Headline reserve charges for Tower Group, Meadowbrook Insurance Group and QBE Americas in 2013 didn’t interrupt an eight-year trend of overall prior-year reserve takedowns for the property/casualty insurance industry overall, according to Fitch Ratings.

But while Fitch estimates that overall favorable prior-year loss reserve development for the industry will shave 2.6 points off the industry combined ratio for 2013, rating agency analysts also report that just five large carriers accounted for three-quarters of the favorable development for the industry overall.

Fitch reviewed loss reserve experience for 100 of the top U.S. P/C insurers, representing approximately 88 percent of industry aggregate loss reserves, as of Sept. 30, 2013, using data from SNL Financial to complete the analysis.

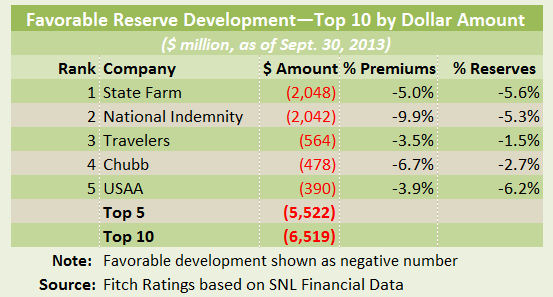

The number of companies reporting significant favorable prior-year development has fallen regularly over the last five years, Fitch reports, identifying State Farm Mutual Automobile Insurance Co., National Indemnity Co., The Travelers Companies, The Chubb Corporation and United States Automobile Association as the five contributors to the bulk of the overall industry takedown.

Fitch’s special report, titled “Property/Casualty Loss Reserve Development: Five Insurers Carry Trend,” also reveals that Fitch’s estimate of favorable development for the industry overall—2.6 percent of earned premiums—is higher than the 2.4 percent figure tallied for 2012.

Measuring prior-year reserve movements against the dollar amount of carried loss reserves, the figures are 2.0 percent for 2013, compared to 1.8 percent in 2012.

The analysis finds:

- Fewer companies in total with favorable reserve development

- Reduced levels of favorable reserve development among leading companies

- Modestly higher levels of unfavorable reserve development relative to beginning reserves for the worst performing companies.

Fitch believes that this pattern is indicative of a weakening in the industry reserve position over time, promoting an expectation for more modest favorable reserve development reported in 2014 for the P/C insurance industry.

Fitch notes that loss reserves from more recent accident years do not exhibit the same level of redundancy as the hard market years 2003−2007, and anticipating reduced favorable development as those hard market years pay out.

Fitch also suggests that “given recent improvements in core underwriting results from a hardening pricing environment, insurers may be more inclined to strengthen reserves from older accident years and latent asbestos exposures in the near term.”

The report lists prior-year reserve takedowns for the 10 carriers with the largest declines, including the five identified above. Although carriers like State Farm and National Indemnity each released more than $2.0 billion of reserves for prior accident years, for several carriers in the bottom-five of the top 10 group, takedowns represented higher percentages of earned premiums.

For example, for sixth-ranked Old Republic, $326 million of prior-year releases represented 19.3 percent of earned premiums.

Eighth-ranked Markel took down $173 million, but this represented nearly 15 percent of carried reserves.

Focusing on insurance groups with unfavorable development, Fitch revealed that American International Group and Liberty Mutual actually reported higher levels of prior-year reserve boosts by dollar amounts–$486 million and $454 million—than Tower, QBE or Meadowbrook.

Meadowbrook, in fact, did not make the top 10 list of companies with unfavorable development in Fitch’s report.

See related article, “Top 5 Reserve Boosts in 2013; Fitch Reveals Carriers with Unfavorable Development.”

The full report is available on Fitch’s website at www.fitchratings.com (under the Insurance tab of the Ratings and Research section)

Source: Fitch Ratings

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages  Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers  Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb  Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk