With underwriting profitability stalled, Platinum Underwriters Holdings could soon join the list of Bermuda reinsurers turning to riskier assets to boost the investment component of income, the company’s chief executive said last week.

While reporting an enviable underwriting combined ratio of 53.0 along with net income of $63.7 million for the quarter, the Bermuda-based reinsurer’s CEO Michael Price said that just focusing on underwriting won’t cut it anymore during an April 17 earnings conference call.

“It’s difficult to imagine and insurance or reinsurance operation today delivering equity-like returns to shareholders with a high-quality fixed income-only portfolio. Given the rate adequacy of insurance risk that’s available, you just can’t get there,” Price said.

Price, who was responding to an analyst who questioned whether Platinum was being reactive in following Bermuda competitors who had already adopted riskier investment strategies or instead had independently grown comfortable with its ability to manage investment risks, suggested instead that an unending soft reinsurance market factored into the decision.

During introductory remarks on the call, Price had said that a higher risk-higher return strategy is one of three that Platinum is considering to deploy its capital after an 11 1/2 year-run of financial performance being supported by returns from fixed income assets of high credit quality.

“Based on our current reserve position, our net inforce portfolio, our asset portfolio and our underwriting prospects for the balance of the year, we believe we are strongly capitalized with a comfortable margin above rating agency targets,” Price said.

Noting the likelihood that Platinum’s capital cushion will grow, “we anticipate having the financial flexibility to expand our underwriting, hold riskier assets or buy back shares,” he continued. He said the decision would be guided by the pricing conditions that play out in various reinsurance markets.

During the question-and-answer session of the call, the analyst pressed Price to discuss whether risk-taking on investments was now “the price of admission” in the Bermuda market, describing what he termed “Watford-like strategies”—a reference to a recently launched multiline reinsurer for which Bermuda-based Arch Capital acting as reinsurance manager and Highbridge Principal Strategies, a J.P. Morgan Asset Management subsidiary handling the investing.

This isn’t entirely new, Price replied, noting that some reinsurance companies have had risky asset investing strategies for their entire existence. He noted, however, that “in Bermuda market—since 2009—we have seen a dramatic increase in the allocation to riskier assets. To some extent it is the new standard.”

Turning back to Platinum, Price said: “We have had a great run for nearly a dozen years, reaping most of our benefit from underwriting profit and interest income from high-quality fixed-income securities. But looking ahead at the competitive landscape and return expectations that people have, I just don’t think that an underwriting only—or predominantly underwriting strategy—is going to produce the kinds of returns we’re expected to produce.”

He continued: “If you’re going to be organized as a publicly traded insurance or reinsurance operation, you necessarily have to consider going beyond the fixed income space.”

Softness As Far As the Eye Can See

Why not just raise reinsurance prices, the analyst asked, noting that if all the market players move in this riskier-asset direction, the reinsurance will just soften all the more.

Price replied that he hoped competitors would be “thoughtful about the types of risks they’re reinsuring and the rewards they need to expect to justify taking those risks.” He also stressed that he does not support an underwriting strategy that credits more than the risk-free rate in the pricing analysis—in other words, one that gives pricing discounts to clients associated with the time-value of money using a higher interest rate assumption.

“Returns available from insurable risk right now are historically on the low side. So to produce an overall combined result that’s acceptable, we are encouraged to take on other types of diversifying risk, which we can do on the asset side. But I think that those risky asset returns should be understood in light of the [underwriting] risk you’re assuming….I don’t want one to be subsidizing the other,” Price said.

Price went on to say that he had seen other reinsurer business models “suggesting that people are confusing the two. I personally find that distasteful. But I don’t control the market. And no one company is going to influence insurance and reinsurance pricing,” he said.

“We are not at the bottom of a soft market,” he said later, responding to another analyst who questioned what type of event might turn the market. “We are in the middle of a soft market and the natural evolution [is] continued softness as far as the eye can see,” he said.

Market Softness Extends ‘As Far As the Eye Can See,’ CEO Says”

Price also addressed questions about how Platinum would go about finding riskier assets to put in its investment portfolio if the reinsurer does indeed change its investment strategy, suggesting that reinsurance underwriting and investing involve some common skill sets.

“Managing relationships with hedge funds and selecting strategies we’d like to support is not very different from managing relationships with ceding companies and selecting treaties we would like to support,” he said. “We will do this with same analytical approach [that we apply to] reinsurance underwriting and fixed income investing.

More directly addressing the question, Price said that, as is the case now, Platinum will continue to work closely with outside investment managers going forward. Platinum’s approach has been to use these managers to provide the company with ideas, execution, accounting, and risk measures, while maintaining actual asset allocation and security selection in house.

“As we consider riskier assets, we may extend some latitude on decision making to the outside managers,” he said, noting that in terms of the types of investments, Platinum is thinking about “the equity space and possibly [the] alternative strategy space.”

Acceptable managers will be those that give Platinum “transparency into their processes,” and those that take “the same analytical approach to their activities that we bring to our reinsurance underwriting,” he said.

Earnings Drivers for Platinum’s First Quarter

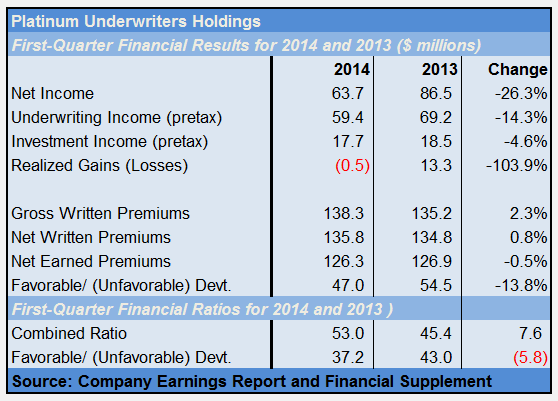

As for Platinum’s reaction on the underwriting side to the current market, Price noted that net premiums of $135.8 million were roughly same as in the first quarter of last year reflecting a “disciplined approach in the face of challenging market conditions.”

Platinum’s earnings got a boost from $47.0 million of favorable prior-year reserve development, representing 37.2 combined ratio points on $126.3 million of earned premiums.

Overall, net income fell 26.3 percent from $86.5 million in last year’s first quarter.

With prior-year reserve takedowns roughly $7.5 million lower than in first-quarter 2013, Platinum’s pretax underwriting profit of $59.4 million was roughly $10 million less than the $69.2 million figure posted for the same three-month period last year.

Investment income of $17.7 million was down slightly from $18.5 million last year, and the company recorded a realized loss of roughly $0.5 compared to a $13.3 million gain last year.

Commenting on reinsurance renewal actions for the year so far, Price said Platinum has written $298 million out of a $331 million pie of expiring premiums, representing a 10 percent decline. For property and marine lines within the total, he attributed a 5 percent rate erosion principally rather than exposure reduction.

“We generally expect property-catastrophe reinsurance rates for peak zones and perils to remain acceptable for the balance of the year. However, we anticipate risk-adjusted rate reductions to continue reflecting the recent influx of capacity into the marketplace,” he said.

Noting that competition is strong and capacity abundant in the casualty segment, Price said Platinum wrote $101 million of its $121 million of expiring casualty premium (a 15 percent drop). “Strong reinsurer appetites for premium volume makes it a buyers market [and] many treaties do not meet our pricing standards,” said the CEO of Platinum, notable for being the first publicly traded Bermuda reinsurer to report earnings each quarter.

In spite of Price’s assessment of the existence of a “buyers market,” not every buyer is taking advantage of softer reinsurance prices—a fact that became clear when the first publicly traded insurer to report announced its earnings later in the day.

Jonathan Michael, chairman and CEO of Peoria, Ill.-based RLI Corp. told an analyst that his company would not lower its reinsurance retentions and cede more business to reinsurers in reaction to falling as reinsurance prices.

“Reinsurance purchasing is a little bit like real estate. The most important thing in real estate is location, location, location. In reinsurance purchasing, the first three most important things are that [the] reinsurer is going to pay the loss when it comes time to pay the loss—and that goes for the second thing and the third thing.

“Way down the line is reinsurance pricing in my opinion and we don’t change our purchasing habits [based on] the pricing of reinsurance. That’s not the way we do business,” Michael said.

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality  Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb  Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday