There were no surprises when QBE published its year-end financial results on Tuesday, with a $254 million after-tax loss on the bottom line nearly matching a preannounced estimate delivered by the Australia-based insurer late last year.

“That’s pretty much exactly in line with the numbers we communicated on the ninth of December” said QBE’s CEO John Neal, referring to QBE’s December 2013 market update putting the overall loss at $250 million.

“The very complexity of our business points to improving control over our data and our metrics to be able to call as accurately as we did, line-by-line, on the numbers on the ninth of December,” he said as he also reviewed nearly on-target for line items like premiums, prior-year reserve development and combined operating ratio individually.

Neal, speaking during an earnings conference Tuesday, also reiterated several other messages delivered back in December last year—namely that he expects U.S. business to be profitable in 2014, and that U.S. middle market business remains “under the microscope” for possible sale.

“If you look at our construct as a commercial specialty insurer, I think you’d challenge whether mid-market is in the specialty space,” Neal said when an analyst asked about market conjecture surrounding the middle market book. “We’re still debating that ourselves,” Neal continued.

“If we think we can grow that [middle market] business and grow it at an appropriate margin, then we would be happy to do so. If not, then we will deem it as being non-core and consider whether that business should be disposed,” he said.

Noting that he has no particular concerns about either keeping or shedding the book, Neal said: “I think it’s an attractive business in the U.S market. U.S P/C business is pretty flat [and] there aren’t many books of business at that size—around $900 million—running with a claims ratio of 61 or 62 percent.

“If we don’t think it’s scaleable, then I think it will be attractive to other people.

“We’re keeping our options open on that, but it’s under the microscope for the first half,” he said.

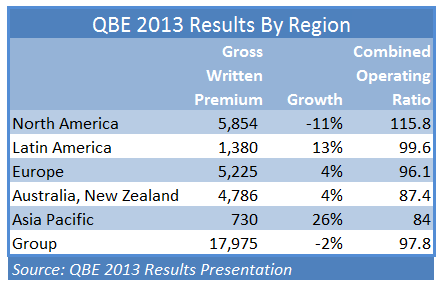

As for the North American QBE platform overall, which produced the worst 2013 underwriting result of the group—a 115.8 combined operating ratio compared to a group result of 97.8—Neal asserted, “Our North American business will return to profit in 2014 and see further improvement in 2015 and 2016.”

The reference to two subsequent years, however, caused one analyst to press for clarification. In December, “you said that you were confident that the U.S. business would be profitable in 2014, but the guidance appears to have softened a bit [with an] expectation of improvement through 2016. Do you still stand by statement in December? Should we be modeling profitability this year,” the analyst asked the CEO.

“Absolutely, yes. The North American business will return to profit in 2014,” Neal repeated. “I think what I’m sort of flagging gently is that for the business to return to levels of profit that we’re looking for universally across QBE’s business, that that might take another 12 months. But we are forecasting a return to profit this year,” he said.

Actual vs. Expected

QBE had estimated a loss of roughly $250 million on Dec. 9, 2013, when it detailed anticipated loss reserve charges (including $300 million related to North American program business), charges related to restructuring lender-placed property insurance (QBE Financial Partner Services or FPS), and $600 million of goodwill impairment changes for North American business.

The final actual reported net after-tax loss of $254 million compares to an overall profit of $761 million in 2012.

The final reported 2013 combined operating ratio (ratio of claims, commissions and expenses to net earned premiums) came in at 97.8, falling at the high end of a range of 97-98 anticipated in December, and representing a deterioration from a ratio of 97.1 for 2012. A slightly worse-than-anticipated combined ratio for crop insurance (102.8 versus 99 indicated in December) was one item that put the overall result at the high end of the estimated range.

Prior-year development for North America totaled $412 million, of which $366 million was program related.

Neal noted that prior-year reserve development across all of QBE, estimated at $650 million in December, actually came in at a lower $621 million figure, attributing the decline to smaller-than-expected reserve movements in Europe and Australia.

Eliminating the noise of all prior-year reserve movements from the results, Neal pointed out that the current accident-year central estimate combined operating ratio is 92.5.

Focusing in specifically on North America’s results, which he characterized as “clearly very disappointing,” Neal said the 115.8 combined operating ratio came in 4.8 points above the December guidance (and 9.0 points above 2012), attributing the difference to $30 million more in crop losses and some greater caution around prior-year reserves and the current accident year.

He said the company took the opportunity to “tidy up” prior-year reserves on non-program business, adding $30 million there, and put another $20 million of risk margin into the program business segment.

Providing comfort on the adequacy of the North American program business reserves as they stand now, Neal said that the company and its auditors conducted exhaustive analyses, and that QBE was able to purchase stop-loss protection against further adverse development on programs in runoff.

Also denting profits in North America was the crop insurance book.Neal noted that the crop business combined operating ratio was 102.8, not changed much from 2013 (at 102.9), but much different than the run rate of 91. Both 2012 and 2013 were impacted by the lag impact of the U.S. drought, he said.

Another North American specialty business, the lender-placed book, suffered from a 37 percent drop in gross written premium, driving the combined ratio up to 115.0 in 2013 from 79.7 in 2012.

On the top line, gross written premiums fell 2 percent for QBE Group overall to just below $18.0 billion. An 11 percent premium drop for the North American operations (to $5.9 billion) drove the overall decrease, with premiums for Latin America and Asia Pacific operations jumping up by double-digits (13 percent and 26 percent) and Australia and Europe posting 4 percent increases in premium.

“On a positive note in North America, average rate increases are coming in at 4-5 percent. That’s the third consecutive year of decent rate increases in North America,” Neal noted.

He said that the rate movements and “underlying combined operating ratios” of 97-98 give QBE “real confidence that the business can return to profitability quickly—and in 2014.” (The underlying ratios exclude prior-year reserve charges, restructuring costs for FPS and assuming a normalized crop combined ratio of 91.)

Neal noted that “necessary activity to remediate and improve the performance” is already in progress. “There are significant cost-out efforts both related to our group-wide operational transformation program and specific to North American that are already being played out,” he added.

He also noted that QBE has embarked on a mission to “reset [the] North American business as a true commercial specialty insurer” with North American CEO Dave Duclos having recruited a highly experienced North American team to support him in taking the business forward over the next three years.

Outside of North America, Neal presented the following results by region:

Going forward, he seemed most bullish on growth in the smallest segment— Asia Pacific—making note of the 26 percent rate of organic growth for 2013 and combined ratio of 84 “encouraging us to maintain our investment in people and technology to support a strong organic growth plan.”

“The growth plans in Asia see the business double in size organically over a five-year period,” he said.

In Europe, where rates increased 1.5 percent in 2013, Neal said QBE will be taking the top line down by almost $600 million in 2014 to improve the combined operating results.

Neal also highlighted QBE’s “absolutely sparkling results” for Australia, where the group posted an 87.4 combined operating ratio, noting that 5.6 percent rate increases helped push premiums up 4 percent, and expenses fell by more than 2 percent. A group-wide operational transformation process was completed first in Australia, he said, noting that the expense line is benefiting quickly.

Going forward, QBE expects top-line growth of 6-7 percent in Australia in 2014 and in each of the subsequent two or three years. “It just wasn’t appropriate to push for growth when we’ve been putting the operational changes in place.… All of that activity is complete now so I think the Australia team feels ready, enthusiastic and able to grow,” he said.

Across the entire business, QBE is forecasting rate increases of 2.5 percent overall, largely driven by rate increases here in Australia and in North America.

“It’s not a marketplace where price is hardening quickly globally but conditions are certainly stable,” Neal reported.

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages  AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes