A Wharton School professor advocates a multiyear flood insurance policy as part of a program aimed at getting owners of flood-prone properties to invest in loss prevention and to hold onto their insurance coverage.

Howard Kunreuther, Professor of Decision Science and Business and Public Policy at the Wharton School of the University of Pennsylvania, reveals that after maintaining insurance coverage for several years and never submitting a claim, many property owners will cancel their policies.

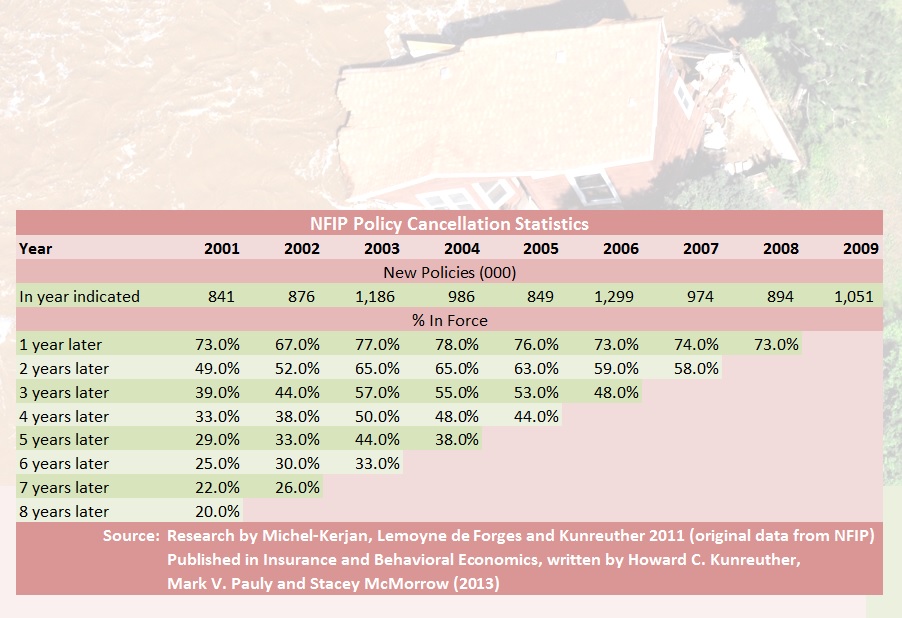

Underscoring the point during a presentation at SAP Financial Services conference in New York last week, Kunreuther presented data on National Flood Insurance Program policy cancellations, based on research he completed in 2011 which is also set forth in his new book, “Insurance and Behavioral Economics.”

Underscoring the point during a presentation at SAP Financial Services conference in New York last week, Kunreuther presented data on National Flood Insurance Program policy cancellations, based on research he completed in 2011 which is also set forth in his new book, “Insurance and Behavioral Economics.”

Here he shows that for 2001, for example, of the 841,000 new policies issues by the NFIP, only 73 percent remained in force one year later, and only one-third were still in force four years later. Eight years, only one-fifth were still in force.

In his book, and during the SAP Financial Services conference presentation, Kunreuther discussed the principles of behavioral economics that prompt the cancellations and deter property owners from investing in property improvements to limit flood damage.

He also reviewed his proposed solution which combines required multiyear flood insurance policies priced at risk-based levels and long-term loans for the loss prevention measures—a plan that also offers insurance vouchers to low-income homeowners to deal with affordability issues.

See related article, “Are Multiyear Policies the Answer for Flood? Behavioral Economics Meets Insurance,” for details.

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk  Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb