Soft market reinsurance conditions are no longer unique to property-catastrophe business, Willis Re said yesterday, pointing to overcapacity as the key driver of Jan. 1, 2014 rates down on most lines.

“Pricing margins on excess-of-loss business have been compressed, and ceding commissions have increased on pro-rata treaties for sought-after clients with large ceded premium volumes,” the reinsurance broker said.

The report also points to pressure on contract terms and conditions, citing expansion of hours clauses, adoption of less punitive reinstatement provisions and examples of expanded coverage for terrorism as examples.

While these are beneficial to buyers, they can have “an insidious impact” on reinsurer losses, the report warns. “Experienced reinsurers will remember that the relaxation of terms and conditions more so than price reduction caused the real damage in the last soft market cycle,” the report says.

In the introductory summary of Willis Re’s 1st View Report, John Cavanagh, CEO of Willis Re, said that the key influence on the 1/1/ renewals “has been overcapacity triggered by a number of converging factors,” listing the factors as:

- Strong 2013 results, which have bolstered traditional reinsurers’ already strong balance sheets.

- New capital from non-traditional capital market sources has grown to reach $50 billion.

- Muted demand from buyers arising from the longer-term trend of better regulation, which has in turn led to a better understanding and management of tail risk

- Muted demand from major insurance groups seeking to retain more reinsurance premium volume and risk on their own growing balance sheets.

Peter Hearn, Chairman of Willis Re, noted that market headwinds have caused large reinsurers to “offer more capacity and more complex, multi-class, multi-year deals.”

“Others are expanding into specialty lines and many have developed multi-channel capacity offerings seeking to use their underwriting expertise to deploy capacity on behalf of capital markets.

“Additionally, we have seen the rise of pooling arrangements that give smaller reinsurers the opportunity to access business they might not otherwise see in their local markets,” he said.

While the Willis Re report, reiterated a message delivered by Guy Carpenter last week about the extent of the soft reinsurance market across all lines, the brokers diverged on the actual level of rate declines for property-cat reinsurance, with Willis reporting bigger drops—up to 25 percent of U.S. business that has been catastrophe free and 15 percent international property-cat renewals.

In late December, Guy Carpenter reported that its Global Property Catastrophe Reinsurance Rate-on-Line Index fell by 11 percent—fueled by a 15 percent decline in the United States, with 10 percent declines coming in Continental Europe, and U.K. cedents.

The Willis Re report notes that “the influence of capital markets capacity is more pronounced on U.S. property-catastrophe placements where a combination of traditional, collateralized and securitized capacity has been utilized throughout more program structures” while international placements “still reside predominately with traditional reinsurers based on longstanding relationships, strong balance sheets and competitive pricing, underpinned by mature capital diversification models.”

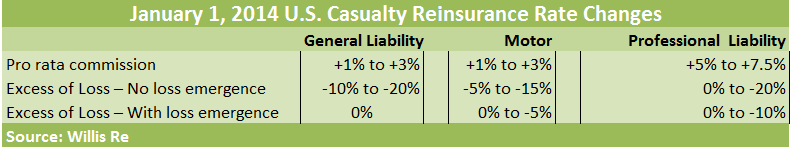

The report details property reinsurance price changes for 25 different regions, and casualty changes for 15 line of business/region combinations.. Willis’ observations on rate changes for the U.S. casualty market are summarized below.

The full report, which also includes discussion of global specialty lines and U.S workers compensation is available on the Willis Re website.

RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit  20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut  Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb