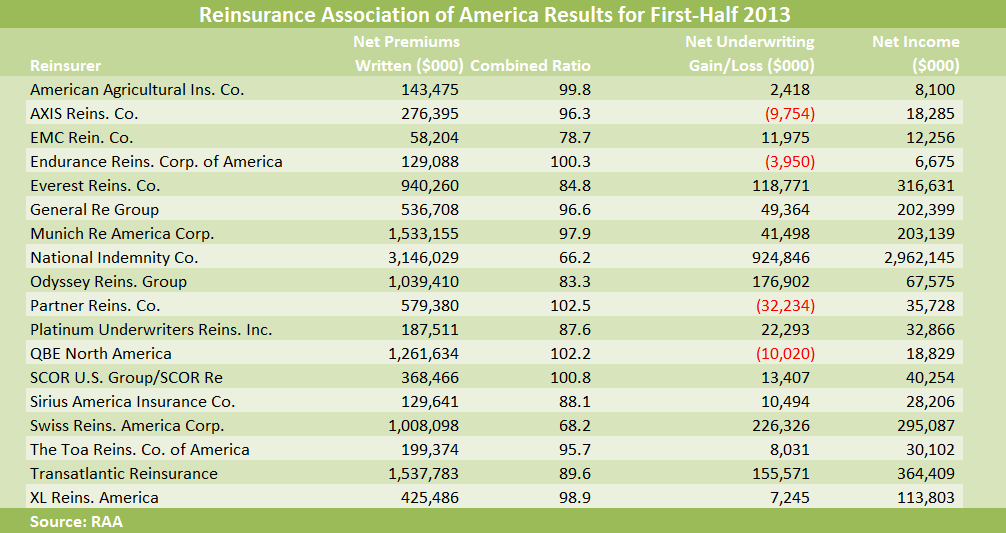

The Reinsurance Association of America (RAA)’s latest survey shows a group of 18 U.S. property/casualty reinsurers posted $4.8 billion net income in aggregate for the first six months of 2013—an increase of 32 percent from $3.6 billion reported by the same group of companies during the same time last year.

The U.S. reinsurers’ net premiums written fell slightly compared to last year. The reinsurers wrote $13.5 billion of net premiums during first six months of 2013, falling 2.2 percent from the $13.8 billion net premiums written by the same group of companies during the same time last year.

The U.S. reinsurers’ net premiums written fell slightly compared to last year. The reinsurers wrote $13.5 billion of net premiums during first six months of 2013, falling 2.2 percent from the $13.8 billion net premiums written by the same group of companies during the same time last year.

The aggregate combined ratio for the 18 U.S. reinsurers was 86.0 percent (55.6 percent loss ratio and an expense ratio of 30.4 percent) for the 2013 first half, improving from 91.2 percent reported by the same 18 companies during the same period last year.

The net underwriting gains also rose. The group of 18 reinsurers posted $1.7 billion in aggregate net underwriting gains for the 2013 first half, up from $842 million reported by the same group a year ago.

Policyholders’ surplus was $127.0 billion, up from $114.6 billion at the end of the second quarter 2013.

RAA conducts surveys of reinsurers’ statutory underwriting results each quarter. This latest survey shows Berkshire Hathaway’s National Indemnity Co. leading the group in generating profits.

National Indemnity’s net income for the 2013 first half came in at nearly $3.0 billion, which makes up more than 60 percent of the aggregate net income reported by the 18 U.S. reinsurers in the survey. Transatlantic Reinsurance had the second-largest net income among the group with $364 million, followed by Everest Reinsurance Co. with $316 million.

Berkshire Hathaway’s National Indemnity also had the largest net underwriting gain in the group, with $925 million for the 2013 first half, which makes up approximately 54 percent of all underwriting income reported by the 18 U.S. reinsurers in the survey.

(Reporter Young Ha is the east coast editor of Insurance Journal.)

Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality