Research by Aon shows that more than 85 percent of insurers will no longer insure terror risk if the federal backstop goes away.

The brokerage firm revealed the conclusion based on its “market intelligence” in a written comment to the U.S. Treasury Department, advising that renewal of TRIA will ensure the continuation of a functional market for commercial property/ casualty terrorism coverage.

“Although a revised version of the original Terrorism Risk Insurance Act (TRIA) federal legislation was signed into law reauthorizing the program for seven years via the Terrorism Risk Insurance Program Reauthorization Act (TRIPRA) in 2007, the Act’s imminent expiration at the end of 2014 has already generated dislocation” in the commercial P/C insurance and reinsurance marketplace, the Aon comment said.

Noting that the TRIA in its various forms has succeeded in increasingly shifting the risk of terrorism loss to the private market, Aon stresses that TRIA “also had the benefit of forcing insurers to offer terrorism coverage.”

“If the mandatory offer of coverage disappears with TRIPRA 2007 expiring without replacement, then the market will contract. This is not supposition–it has been backed up by carrier behavior with prior TRIA expirations—with nearly 85 percent of property insurance carriers looking to exclude terrorism in the absence of TRIA,” the Aon comment states.

Also conceding that more capital would enter the market in the form of specialty standalone terrorism insurers should TRIA expire, Aon says that “this capital would not come close to approximating the $100 billion of contingent reinsurance capital provided by TRIA.”

The commentary includes a chart (a downward sloping line graph) showing average property terror insurance price declines between 2002 and 2012 of close to 50 percent. Highlighting a slight uptick on the chart after 2012, Aon comments that “a noticeable increase in terrorism pricing” starting in the first quarter of 2013 is a function of prevailing rate cycles and the fact that markets began to adjust their portfolios of risk to manage the potential expiration of TRIA.

The Aon comment also notes that it is “highly unlikely” that the risk models will improve to a point that allows insurers and reinsurers to be comfortable with the ability to forecast the size and frequency of potential losses or terrorism accumulations.

In a statement released in conjunction with the comment, Ed Ryan, a senior managing director with Aon Benfield, the firm’s global reinsurance business, said: “The main hurdle in assessing and underwriting terrorism risk is that the frequency of loss from terrorism is neither predictable nor random. Therefore, terrorism insurance is unlike any other marketplace risk. The uncertainty surrounding terror risk makes insurance coverage unique and this requires a novel approach.”

Aaron Davis, a managing director with Aon Risk Solutions, added: “Today’s successful terrorism risk marketplace relies on the TRIA program. TRIA minimizes price volatility and coverage uncertainty.”

“This makes TRIA reauthorization imperative for our country and the economy,” he said.

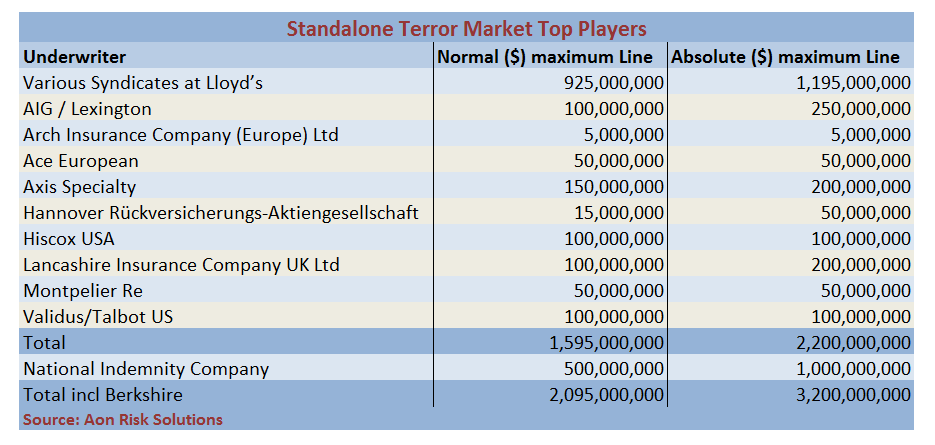

The comment also included a chart showing carriers participating in the standalone terrorism, which exists as a specialty subset market within the property marketplace, according to Aon. “This market is comprised of global P/C carriers and reliant on TRIA’s backstop for some of the capacity it deploys to insureds in the United States,” Aon says.

Aon notes that the standalone terrorism market was in place to cover global terrorism exposures before 9/11 and has emerged as a growth area for terrorism risk in a post-9/11 insurance world.

According to Aon, capacity has increased by over 130 percent since 2006, to a technical level of $2.2 billion and a normal “per risk” level of $1.6 billion (which is reduced to $750 million or less in certain problem postal code/ZIP code zones).

Source: Aon

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut  Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook

Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash