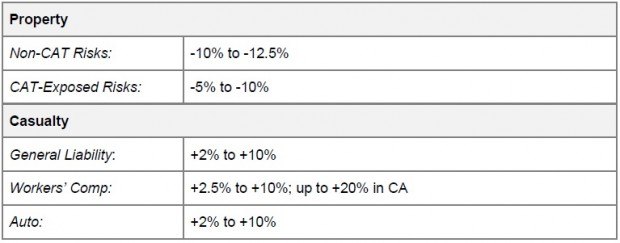

Commercial property insurance buyers could see prices fall from 10 to 20 percent on non-catastrophe risks in 2014 thanks to the influx of alternative capital to the insurance industry, insurance and reinsurance broker Willis Group Holdings says in its updated forecast.

Pricing for risks exposed to natural catastrophes such as hurricanes will likely decrease in the 5 to 10 percent range, the broker says.

For commercial casualty lines, buyers should expect a continuation of single-digit increases, with higher rate hikes in some states such as California.

The forecast is from Willis’s semiannual 2014 Marketplace Realities report, and reflects a change from the broker’s forecast in the spring when Willis predicted modest decreases for non-catastrophe exposed risks and rate increases for catastrophe exposed accounts.

The downward pressure for next year’s pricing is being driven by an influx of alternative capital to the insurance industry, particularly the segment devoted to catastrophic property risk, according to Willis.

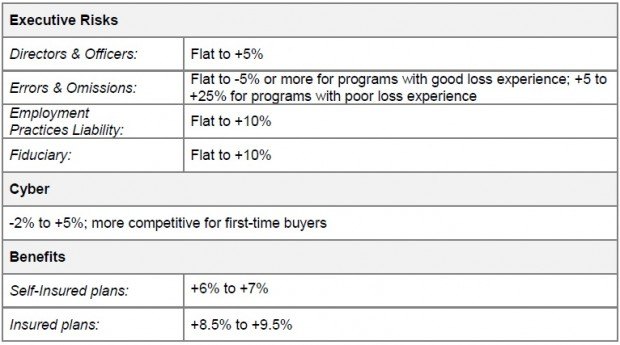

Overall, 14 insurance lines will likely see rate increases, while eight will see decreases, according to Willis experts. However, in many cases, the expected level of rate increase is moderating, and in some cases, predictions from the spring have reversed. For errors and omissions (E&O) and trade credit insurance, spring predictions of increases have been supplanted by expectations of modest decreases or flat rates. Two exceptions are political risk and terrorism, where Willis says market hardening forces are gathering momentum.

Willis expects rate increases in casualty insurance lines, including workers’ compensation and auto, employee benefits, cyber, executive risks, crime/fidelity, health care professional, construction, kidnap and ransom, political risk and terrorism.

Meanwhile, rates are expected to fall in property, E&O, aerospace, energy, environmental, marine, surety and trade credit.

In the employee benefits space, employers remain preoccupied with health care reform, and while the regulatory changes may be a contributing factor to increases in health care costs, rate hike predictions are slightly down from earlier in the year: falling from an overall prediction of 8-10 percent increases to 6-7 percent increases for self-insured plans and 8.5-9.5 percent for insured plans.

In introductory remarks, Eric Joost, chief operating officer of Willis North America and senior editor of Marketplace Realities, addresses the controversy accompanying the new capital that is impacting the insurance marketplace.

“The reaction has not been all positive, to say the least, especially with respect to the new sources of capital,” Joost writes. However, “some of this represents some real innovation – in an industry often criticized for conservatism and a lack of innovative progress. From our perspective we see clear benefits to these new vehicles, because our perspective is really that of our clients. For our clients – insurance buyers – the increase in supply of capital makes a more inviting marketplace.”

More certain, Joost says, is the reason for the evolution in the industry: “It’s the advent of big data, insurance style – the increased access and ability to work with the data related to the possibilities of risk transfer.”

The following charts from the Willis report show the broker’s expectations for pricing in 2014:

Source:

Source: Preparing for an AI Native Future

Preparing for an AI Native Future  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs  Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid