A.M. Best currently has a stable outlook on the global reinsurance industry, but that could change when the rating agency revisits the outlook at midyear, the firm said in a special report Friday.

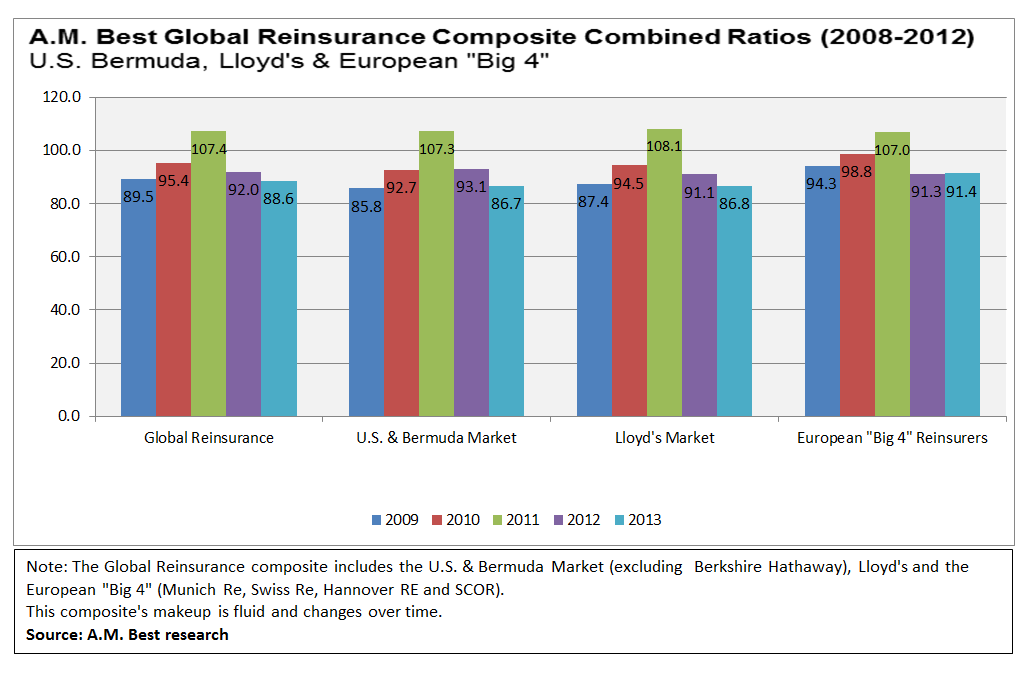

The report shows that most reinsurers reported their best combined ratios in five years in 2013, with a combination of a benign level of catastrophes and favorable loss development for prior accident years underpinning the results.

But a “difficult road lies ahead, which may be far more treacherous,” Best’s analysts write in the report titled, “Could 2013 Be the Apex of the Next Few Years?”

Beyond the title, the report asks several additional questions, including whether a large U.S. catastrophe could stabilize an increasingly competitive market and whether additional capital that has been attracted to the already saturated market is “smart money or…naïve?”

The report doesn’t answer directly any of these questions. It does say, however, that “it appears that the market is at an inflection point,” noting that activity during the April renewals doesn’t bode well for the industry’s next market chapter that will prompt the rating agency to revisit its outlook midyear.

Standard & Poor’s already has put a negative outlook on the reinsurance industry. In S&P’s view, increasingly competitive behavior between reinsurers during Jan. 1 renewals was the “tipping point” that signaled a negative trend in financial strength ratings for the reinsurance sector.

Looking ahead to the June and July renewals, the A.M. Best report says that while the ideal scenario would move the market toward more stable pricing, terms and conditions, “it now appears that the pressure on underwriting will continue.”

“If that is the case, it will be interesting to see how the new capacity reacts,” the report says, noting that additional inflows will only make a deteriorating situation worsen faster.

Prudent enterprise risk management has served reinsurers well in the past, and has supported Best’s stable outlook so far, but “there are early indications that underwriting restraint may be waning as competition from alternative capital intensifies.”

“The supply/demand equation of too much capital chasing the same opportunities has not only put pressure on reinsurance pricing, but also placed focus on reinsurance terms and conditions. The recently concluded April renewals revealed a worse-than-expected outcome for reinsurers as the abundance of worldwide capacity weighed on negotiations.”

Reviewing some familiar ground about primary insurers increasing retentions and lowering demand, as well as supply increases from external capital entering the market through insurance-linked securities, collateralized structures and even rated balance sheets, the report characterizes the external threat as a potential “game-changer.”

The external players’ ability to operate at a lower cost of capital is placing pressure on the traditional reinsurance model to become more capital efficient or increase investment returns by taking more asset risk.

The A.M. Best analysts also predict that if the soft reinsurance market persists or broadens, merger and acquisition activity may increase in the sector “as larger players look to deploy excess capacity and smaller players feel pressure to find a safe off ramp.”

Separately last week, Aon Benfield predicted that reinsurance buyers can continue to look forward to favorable pricing at midyear 2014 and beyond.

April 1 cedents seeing “material benefits” from the record level of traditional and alternative capital dedicated to reinsurance were mainly Japanese companies and a few U.S. companies. “We expect continued benefits to be realized by ceding companies at the June and July key renewal dates,” the broker said in its outlook report.

Going further, the broker report said, “it is clear that [the traditional reinsurance market] will match the new lower disaggregated (diversifying) price-points of alternative investors.”

“Reinsurance buyers are now able to imagine a future where very heavy margin loadings for peak zones may not be part of the long-term future,” the Aon Benfield report says.

According to Aon Benfield’s calculation, global reinsurer capital amounted to $540 billion at the end of 2013, an increase of 7 percent over the year. The figure includes is traditional capital for pure reinsurers and total capital for carriers that write both insurance and reinsurance, as well as alternative capital. It also includes government funds that provide reinsurance-like capital, such as the Florida Hurricane Catastrophe Fund and the Japanese Earthquake reinsurance scheme.

The broker estimates that the alternative capital portion of the total grew 28 percent to $50 billion in 2013 from $39 billion in 2012.

Giving a different measure of reinsurance capital, the A.M. Best report notes that shareholders equity for the traditional reinsurance industry amounted to $219 billion at year-end 2013. Companies contributing to this figure for Best’s global reinsurance composite include the U.S. & Bermuda Market (excluding Berkshire Hathaway), Lloyd’s and the European “Big 4” reinsurers—Munich Re, Swiss Re, Hannover RE and SCOR.

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash  Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk  AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  Preparing for an AI Native Future

Preparing for an AI Native Future