Aspen Insurance Holdings announced Monday that its board of directors has unanimously rejected a $3.2 billion takeover bid from Endurance Specialty Holdings announced hours earlier, calling the proposal “ill-conceived,” among other things.

Early on Monday morning, Bermuda-based Endurance announced that it was directly reaching out to Aspen shareholders to advise them of a $47.50 per share bid to win the company, after having made repeated attempts to engage in more friendly negotiations, which Endurance said it initiated in January.

“Endurance’s ill-conceived proposal undervalues the company, represents a strategic mismatch, carries significant execution risk and would result in substantial dis-synergies,” Glyn Jones, chairman of the board of Aspen, said in a statement rejecting the unsolicited proposal.

In a letter to Aspen’s board attached to an early morning media statement, John R. Charman, Endurance’s chairman and CEO, had expressed confidence that Aspen’s shareholders would recognize the value of its proposal and actively encourage the Aspen board to begin constructive discussions with Endurance.

Charman said the deal would be paid for with a combination of cash and Endurance common shares.

The combined company would have more than $5 billion of combined annual gross premiums written, diversified across products and geographies, and more than $5 billion of pro forma common shareholders equity, he said.

“The proposal offers up-front value for Aspen’s shareholders, who will receive a substantial premium for their shares, as well as the opportunity to participate—along with Endurance’s shareholders—in future value created by a stronger and more profitable company,” Charman said in a media statement.

Less than two hours later came Aspen’s response rejecting Endurance’s overture in no uncertain terms.

Aspen said its board of directors, after careful evaluation with the assistance of its financial and legal advisors, concluded that the proposal from Endurance is “not in the best interests of Aspen or its shareholders.”

Jones alluded to the fact that Endurance has been undergoing significant changes in the past year, with Charman coming on board in May 2013 after leading a third Bermuda competitor for nearly a decade—AXIS Capital Holdings, a company which he founded in 2002.

“Aspen has a proven track record of performance and a clear strategy to increase shareholder value. Endurance has a mixed operating track record, new leadership, an unproven strategy and no experience with large acquisitions,” Jones said.

“Moreover, this transaction would be highly disruptive to Aspen’s corporate culture, which has proven to be a significant competitive advantage in the marketplace,” Jones continued in the statement.

See related article, “Round 3: Endurance Says Aspen Offers Shareholders ‘Red Herrings’ Instead of Value With Bid Response.”

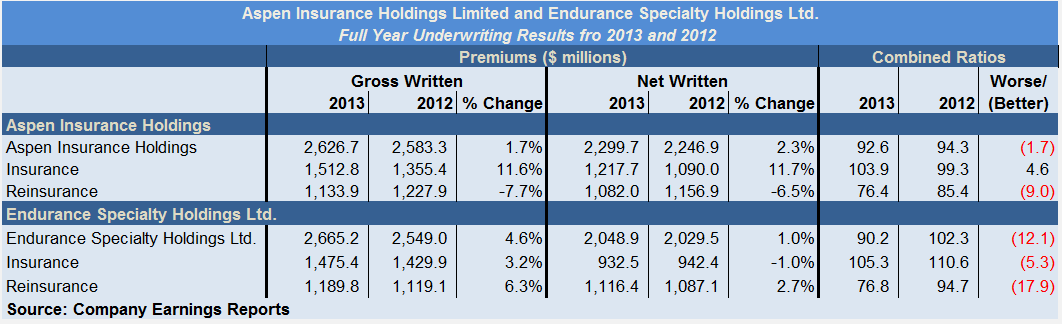

Supporting the reference to unprofitable insurance business, Aspen noted that Endurance’s insurance segment underwriting income excluding reserve releases has been negative from 2011 to 2013.

According to Aspen, Endurance’s earnings in recent years have been disproportionately driven by reserve releases.

“The path for future earnings is unclear,” Jones and Aspen CEO Chris O’Kane wrote in a letter to the Endurance board attached to the media statement.

Deal Terms, Business Mix

The letter also charged that Endurance had misstated Aspen’s 10 percent ROE (return-on-equity) guidance for 2014 as a long-term goal for the company.

According to Charman’s letter to the Aspen board, Aspen shareholders who accept cash for their Aspen shares under terms of the proposed deal “will receive up-front value that would otherwise take over two years to achieve based on consensus Street estimates for Aspen’s ROE.” He cited a figure of 13.4-times the 2014 consensus Street earnings estimates for Aspen as equivalent to the deal value.

“For those Aspen shareholders who remain invested in the combined company, our proposal provides the same highly attractive up-front premium as well as the opportunity to participate in a combined company with meaningfully improved earnings and ROE outlook, with significant additional upside opportunity over time,” the letter said.

According to Charman, the deal consideration also represents a 21 percent premium to Aspen’s closing share price on April 11, 2014 and a 15 percent premium to Aspen’s all-time high share price of $41.43 on Dec. 31, 2013.

Charman, who was one of Endurance’s largest shareholders, having purchased (together with his family) $30 million of the company’s ordinary shares prior to joining the company, committed to buying $25 million more Endurance common shares in his letter to the Aspen board, evidencing his “own deep conviction about the future of Endurance and the benefits of the combination.”

Charman’s letter also discussed the benefits of a $7.6 billion total capital base, such as having the ability to pursue growth opportunities and allowing the combined entity to withstand volatility. In addition, it highlighted complementary specialty lines businesses—Endurance’s U.S. crop insurance business and global catastrophe reinsurance business; Aspen’s “core strength in the London market” and historical strength in marine and energy lines.

The Aspen letter, in contrast, noted that a review of Endurance’s business mix by Aspen’s board has revealed what it believes is an overconcentration in crop insurance—”a business which is troubled, low margin, recently volatile and exposed to major risks”—as well as a lack of progress in other nascent insurance businesses.

On the reinsurance side, “Endurance is hesitant and uncertain about the industry,” the letter said, adding that “Aspen has a strong and well-regarded reinsurance business with a clearly defined strategy for addressing the changes in market dynamics.”

Aspen also charged that Endurance has “shown a public disdain for Lloyd’s,” which it said “is the growth engine of Aspen’s well-established international insurance business.”

Aspen, one of the Bermuda companies that emerged after 2001, was set up by 39 people who used to work at a Lloyd’s business known as Wellington, including O’Kane.

Aspen, Endurance and AXIS Capital are all members of the Bermuda “Class of 2001,” formed in the wake of the 9/11 attacks.

Charman has four decades of global experience in the insurance industry, first as an underwriter and then as a chief executive. He held his first CEO role at Tarquin plc, the parent company of the Charman Underwriting Agencies at Lloyd’s, which was sold to ACE Ltd. in 1998.

Within a few months of joining Endurance, Charman announced that the Endurance management team had been completely restructured, the underwriting culture was being refocused, and that underwriting talent had greatly expanded while total headcount and corporate costs have been slashed. He has also spoken about a focus on specialty and professional lines, as well as growing internationally, including into the London professional liability insurance market.

The culture is at odds with Aspen’s, according to Monday’s letter from Jones and O’Kane to Endurance’s board, which also accuses Endurance of poaching Aspen employees.

“Any combination with Endurance’s centralized, top-down management model, as compared to our collaborative, teamwork-oriented culture, would result in extreme personnel disruption and loss of attractive business,” the letter said.

“It is worth noting that our company is in significant litigation due to your orchestrated poaching of Aspen employees and clear breaches of fiduciary and other duties arising from this.

“The dis-synergies from the transaction you propose, including loss of business and personnel, combined with Endurance’s unappealing business mix, earnings track record and incompatible culture, make the combination unattractive, particularly in contrast to what Aspen expects to achieve by following our standalone plan,” the letter said.

Meanwhile, Charman’s letter noted, “The retention of key members of the Aspen management team, underwriters and employees will be critical to the success of the combined business.” It also described the cultures as compatible.

“Aspen’s collaborative, teamwork-oriented culture will integrate seamlessly with Endurance’s collegial environment,” Charman contended in his letter.

The letter also said that Endurance expects “transaction synergies exceeding $100 million annually,” including cost savings, underwriting improvements, capital efficiencies and enhanced capital management opportunities.

Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation  Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook

Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook  Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality  Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday