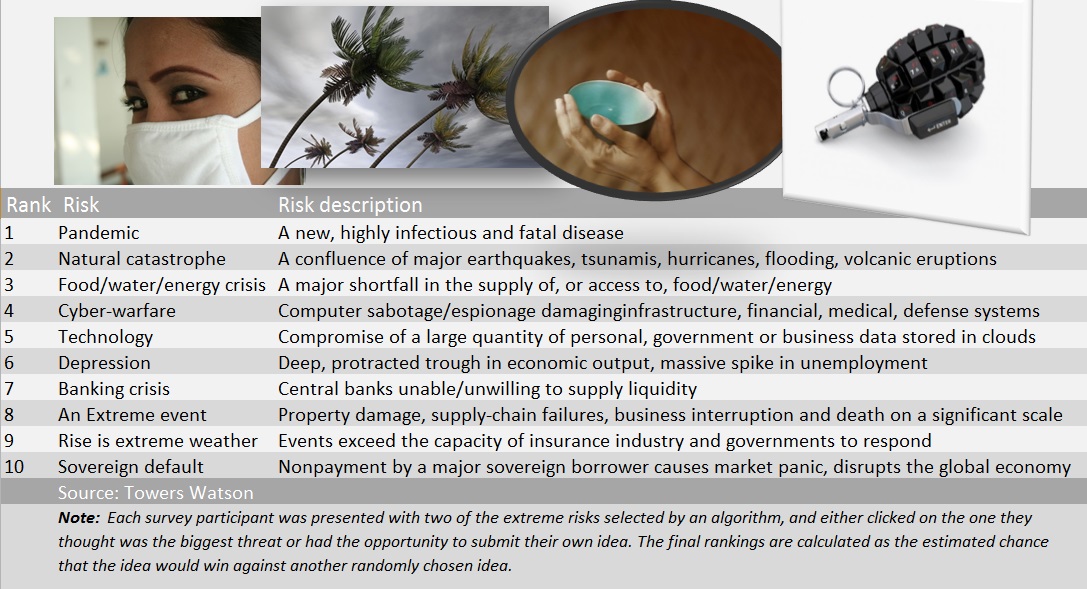

Global insurance industry executives rank global pandemic, large-scale natural catastrophe and a food/water/energy crisis as the three most important extreme risks for the industry to worry about in the long term, according to a recent survey.

The survey was conducted by global professional services company Towers Watson, allowing survey participants to submit their own ideas about which extreme risks that are the biggest threats or to accept ideas offered by the survey originator.

While pandemic, nat cat and food, water or energy shortage were offered by Towers Watson as respondents worked their way through the survey, users submitted three additional risk ideas that rose into the top 10:

- Technology risk, arising from hacking, compromise or other misuse of a large quantity of personal, government or business data stored in clouds ranked fifth.

- An extreme event causing large scale property damage, supply-chain failures, business interruption and deaths was ranked eighth.

- A potential rise in extreme weather ranked ninth—described as events that exceed the capacity of insurance industry and governments to respond, with physical and social implications.

All the other extreme risks ranked in the top 10 were risks that Towers Watson offered as possibilities to survey respondents. Other top 10 extreme risks named include cyber-warfare (#4), an economic depression (#6), a banking crisis (#7) and a default by a major sovereign borrower (#10).

The entire top 10 list is presented below:

“Much as we would have expected pandemics and natural catastrophes to figure prominently in insurers’ extreme risk thinking, the high rankings of concerns such as cyber-warfare and a major data compromise in the cloud (user-submitted idea) illustrate how the industry is keeping up to date with risk assessment,” said Stephen Lowe, senior consultant, Risk Consulting and Software, Towers Watson, in a statement.

“Much as we would have expected pandemics and natural catastrophes to figure prominently in insurers’ extreme risk thinking, the high rankings of concerns such as cyber-warfare and a major data compromise in the cloud (user-submitted idea) illustrate how the industry is keeping up to date with risk assessment,” said Stephen Lowe, senior consultant, Risk Consulting and Software, Towers Watson, in a statement.

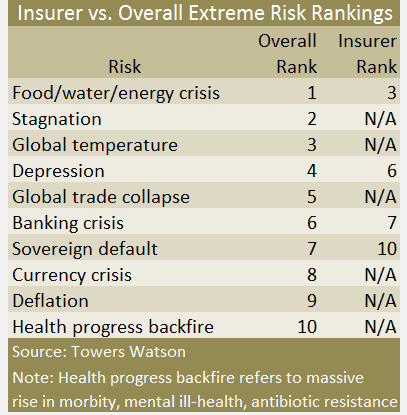

The survey was carried out as an extension of Towers Watson’s regular biennial analysis of the extreme risks likely to affect the broader investment community. That research and ranking, titled Extreme Risks 2013, categorizes very rare events that would have a high impact on global economic growth and asset returns if they occurred.

This year, the broader survey top three were: food/water/energy crisis, stagnation and global temperature change.

Economic depression ranked in fourth place based on a scoring of results from 30,000 participants in a wiki survey—losing the top spot for the first time since the research began in 2009.

The insurer group ranked economic depression in sixth place, while stagnation and global temperature change—the risk the earth’s climate tips into a less-habitable hot or cold state—did not make the insurers’ top 10.

Towers Watson notes that in the broader survey, the risk of an insurance crisis—defined as insolvency within the insurance sector—ranked in 13th place, falling five places from the prior survey in 2011. Insurers did not identify this extreme risk among the top 10 summarized by in the Towers Watson report.

Votes were compiled in a wiki survey, which enabled participants to add their own ideas. Over 30,000 votes were cast in the broad survey of the investment community.

The Towers Watson ranking of these risks is derived from a scoring system that incorporates assessments of the likelihood, intensity of impact, scope of impact and uncertainty of each individual risk.

Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook

Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook  Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation  Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality  Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes