In its latest sigma report forecasting profits and premium growth for insurers over the next two years, Swiss Re says the eventuality of a hard market is a given—it’s just a matter of when.

Estimating a 7 percent return on equity for primary non-life insurers and a 10 percent return for non-life reinsurers in 2013, the report titled “Global insurance review 2013 and outlook 2014/15” predicts little change in these figures for 2014 and 2015.

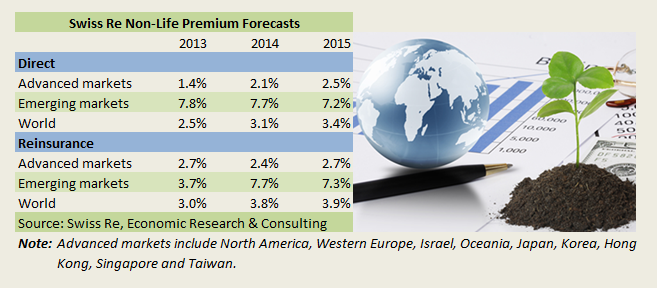

And premium growth will rise slowly—to 3.4 percent by 2015 for global insurers and 3.9 percent for reinsurers—with prices stabilizing at best, the Swiss Re report says.

“The current market situation is typical for a mature soft market cycle,” the report says, referring to a moderate price turn in 2013. “Prices are no longer weakening.”

“When broader-scale hardening will occur is uncertain, but [several] factors point to an eventual strong turn in the market,” the report says, including the possibility that individual insurers may soon need to boost loss reserves, the potential impact of Solvency II and investment market impacts on insurer capital.

With respect to loss reserving, the report says that while the timing is difficult to estimate because of company-by-company differences in reserving practices, “reserve releases will eventually shift to a need to strengthen reserves.”

“When this sets in, it will no longer be possible to ignore insufficient pricing, and the scene will be set for a hardening of rates,” the report predicts.

The impacts of stricter solvency regulations and higher capital requirements have a more predictable timeline, with Solvency II expected to be implemented in 2016. These “will help turn the market,” the report says, adding that a tightening of rating agency models is also expected in the 2016 time frame.

As for developments in the financial markets, the report notes that the capital impact of a quick and strong rise in interest rates could trigger a hard market.

At one point in the report, focusing on reinsurers, Swiss Re notes that in 2013, “the single incident with the highest impact on reinsurers’ balance sheets was U.S. Federal Reserve Chairman Ben Bernanke’s May 22 speech announcing a possible tapering of the Fed’s bond-buying program in the following months.” Interest rates rose in the United States and other markets, and the value of fixed-income securities went down, the report notes, adding that 15 global reinsurers included in a Swiss Re analysis lost about 6 percent of their equity as a result.

The report emphasizes that reinsurer and primary insurer capital bases are strong—with insurer capital back above pre-financial-crisis levels. But balance sheet issues have increased in the post-crisis years also, the report notes, highlighting the loss reserve issue, the potential for mark-to-market losses on fixed income assets as interest rates rise and the European sovereign debt crisis, which “is far from resolved,” according to Swiss Re.

Returning to the income statement, Swiss Re noted the still low levels of interest rates to explain its forecasts of only slightly improving returns for both insurers and reinsurers—despite the fact that Bernanke’s comments on tapering generated a 70-basis-point hike in U.S. interest rates and a 40-basis-point increase in eurozone rates in the first half of 2013. (Editor’s Note: 1 basis point is 0.01 percent.)

Still, on average, reinsurers achieved only a 3 percent annualized investment yield for the first half of 2013, compared to 3.7 percent during 2011 and 2012, Swiss Re said, estimating a full-year ROE of roughly 10 percent for non-life reinsurers in 2013, compared to 14 percent in 2012.

“It is estimated that the global reinsurance sector will report a good but not necessarily strong performance in 2013,” the report concludes, also forecasting ROEs between 9 percent and 10 percent for 2014 and 2015.

Swiss Re’s 7 percent ROE estimate for the primary insurance industry for 2013 is an industry-average calculation based on data for eight leading non-life insurance markets: Australia, Canada, France, Germany, Italy, Japan, the U.K. and the United States.

Underwriting Profits; Premium Growth

On the underwriting side, the report sets forth separate 2013 combined ratio estimates for primary insurance markets in the United States and Europe, putting the U.S. combined ratio at 96.9 (101.4 on an accident-year basis) and the Europe ratio at 96.

On the reinsurance side, Swiss Re expects a combined ratio of around 90, reflecting slightly below-average catastrophe losses and significant releases from loss reserves in prior years, with the reserve releases shaving two to three points off the overall combined ratio.

For 2014, Swiss Re puts the non-life reinsurance combined ratio up five points higher—at 95—assuming average catastrophe losses, stable reinsurance rates, a less benign claims environment than in the last three years and declining reserve releases.

Other highlights of the report include charts of historical and projected premium growth rates by region for direct and reinsurance business, with Swiss Re predicting that emerging markets will continue to pull up the worldwide average, while premium growth in advanced markets remains below 3 percent for both the direct and reinsurance segments.

Swiss Re generally forecasts higher reinsurance premium growth than direct premium growth, with the exception of the emerging markets figures for 2013—3.7 percent for reinsurance and 7.8 percent for direct. In 2011 and 2012, however, reinsurance premium growth rates were significantly higher, at 20.8 percent for 2011 and 6.7 percent for 2012.

For insurers, emerging market premiums grew by 7.8 percent in 2013 by Swiss Re’s estimates—down slightly from 8.0 percent in 2012. While Swiss Re attributes the slight decline to an economic slowdown in many export-dependent countries of Southeast Asia and Central and Eastern Europe, the report adds that in China non-life premiums rose by about 13 percent based on new car sales and infrastructure investments, and that premiums in Latin America, Africa and the Middle East are also estimated to have been stronger this year than in 2012.

Looking forward for non-life insurance, Swiss Re predicts that strong premium growth will likely continue in emerging markets but at a slower pace due to weaker economic expansion in Latin America and Asia.

Overall, Swiss Re reports that “pricing has started to improve in many non-life insurance segments, but a broader-based hardening is still a long way away.”

Turning to reinsurance, the report assesses the potential impact of alternative reinsurance capacity on 1/1/2014 renewals, predicting that alternative capital providers will continue to focus on the U.S. market and on natural catastrophe coverage where “well-modeled risks, low entry barriers and relatively high margins characterize the market.”

Given that alternative capacity has been less widespread in Europe than in the United States, and also that natural catastrophe losses have been high in Europe this year, property-catastrophe reinsurance rates could increase in Europe, Swiss Re says.

“For the non-cat segment, which still makes up the bulk of the non-life reinsurance business, the outlook is generally stable, with deviations in both directions according to the underwriting experience in the respective segment,” the report adds.

Overall, Swiss Re estimates that global premium growth in the reinsurance sector, which largely follows premium trends in primary insurance, will improve from 3.0 percent in 2013 to 3.8 percent in 2014 and 3.9 percent in 2015.

“Of the additionally expected volume of around $27 billion by 2015, $16 billion will come from the advanced and $11 billion from the emerging markets,” the report says.

Swiss Re notes that pricing signals from this year’s reinsurance industry conventions in Monte Carlo and Baden-Baden indicate that 2014 renewals will be “stable to slightly softer.”

“Significant hardening will be limited to lines and segments that have recently experienced high losses,” the report says. “Casualty rates, especially in the United States, have improved moderately but are still far from their previous levels.”

Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation  Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers  Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash  Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk