflection Point

Still, O’Kane made it clear that Aspen tends to continue to produce double-digit ROEs as a standalone company. He reconfirmed guidance provided to analysts in February 2013 stating that Aspen would deliver a 10 percent return in 2014, and went on to project an 11 percent return (100 basis points higher) for 2015.

The expectation for 2015 assumes a $200 million cat load, normal loss experience, rising interest rates and a less favorable pricing environment, he said.

O’Kane spoke at length about “portfolio optimization”—one of three pillars of a strategy to boost returns that was set in motion a year ago. (The other two pillars are capital management and enhanced investment returns.) He described this as continuously analyzed market dynamics to identify opportunities for superior returns.

He also stressed that the $150 million that the company has spent to build its U.S. insurance platform has been money well spent. “We have now reached an inflection point,” he said, indicating that he expects profitable premiums to grow at a much faster rate than the expense base” going forward.

“The market is now bringing us opportunities that previously we would have to go seek,” he added, at one point referring to relationships and connections of Aspen’s underwriters in the market, such as those of professional liability underwriter Bruce Eisler, which may help Aspen win business when clients seek alternative carriers after having bad experiences with competitors.

Eisler, formerly of Liberty Mutual, was one of a large group of seasoned underwriters who joined Aspen in 2010 and 2011, when Aspen started investing in new hires for its U.S. specialty insurance business. Also joining at the time were Mario Vitale, a veteran of Zurich who is now CEO of Aspen Insurance, and Fred Cooper, formerly of AXIS Capital.

Cooper, who led Aspen’s management liability team after leaving AXIS, more recently left Aspen to join adversary Endurance last year, long before hostile bid came to light.

During Thursday’s call, O’Kane did not mention Cooper specifically, but did suggest that the departure of some members of Aspen’s directors and officers liability underwriting team was not entirely unwelcome.

The comment came during a discussion of conservative loss reserving practices and the selection of initial loss picks for new insurance lines of business. O’Kane, noting that the D&O line can produce loss ratios as low as 30, said the prior team wanted to book that loss ratio upfront, whereas the management team prefers booking to 60 initially and taking the reserves down over time.

“Aspen is an underwriting company founded by an underwriter,” O’Kane said earlier in the call, noting that Aspen’s loss ratios have been on par or better than peers over time. “To do that, we hire very good underwriters and we give them a lot of authority. We also surround them with very good actuaries….

“We don’t aspire to have the lowest expense ratio out there,” he said, noting that Aspen’s aspiration instead is to have safe business, good loss ratios, somewhat higher than average expense ratios, but stable combined ratios.

Like O’Kane, Endurance’s Charman began his career as an underwriter. Since taking the helm at Endurance, Charman has restructured the management team, and used cost savings to hire new underwriting teams.

Scale Not Necessary in Reinsurance?

On the reinsurance front, O’Kane suggested that scale isn’t the name of the game in 2014.

“Some may ask, do you need to be bigger,” he said. Answering his own question, he replied, “Our reinsurance business is not only competing. We are winning” by putting the right people in the right places.” In particular, he said that Aspen had written more property reinsurance business in its U.S. regional initiative at Jan. 1 than the company had planned to write for the entire year.

O’Kane also said that “alternative capital is here to stay” and Aspen is utilizing it to better serve clients, noting that the company was able to write larger lines at Jan. 1 using Silverton Re to transfer some of the property-cat risk to third-party capital providers.

In December last year, Aspen set up Silverton Re, a Bermuda-domiciled special purpose insurer to provide additional collateralized capacity supporting Aspen Re’s global reinsurance business.

During the first quarter, Aspen Capital Management increase capital under management by $20 million to $125 million, O’Kane said.

How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers  Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk