The only major component of net income moving downward for property/casualty insurers during the first half of 2013 was investment income, according to a compilation of aggregate industry figures published on Thursday.

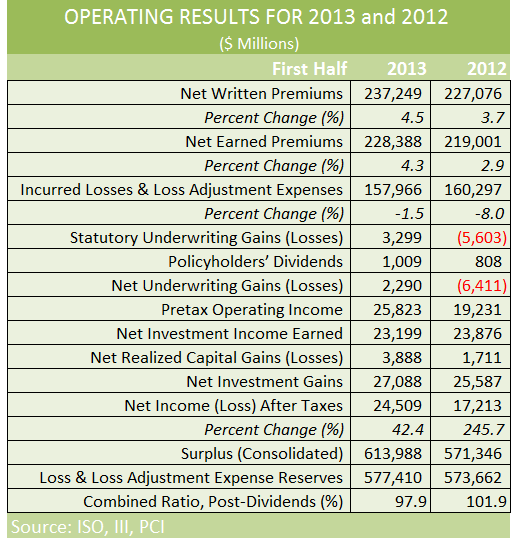

With net premiums growing 4.5 percent, and catastrophe losses down from last year’s first-half levels, net income jumped 42 percent to $24.5 billion for the industry overall, and surplus reached a record $614.0 billion at June 30, according to financial results published jointly by ISO and the Property Casualty Insurers Association of America.

With net premiums growing 4.5 percent, and catastrophe losses down from last year’s first-half levels, net income jumped 42 percent to $24.5 billion for the industry overall, and surplus reached a record $614.0 billion at June 30, according to financial results published jointly by ISO and the Property Casualty Insurers Association of America.

Commenting on the results, Robert Hartwig, president of the Insurance Information Institute, noted that top-line growth was a meaningful contributor to improved underwriting profitability, with the 4.5 percent rise in net written premiums for the six-month period breaking down to 4.7 percent for the second quarter and 4.1 percent for the first quarter.

In addition to being a notable acceleration from the first quarter, the 4.7 percent second-quarter growth figure was the 13th consecutive quarter of growth, marking the longest continuous period of growth in nearly a decade, Hartwig reported.

Still the overall return for the industry on surplus—an annualized rate of return on average policyholders surplus of 8.2 percent—fell short of historical averages, according to Michael R. Murray, ISO’s assistant vice president for financial analysis.

Even though premiums advanced and even though the 97.9 percent combined ratio for first-half 2013 was 6.1 percentage points better than the 104 percent average combined ratio for the past 54 years, Murray said the 8.2 percent return was below the 8.9 percent recorded for the same historical period (from the start of ISO’s annual data in 1959 to 2012).

“With investment yields, financial leverage, and tax rates like those in first-half 2013, ISO estimates that the combined ratio would have to improve another 1.2 percentage points to 96.7 percent for insurers to earn their long-term average rate of return,” Murray said.

Robert Gordon, PCI’s senior vice president for policy development and research, noted that a drop in net losses from catastrophes accounted for roughly one-third of the improvement in underwriting results in first-half 2013, with the remainder primarily attributable to premium growth.

“More specifically, [the industry] combined ratio improved by 4 percentage points in first-half 2013, with the drop in net [losses and loss expenses] from catastrophes accounting for 1.2 percentage points of the improvement. The remaining 2.8 percentage points of improvement are largely due to premium growth,” Gordon said.

ISO also noted that a higher level of favorable development benefited results (by about 0.5 combined ratio points by Carrier Management’s calculations) with $8.5 billion in reserve takedowns for prior accident years recorded in this year’s first half, compared to $7.2 billion in favorable development in first-half 2012.

According to ISO’s Property Claim Services (PCS) unit, catastrophes striking the United States in first-half 2013 caused $9.7 billion in direct insured losses (before reinsurance recoveries) for all insurers (including residual market insurers and foreign insurers and reinsurers), down from $4.7 billion in first-half 2012, but actually coming in a little above the $9.2 billion average for first-half direct catastrophe losses during the past ten years.

Source: ISO, PCI, III

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford